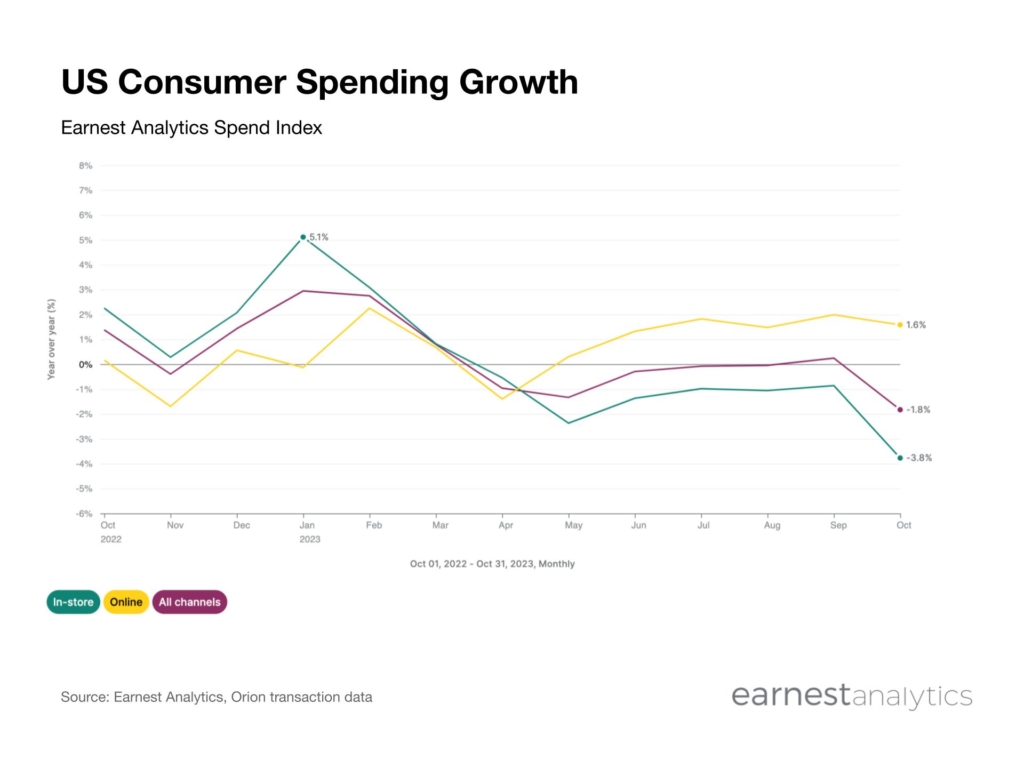

October 2023 Earnest Analytics Spend Index

Sign up to explore EASI data and category level trends for free in Earnest Dash.

Earnest Analytics Spend Index powered by Orion transaction data fell below year ago levels as a steep deceleration in-store exacerbated a smaller deceleration online. Consumer spending was weak across the board, with some of the steepest monthly decelerations in Home Furnishings and Home Improvement. Apparel also slowed, with Footwear, Mid-Tier Department Stores, and General Apparel all falling high single and low double digits compared to year ago levels. Gyms slowed significantly to flat growth as YoY comps became harder headed into the New Years Resolution season, while Home Fitness fell low double digits YoY. Travel softened As Air Travel fell around 10% YoY, trailed by Lodging & Accommodations and Online Travel Agency weakness. Online Marketplaces was a bright spot, growing mid-single digits as Amazon hosted its early access sale. Delivery Aggregators also stood out with mid-single digit growth YoY.

Sign up to explore EASI data and category level trends for free in Earnest Dash.

*About the Earnest Analytics Spend Index:

The Earnest Analytics Spend Index (EASI) is an alternative data-driven measure of consumer spending that tracks spend across 2,500+ large national brands in major consumer discretionary and staples subcategories. The near real-time data is derived from the credit and debit spend of millions of de-identified U.S. consumers. Advantages of using EASI include better representation of e-commerce spend, disaggregation by geography, and online versus in-store breakouts.

Historical numbers could vary slightly due to methodology updates.