Shein rival Cider makes fast fashion inroads with sustainability focus

Cider’s ascendancy in the Fast Fashion arena

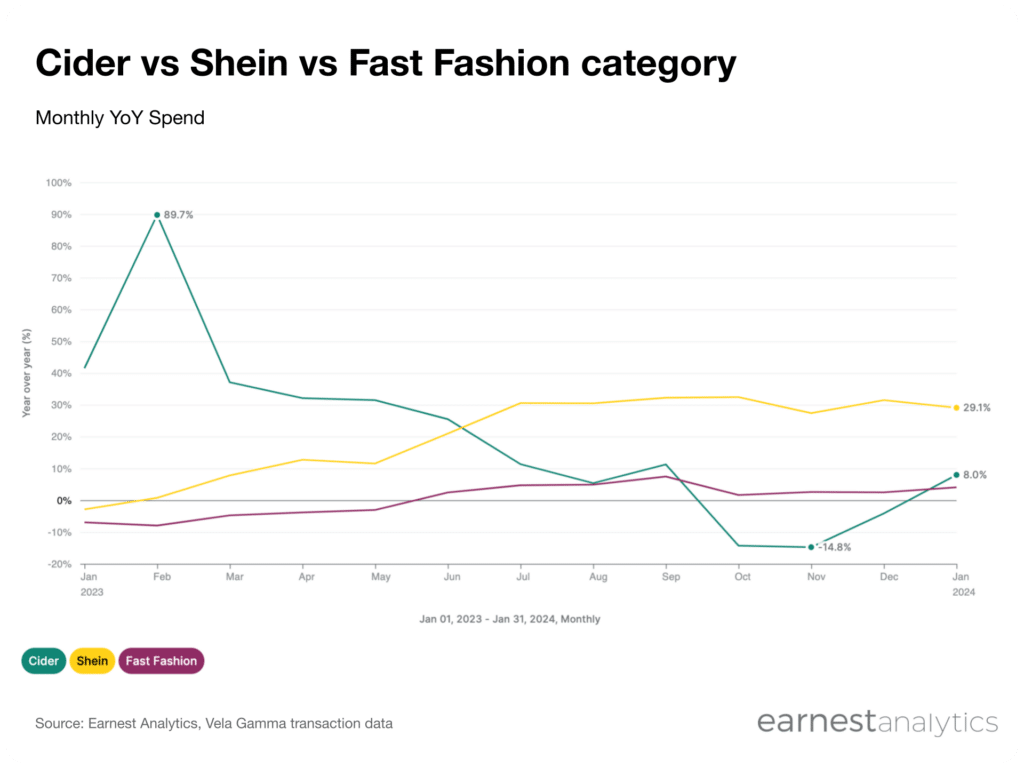

Sales at Shein fast fashion ecommerce competitor Cider peaked at 89.7% YoY in early 2023, surpassing its fast fashion peers, according to Earnest credit card data. However, sales slowed as the year progressed, dipping into negative YoY territory by October before rising 8% YoY in January 2024. Shein, in contrast, displayed consistent growth throughout the period, concluding January 2024 with a notable 29% YoY growth and outshining the wider fast fashion sector that experienced slight variations and had largely stable growth. Given their similar fast fashion models and competitive pricing, many consumers have begun asking: “Is Cider like Shein?”

Access chart in Dash.

Cider’s small but steady Fast Fashion foothold

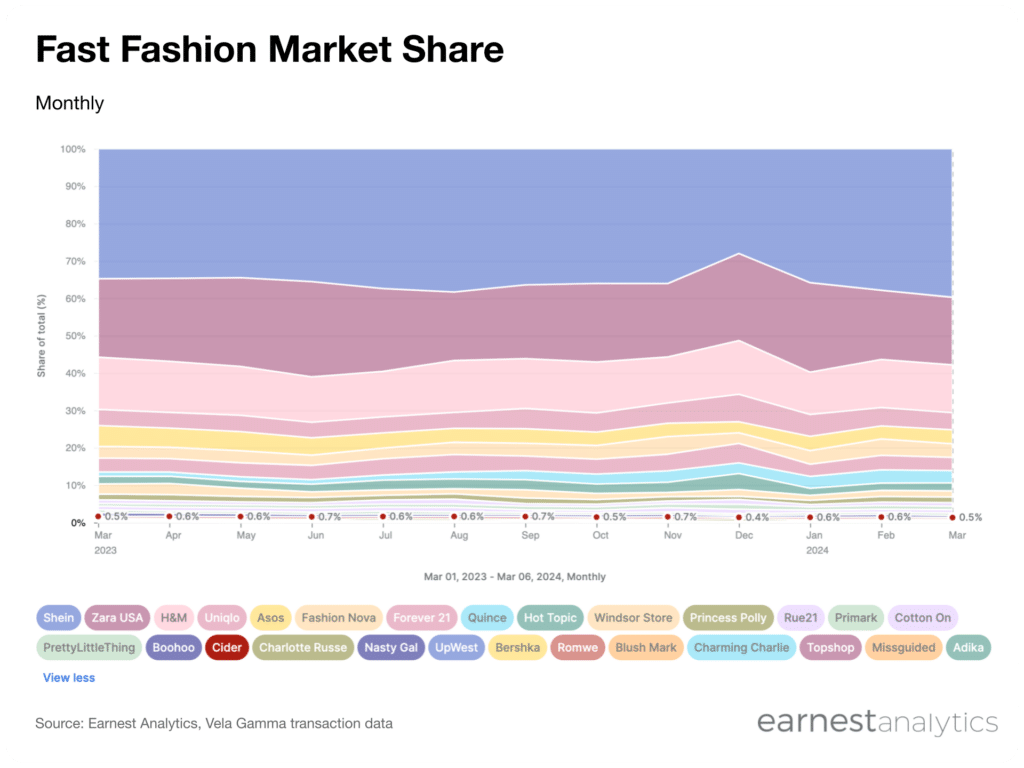

Cider’s double digit growth has so far not made a dent in its share of the fast fashion market. Shein and Zara still commanded 38% and 19% in February 2024, respectively. Since 2023 Cider’s market share hovered around the 0.5% to 0.7% range, suggesting the brand’s stable yet niche appeal in a market dominated by giants.

Access chart in Dash.

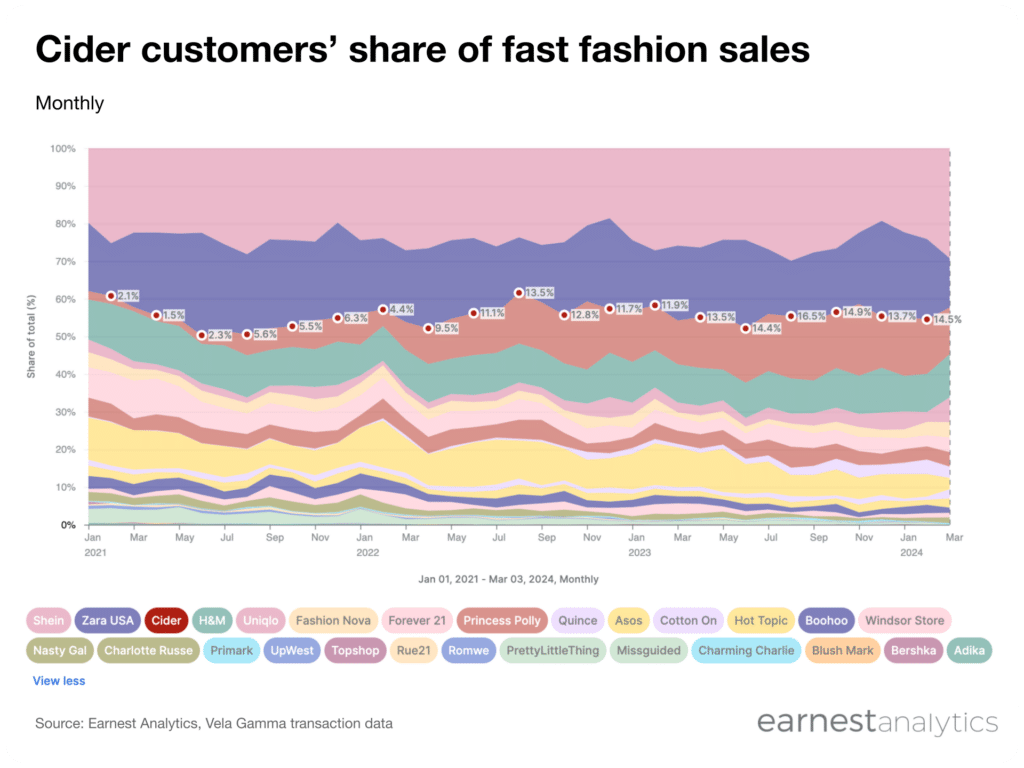

Cider makes modest inroads into Shein’s customer base

As of February 2024, Cider captured around 1% of the spending from Shein’s customer base, a figure that has not shown any growth since the previous year (access chart in Dash). However there are some signs that the brand is disrupting Fast Fashion brands to a limited extent. The 1% of Shein customers who shopped at Cider spent 18% less at Shein in February 2024 than the year prior. Cider customers spent 15% of their Fast Fashion wallet at the company in February, roughly the same share they spent at Zara.

Access chart in Dash.

Is Cider like Shein?

Cider and Shein share several similarities, such as affordable pricing, trend-driven designs, and an online-only business model. However, key differences in their market influence and growth trajectory provides a few differences. While Shein dominates the fast fashion space with steady growth and a significantly larger market share, Cider remains a niche player with a stable but limited presence. The data suggests that while some Shein customers have explored Cider, it has not yet gained enough traction to significantly impact Shein’s dominance. Ultimately, Cider and Shein cater to the same audience with similar business models, but Shein’s expansive reach and sustained growth set it apart from its smaller competitor.

Track Fast Fashion spending free