Some retailers would benefit from a TikTok ban in 2025

TikTok Shop took the market by storm in just two years. The social media platform sold more merchandise than Sephora [LVMUY] in late 2024 according to Earnest credit card data. TikTok Shop also handily outperformed during the 2024 holiday season. But a potential ban could result in brands losing access to a vital marketing and sales channel.

Now, some brands could turn into TikTok Shop ban winners based on customer overlap and disruptive impact from the platform.

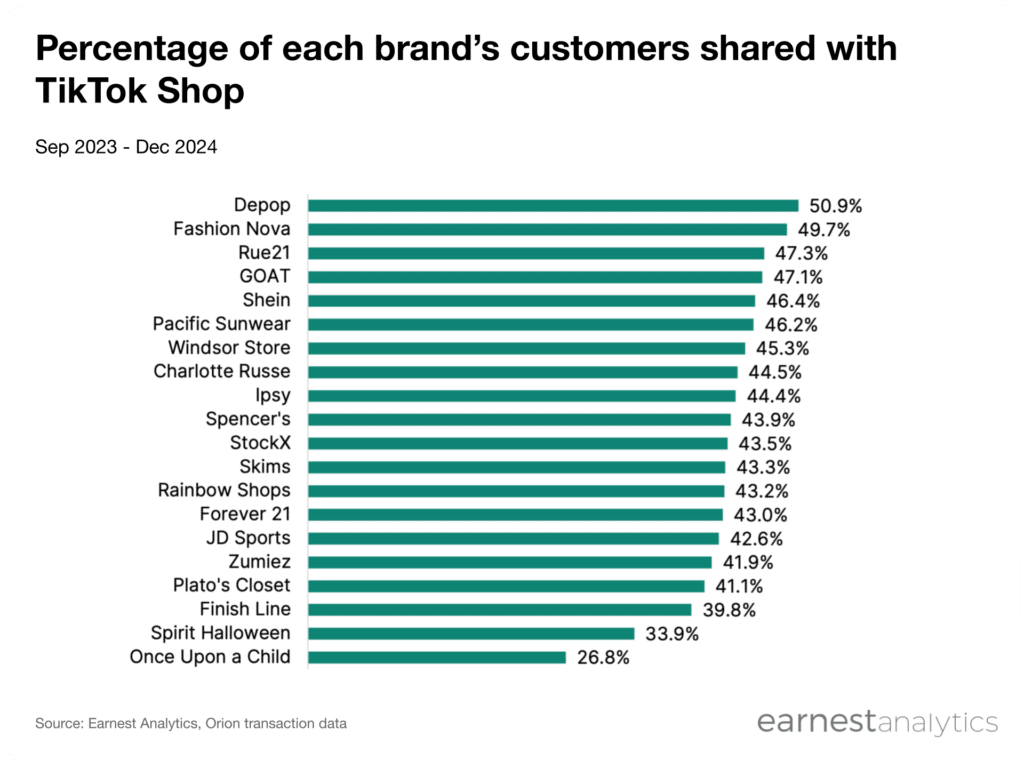

Depop, Fashion Nova, Rue21 share half of customers with TikTok Shop

Depop [ETSY], Fashion Nova, and Rue21 share the highest percentage of their customers with TikTok Shop according to Earnest credit card data. Between September 2023 and December 2024, over half of Depop customers also made a transaction at TikTok Shop. The figure was 47.9% for Fashion Nova and 47.3% for Rue21.

Chinese fast fashion giant Shein shared 46.4% of its customers with TikTok Shop during the same period. This high of an overlap with the largest fast fashion retailer in the US exemplifies the staggering growth of TikTok Shop in only two years.

Sneaker and streetwear marketplace GOAT shared 47.1% of its customers with TikTok Shop, followed by several other retailers.

Major retailers with the highest overlap of TikTok Shop customers tend to focus on women’s apparel, fast fashion, or resale. Some are also online beauty specialists like Ipsy. All tend to appeal to young Millennial or Gen-Z shoppers.

Just because a retailer has high overlap with TikTok Shop, does not mean a TikTok ban would help them win back sales.

Rue21, Charlotte Russe, and Rainbow Shops, could benefit from a TikTok Shop Ban

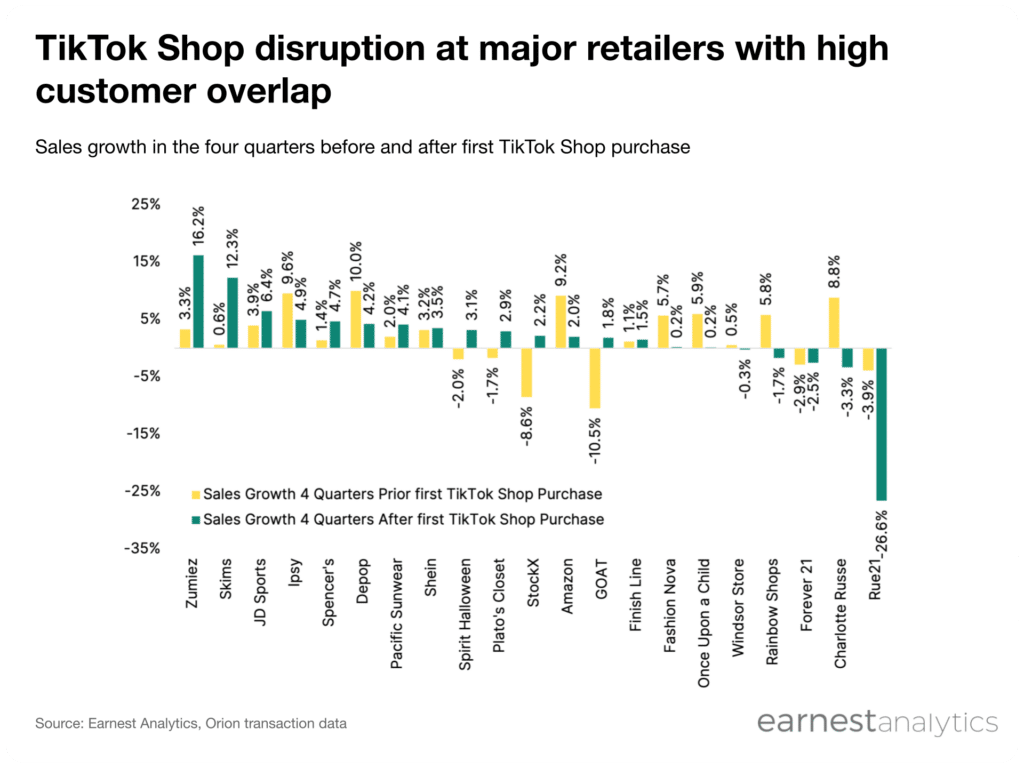

Customers of established brands do not uniformly reduce spending at those brands after making their first purchase at TikTok Shop. GOAT shoppers spent at least 1.8% more on the platform four quarters after their first TikTok Shop purchase. That represents a 12 point sales acceleration. Zumiez [ZUMZ], Skims, and Plato’s Closet experienced similar accelerations in spending after their customers’ first TikTok Shop transaction.

Customers spent more after their first TikTok Shop purchase at JD Sports [JDSPY], Spencer’s, Pacific Sunwear, Spirit Halloween, and Plato’s Closet. Shein, and Finish Line also saw small gains in sales to TikTok Shop customers.

However, customers at some brands and retailers spent less at those retailers after making a first purchase on TikTok Shop. This suggests that a TikTok ban could undo some competitive losses, and turn those brands into TikTok Shop ban winners.

Rue21 experienced one of the largest negative impacts from TikTok Shop. Rue21 customers spent 26.6% less at the store than any other major retailer four quarters after their first TikTok Shop purchase. That marks a 23 point deceleration from pre-first TikTok Shop purchase spending growth.

Charlotte Russe also felt a major impact from TikTok Shop. Customers spend 3.3% less four quarters after their first purchase at TikTok Shop, a 12 point deceleration.

Amazon [AMZN], with its wide assortment of goods and fast shipping, was not immune from the impact of TikTok Shop either. Amazon customers spending grew around 9% a year before their first TikTok Shop purchase. Four months after the first purchase, Amazon customer spending growth fell to 2%, a 7 point deceleration.

Windsor Store, Rainbow Shops, and Forever 21, a Shein subsidiary, all experienced declines after customers began shopping at TikTok Shop. Ipsy and Depop experienced mid-single digit sales decelerations after their customers’ first TikTok Shop purchase.

Sizing up TikTok ban winners

Rue21 could be by far the biggest TikTok ban winner. Over half of its customers spend at the social media platform, and once they do, they reduce spending at Rue21. The ban could provide relief from TikTok Shop’s competitive pressure.

Charlotte Russe, Windsor Stores, Rainbow Shops, and Forever 21 could also get relief if a ban is put in place.

Amazon could win some business back from TikTok Shop’s ban based on disruptive effect. But only 23% of its customers purchased on TikTok Shop in 2023 and 2024, making the ban’s impact smaller.

Download full TikTok Shop analysis