Shutterfly SPAC

With the WSJ reporting Apollo’s plans to take Shutterfly public again—specifically through a merger with a special acquisitions company (SPAC)—we looked at growth for the online photo and keepsake printer.

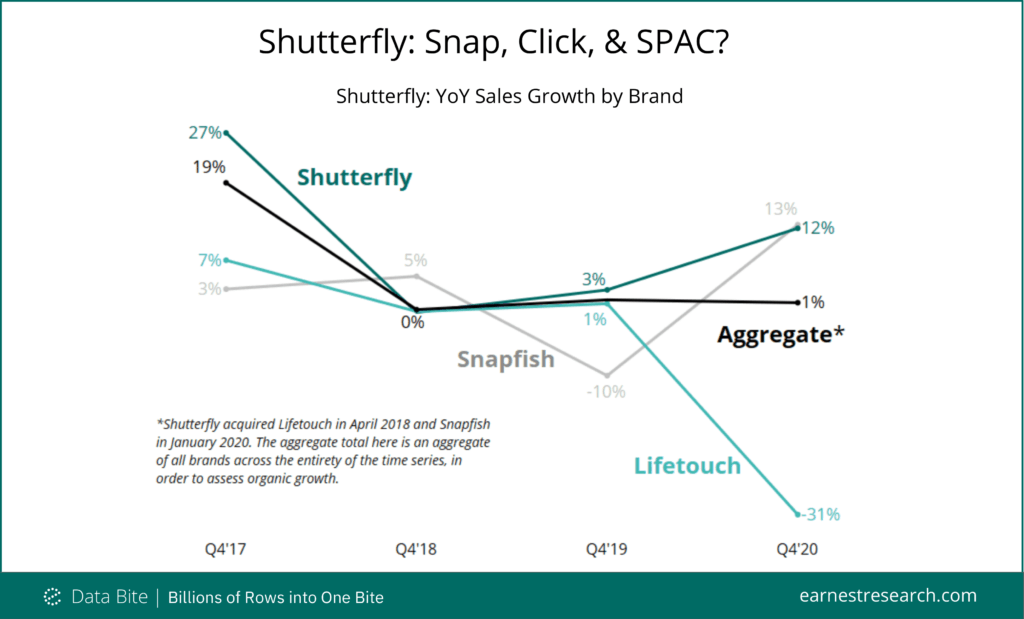

Given the importance of the fourth quarter performance—~50% of annual net revenue for Shutterfly Consumer per their last public filings—we chose to focus on year-over-year growth during this critical period. With holiday travel and celebrations limited due to COVID, Shutterfly appears to have benefited as consumers spent 12% more sending pictures of themselves to their loved ones this holiday season. Snapfish, which merged with Shutterfly in January 2020, saw similar growth of 13% in Q4’20, a stark reversal of Q4’19’s 10% decline.

School photography-focused Lifetouch, however, suffered from widespread school closures and the pivot to remote learning, resulting in growth dropping 31%. Again, Q4 is of outsized importance to this brand, accounting for ~35% of annual revenue per their last public filing.

Overall, the strength at Shutterfly and Snapfish was offset by the weakness at Lifetouch, leading to 1% growth from an organic perspective (ignoring acquisition dates).