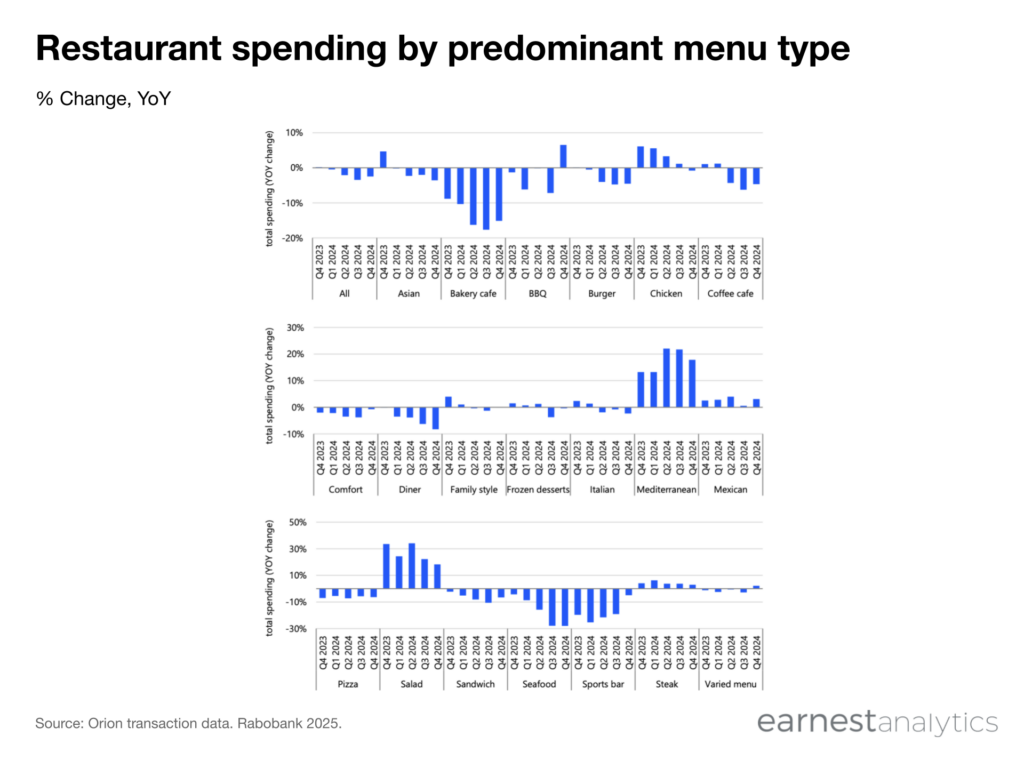

Mediterranean, Salad grow; Burger, Sandwich, Coffee restaurants decline in 4Q24

According to data measuring credit and debit card transactions in large restaurant chains across the US, restaurant spending saw improvements in Q4 2024 across all surveyed categories. However, it is still too early to affirm this is part of a rebound. Transactions dropped by 4.3% YOY in Q4 2024 (see figure 1), an improvement from the previous two quarters. This indicator has been in negative territory for seven consecutive quarters, a result of the financial strain on consumers. Combined with the continual rise in foodservice prices, this has pivoted food consumption toward home preparation.

While traffic is down, average check sizes have continued to grow, albeit slower than before and below menu inflation. In Q4, average check sizes increased by 1.9% (see figure 2), while inflation for food-away-from-home during the same period was roughly 3.7% (see figure 3). In addition to reduced visits, higher prices and compressed discretionary income have taken a toll on the number of items ordered, leading consumers to prioritize lower priced items and seek promotional deals at establishments.

Salad and Mediterranean chains have had substantial growth in the past quarters. This indicates that US consumers have welcomed the expansion of novel fast casual chains providing food offerings seen as healthier. It may also be a partial reflection of the expanding use of glucagonlike peptide-1 (GLP-1) drugs. Although we don’t have data covering GLP-1-influenced restaurant spending, recent surveys on grocery spending indicate these menus are characterized by higher spending on produce and lean protein.

Of all menu types in US foodservice spending, burger, sandwich, and coffee chains experienced the most significant decline in visits in Q4 2024. On average, US consumers visited burger chains 11 times in Q4, which is a decrease of 0.32 visits (or -2.9%) compared to the same quarter of the previous year. In contrast, salad and Mexican restaurants saw an increase in visits, with averages of two and four visits respectively. However, their combined growth of 0.17 visits was insufficient to counterbalance the decline in burger chain visits. Chicken restaurants, which have been expanding rapidly in recent years, remained the second most popular choice, with consumers visiting them 6.3 times this quarter.

Download foodservice and food retail 4Q24 report