New normal in US foodservice and retail: visits are down, check size growth is slowing

By JP Frossard and Thomas Bailey, Rabobank Consumer Foods

Download the full Earnest Files: A new normal for US foodservice and food retail.

Credit and debit card transactions from Earnest Analytics suggest a range of fascinating emerging trends in US grocery shopping and eating out throughout 2023. This period was marked by price increases being passed on to consumers and the first signals of slowing and changing spending patterns. Less notably, this year is also the first truly “post covid” year, with the economy fully open and no major outbreak affecting Americans’ routines.

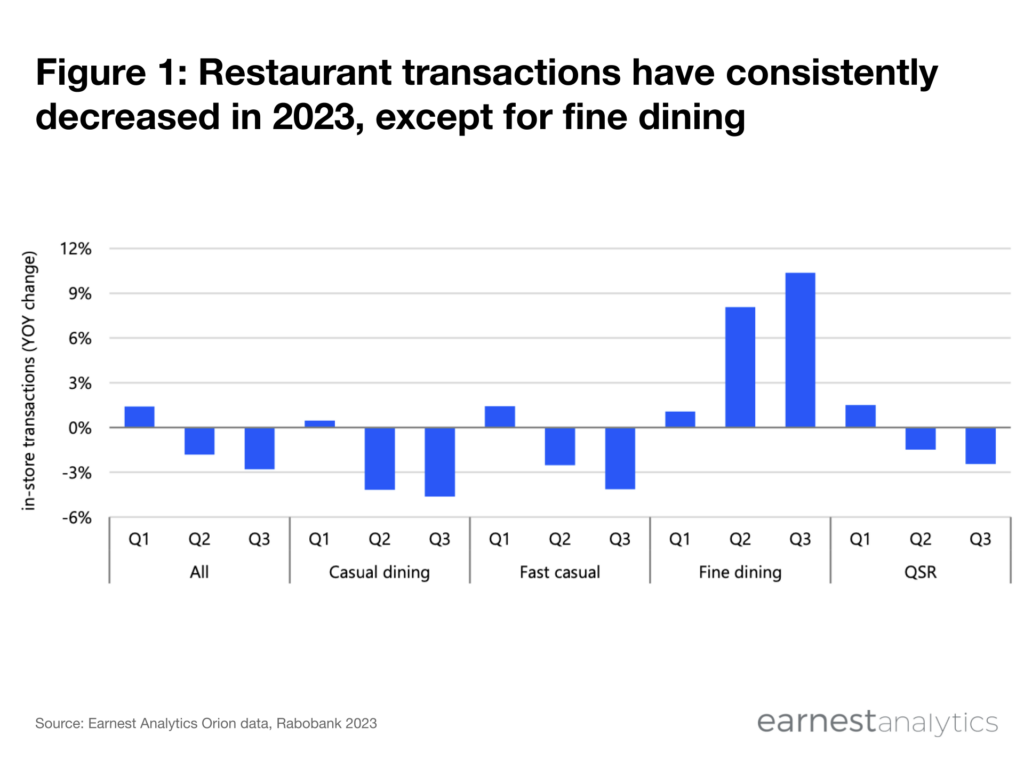

Unsurprisingly, restaurant transactions have fallen 3% YoY in Q3. This decline can be attributed to increased menu prices and more cautious consumers with dwindling discretionary income. Remarkably, fine dining transactions surged 10% YoY, reflecting growing disparity in spending habits between affluent and lower-income consumers. Meanwhile, a slight surprise was the continued growth in online food orders, up 2% YoY, with a notable 75% increase from Q3 2019 figures, indicating sustained acceptance of virtual channels.

Download the full Earnest Files: A new normal for US foodservice and food retail.