Robinhood growth slows as stimulus investors pivot

Note: This is a preview of our larger deep-dive on Robinhood and Broker-Dealers. Download the full case study here: Analyzing Robinhood vs Broker-Dealer Performance using Consumer Transaction Data.

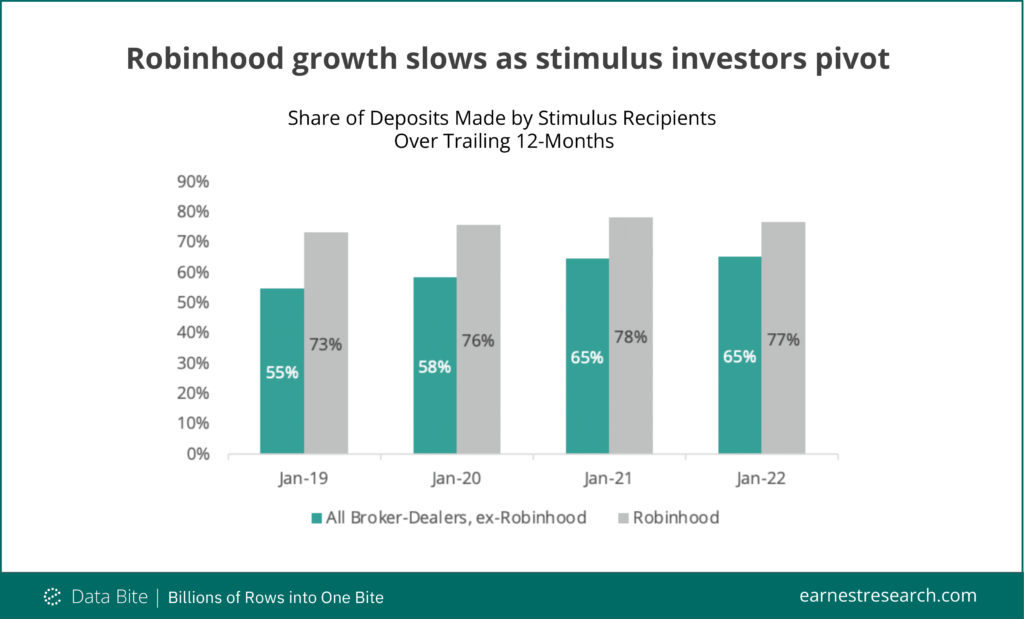

Broker-Dealers like Robinhood are facing falling deposit growth and fewer active customers in 2022 despite a brief recovery in deposit growth in the early days of the Ukraine-Russia War and a successful 2021 IPO. Stimulus recipients (a proxy for lower- and middle income investors) became even more notably conservative investors in 2022 than the two prior years. This is a larger issue for Robinhood than most Broker-Dealers. Over 77% of Robinhood deposits in the trailing 12 months ended January 2022 came from stimulus recipients, compared to 65% for other Broker-Dealers. The entire industry is now more reliant on consumers who qualified for stimulus in 2021 and 2022 than before Covid-19.

Robinhood is in a uniquely precarious position despite robust customer growth in 2021 as market swings could discourage some middle- and lower-income investors from the stock market. Download full case study here: Analyzing Robinhood vs Broker-Dealer Performance using Consumer Transaction Data.