Fight is brewing between Miller, Bud Light for shrinking beer market ahead of Super Bowl LVIII

Contact sales for details.

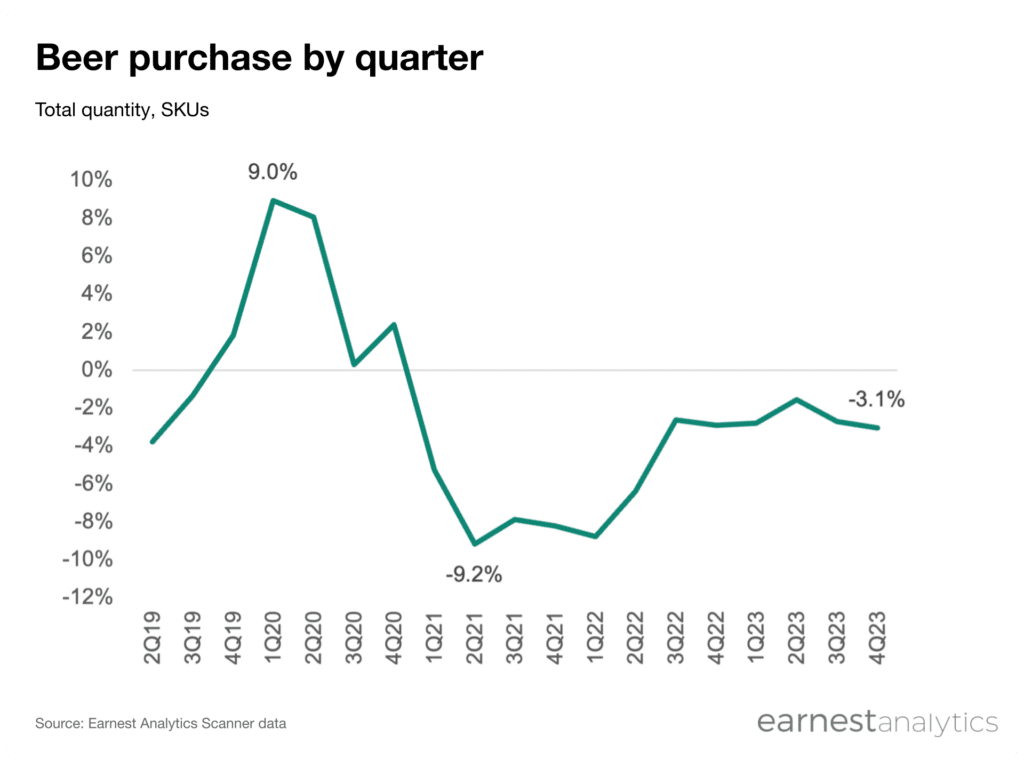

Beer sales among major US brands fell 3.1% YoY in the 4Q according Earnest Scanner (CPG) data. After a pandemic-driven spike in 2020, beer quantity purchased declined every quarter since 2021, stabilizing in 2023 at negative mid-single digit declines. Beer sales had already been declining among major brands prior to the pandemic, which provided a temporary reversal in the negative trend and a boost to alcohol delivery.

This negative trend is playing out against a changing competitive landscape headed into one of the largest beer consuming periods of the year, the Super Bowl. Beer brands have an uphill battle this year. On an annual basis, Earnest data reflects three consecutive years of YoY decline in beer sales by quantity, with 2023 sales 11% lower than their pre-pandemic level. This leaves the largest brands competing for slices of a shrinking pie.

Contact sales for details.

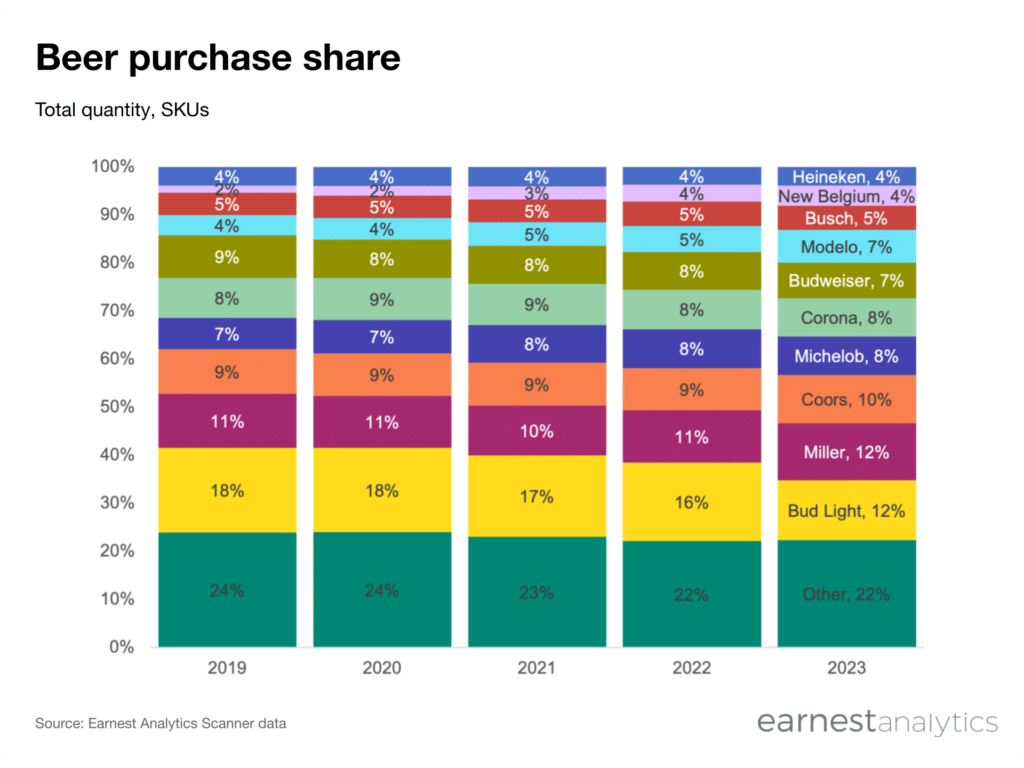

Bud Light’s dominant share of sales began to slip in 2021, as Michelob, Corona, New Belgium (selling Fat Tire and Voodoo Ranger), and Modelo all gained share. But a series of PR challenges in April 2023, followed by various boycotts, cost the official beer of the Super Bowl its lead as reported by Earnest at the time.

Headed into Super Bowl LVIII, Miller and Bud Light are now neck and neck for most sold beer by quantity in the US. Bud Light parent Anheuser-Busch launched an ambitious comeback plan around the event that could push the brand back to its number one spot. Nevertheless, a longer trend away from beer may be the more daunting challenge for the company than clawing back its lost share.

Methodology

Analysis conducted using our consistent store panel on the 20 following major beer brands: Blue Moon, Bud Light, Budweiser, Busch, Coors, Corona, Founders, Guinness, Heineken, Michelob, Labatt, Miller, Modelo, Natural Light, New Belgium, Samuel Adams, Sierra Nevada, Stella Artois, Pabst, Yuengling.