Saks’ Neiman Marcus acquisition opens door to new luxury shoppers

Access chart in Dash.

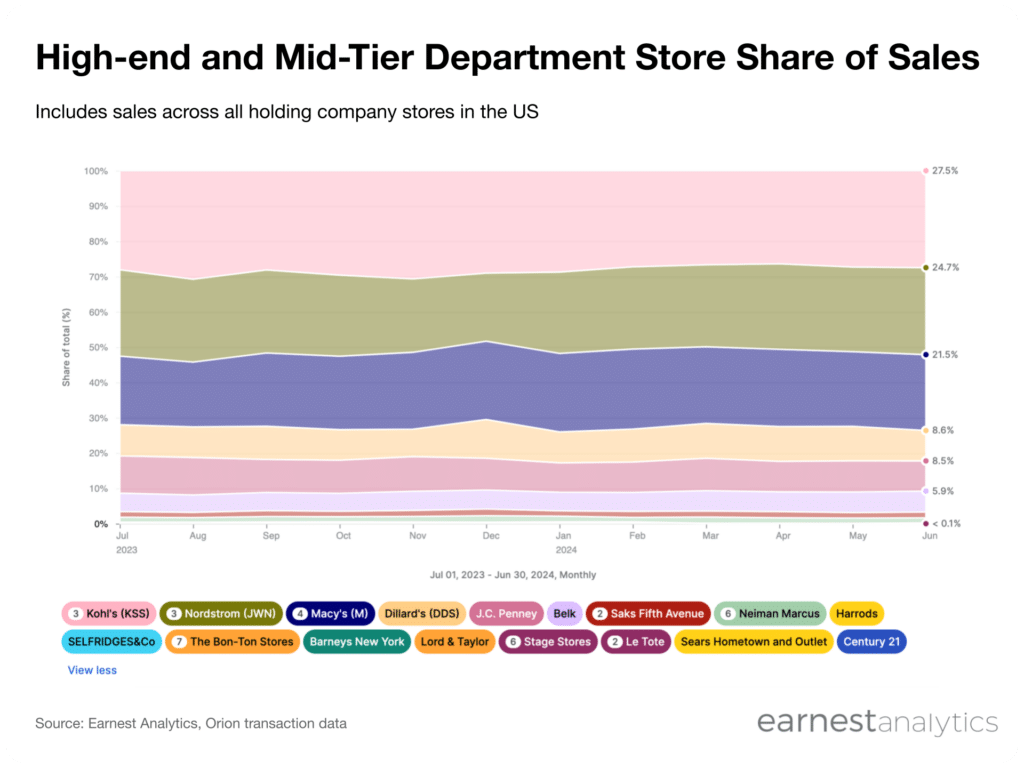

Saks’ proposed Neiman Marcus acquisition would combine the 7th and 8th largest mid-tier and luxury department store groups by sales in the US, behind Belk, according to Earnest credit card data. The announcement comes after relatively disappointing holiday sales and tax refund spending for luxury brands and high-end department stores.

Saks, which encompasses both its upscale Saks Fifth Avenue locations and its discounted Off Fifth stores, has a significant concentration within the East Coast region, particularly in New York City. Neiman Marcus, originating from Texas, maintains a predominant presence in the Southern and Western regions of the United States. However, its portfolio also includes Bergdorf Goodman, an iconic New York retailer, Last Call, a discount concept, Horchow, a furniture retailer, and Mytheresa, an online retailer.

Access chart in Dash.

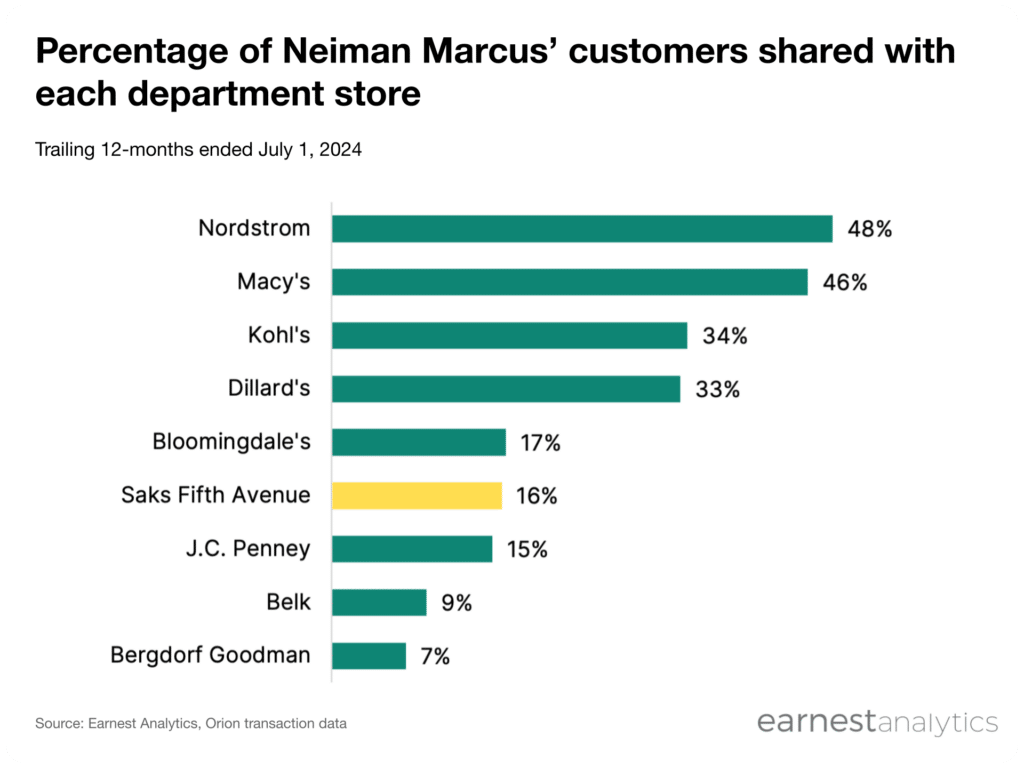

Only 16% of Neiman Marcus’ customers also shopped at Saks Fifth Avenue during the 12-month period ending July 1, 2024 according to Earnest credit card data. This customer overlap is significantly lower compared to other notable mid-tier and high-end department stores. For instance, Nordstrom had a 48% customer overlap with Neiman Marcus, Macy’s had 46%, and Kohl’s 34%.

This disparity in customer overlap suggests that Saks has an opportunity to expand its reach into a luxury shopper segment and into geographies where it currently does not have a substantial presence. By potentially merging with Neiman Marcus, Saks could tap into a more affluent clientele base and potentially gain access to a broader range of luxury brands and merchandise, which includes the high-end designer focused Bergdorf Goodman.

This strategic move could strengthen Saks’ position in the competitive luxury retail market and allow it to compete more effectively with other major players in the industry.

Track department store spending for free