Rinvoq’s IBD growth bolstered 3Q24 performance

- Earnest’s Phoenix dataset accurately tracked strength in Rinvoq 3Q24 U.S. Net Revenues reported by AbbVie (ABBV)

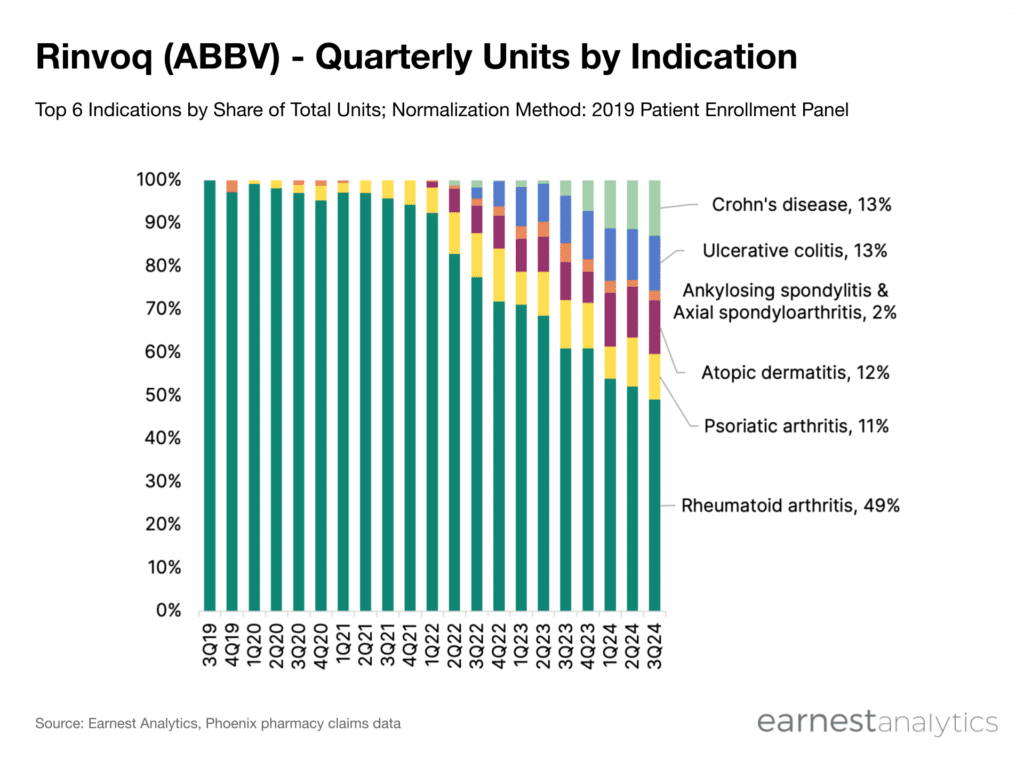

- Rinvoq’s newer irritable bowel disease (IBD) indications, ulcerative colitis and Crohn’s disease, continue to drive overall growth. IBD volumes accounted for ~26% of Rinvoq volumes, up from ~15% in 3Q23

Rinvoq’s IBD growth continues

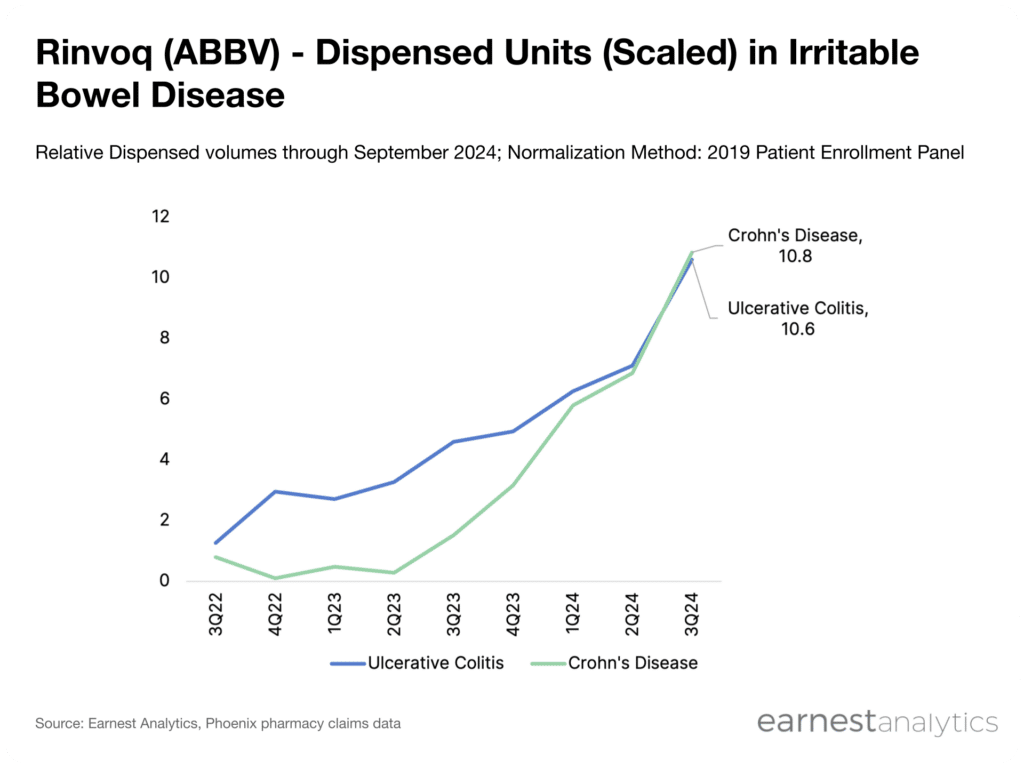

Rinvoq (ABBV), a mainstay treatment for numerous autoimmune diseases, continues to grow ~50% YoY, long after its initial approval in 2019. Label expansion into ulcerative colitis (UC) in 2022 and Crohn’s disease in 2023 have supported Rinvoq’s sustained growth.

Earnest Phoenix pharmacy claims data correctly signaled strength relative to Visible Alpha consensus estimates of 40% YoY growth for 3Q24 Rinvoq U.S. Net Revenues. ABBV reported growth of 46% YoY, which was at the midpoint of Earnest’s forecasted 43% to 49% range. Phoenix data, which has visibility into trends by indication, also corroborates management commentary that Rinvoq’s 3Q2024 revenues “reflect robust uptake in IBD.”

Dispensed volume attributable to IBD since 2022

The Phoenix data indicates a notable ramp in dispensed volume attributable to IBD indications beginning in 2Q22; inflammatory bowel diseases accounted for ~26% of Rinvoq volume in 3Q24, up from ~15% in 3Q23. While Rinvoq’s first IBD approval was in ulcerative colitis, uptake in Crohn’s has been particularly rapid.

Crohn’s disease’s share of dispensed volumes has increased from 4% to 13% in the last year and is now on par with ulcerative colitis share of volumes. As of 2Q24, AbbVie expected Rinvoq “to double respective sales in IBD this year.” During 3Q24 earnings, AbbVie’s CCO remarked that “Rinvoq’s uptake is exceeding our expectations” and emphasized that “adoption in Crohn’s disease has been impressive.”

With Earnest’s Phoenix dataset, Rinvoq volumes can be tracked in real time to provide a holistic understanding of full 2024 performance.

Request Phoenix Pharmacy Claims information