GLP-1 Series Part 4: End of Mounjaro’s bridge program drove improved gross-to-net

Contact sales for details.

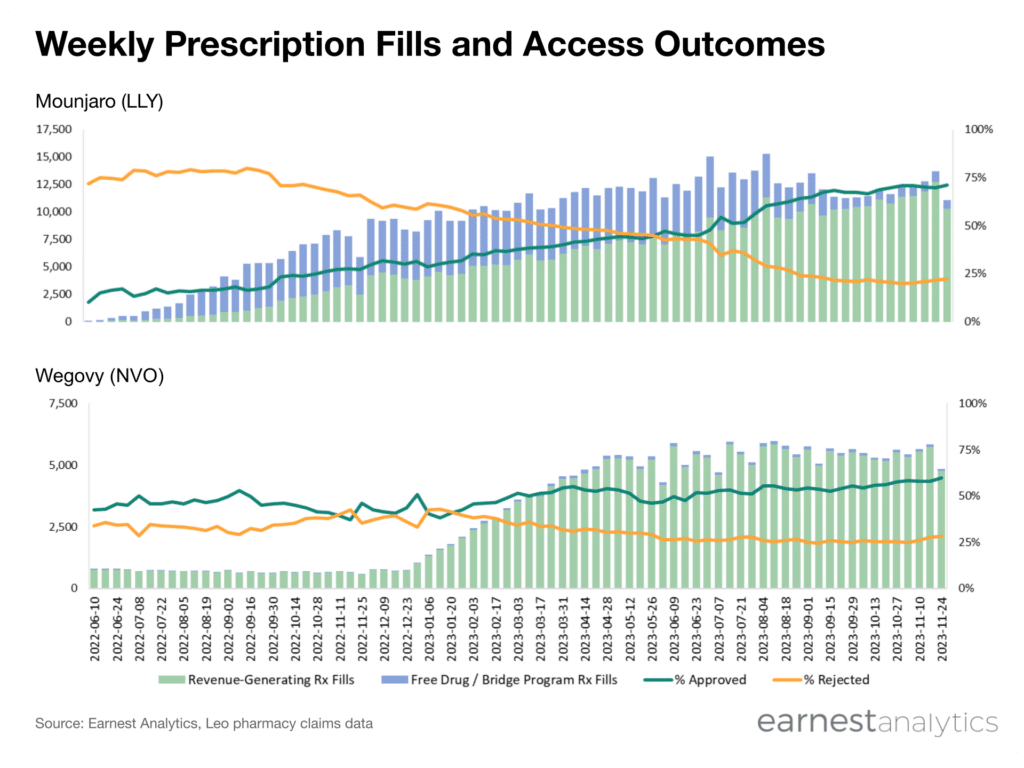

When Mounjaro first came to market, Eli Lilly prioritized access to the drug by establishing their bridge program, allowing patients without commercial coverage to receive the drug with steep manufacturer-subsidized discounts. Bridge programs have more meaningful ramifications to a drug’s gross-to-net compared to traditional coupon programs for which the manufacturer is simply offsetting a portion of a patient’s out-of-pocket cost.

During the summer of 2023, around the time Eli Lilly achieved majority commercial access (i.e., more patients covered by their primary insurers than not covered), they wound down their bridge program and changed its terms to cover a lower percentage of drug’s cost. While weekly scripts volume inclusive of bridge program claims appeared to plateau during this period, revenue-generating claims (i.e., claims filled without any patient-assistance programs) continued to grow week-over-week. By contrast, revenue-generating claims volume for Novo Nordisk’s Wegovy flattened over that same time period.

The granularity of Leo pharmacy claims data lends itself well to track key market access dynamics such as patient-assistance program utilization, a meaningful driver of gross-to-net particularly in the early months of a drug’s commercial launch.

Data Disclaimer:

Results reflect data as of December 7th, 2023 when they were prepared. Current results may have changed due to panel and methodology updates.

Learn more about Leo Pharmacy Claims data