Peloton leading in shrinking at-home fitness category

Peloton (PTON) is the undisputed leader in At-Home Fitness spending according to Earnest credit card data. The stationary bike and treadmill maker’s foray into on-demand fitness classes may have helped buoy its value proposition long after the pandemic. Still, Peloton is commanding an increasing lead in a shrinking market (see 2024 Fitness spending fell on weak home sales). The company maintained its 51% market share in 2024, up from 49% two years prior.

BODi (BODI) is the next largest At-Home Fitness company by sales, with 11% of sales in 2024. Market share falls quickly after the top three competitors. Rogue Fitness and iFIT are the next largest by market share. Those are followed by hardware companies Tonal, NordicTrack, and Concept2. The remaining Hydrow, BowFlex, and Mirror (PTON) all have less than 2% of market share.

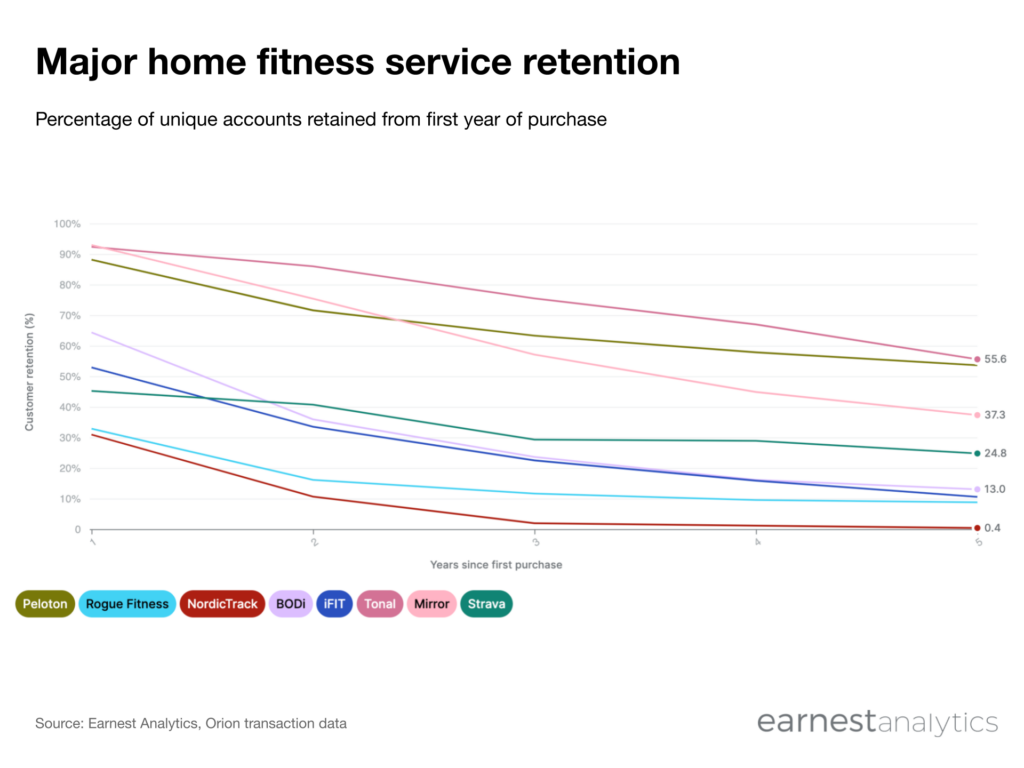

Peloton, Strava retention stand out

Peloton and Tonal are the long-term leaders in fitness retention according to Earnest credit card data. Over 55% of Peloton and Tonal customers still transact on the platform 6 years after their first purchase, down from 88% and 93% at one year, respectively. Mirror also has relatively high retention. Over 93% of Mirror customers use the platform one year later, and 37% remain after 6 years. However, their long-term loyalty is the exception among home fitness brands with high early retention. Most see a large decline between years 2 and 3.

Still At-Home fitness tends to see higher retention rates than Gyms or Fitness Classes. Many of these are hardware coupled with subscription services that consumers need in order to use the equipment. Whereas an inactive gymgoer may cancel their membership if they aren’t using it, many At-Home Fitness consumers will continue their subscriptions as they attempt to rationalize the hardware purchase.

Over time, most At-Home Fitness retention trends turn downwards with one major exception. Fitness tracking app Strava tends to see a long term upward retention “smile.” The app is unique in that unlike other At-Home Fitness purchases, it does not include hardware nor guided workouts. Instead, Strava tracks and shares workouts with connections. The social network nature of the app could be the secret to its success compared to other fitness subscriptions. Strava users are 2x more likely to still be paying for the app 6 years after their first purchase compared to CrossFit or Orangetheory classes.