McDonald’s customers turn to Taco Bell, Dutch Bros in their search for value

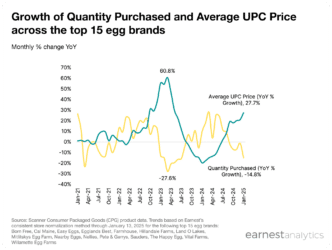

See chart in Dash.

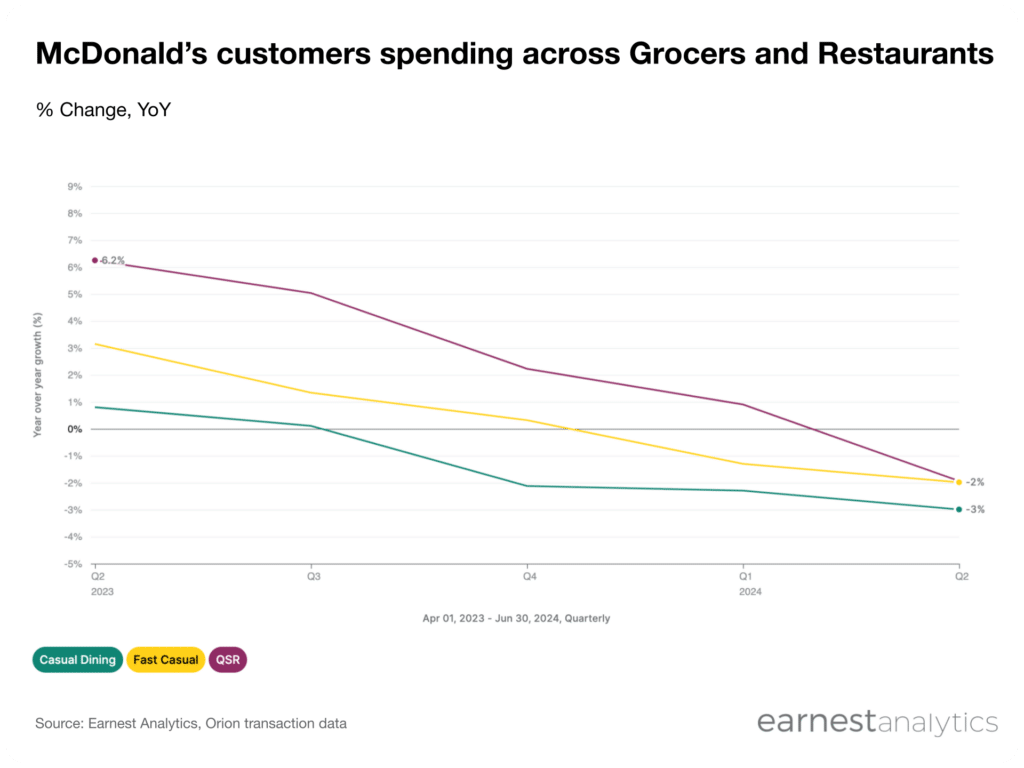

McDonald’s customers spent 1.9% less at fast food (quick service restaurants or QSR) brands during MCD’s second quarter of 2024 compared to 2023, but decreased spending at Casual Dining (-3%) and Fast Casual (-2%) even faster, according to Earnest credit card data. The result was that McDonald’s customers’ QSR share of Restaurant spending increased slightly compared to the same period in the previous year. Nevertheless, McDonald’s share of QSR spending among its customers shrank to 15% in the second quarter, down from 15.4% in the first quarter (see data in Dash). Executives admitted that their “value leadership gap has recently shrunk” compared to other brands during the associated second quarter 2024 earnings call given recent price increases.

This suggests that while McDonald’s customers may be looking for value, as seen in the extension of MCD’S new $5 value meal, they are not yet fully leaving fast food restaurants to eat at home.

Access data in Dash.

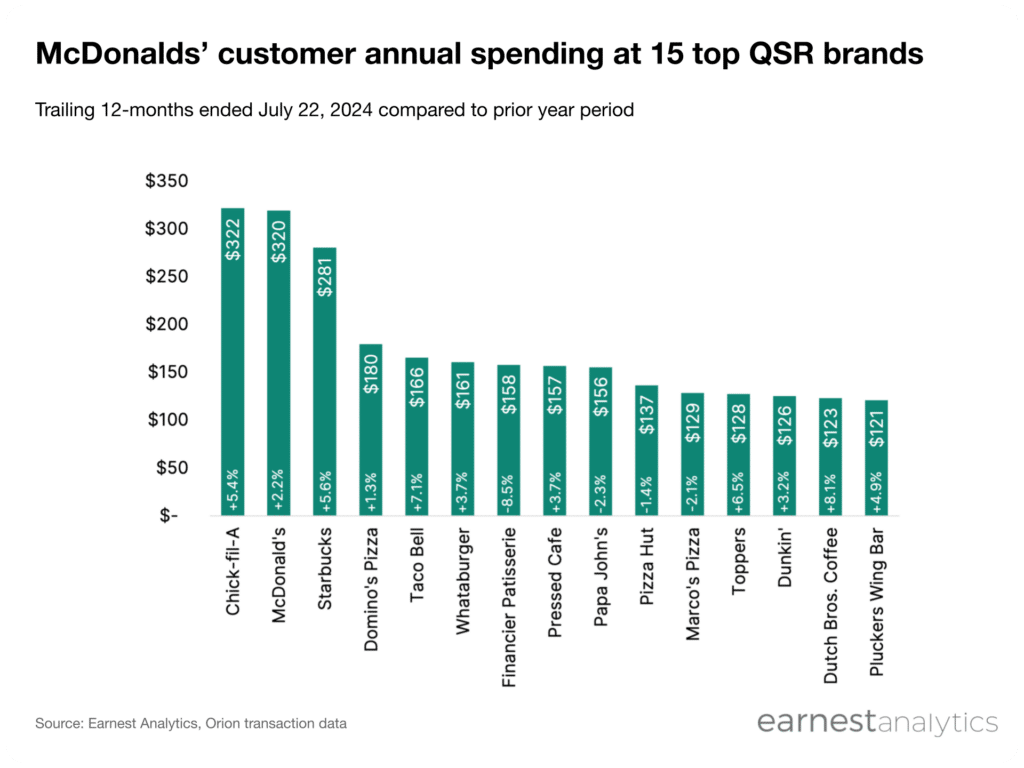

McDonald’s customers spent $322 at Chick-fil-A in the 12 months ended July 22, 2024, slightly more than they did at McDonald’s. Meanwhile, McDonald’s spending at Chick-fil-A grew 5.4% YoY, outpacing the spending growth of McDonald’s customers at McDonald’s (+2.2% YoY). Taco Bell experienced the biggest increase in spending by McDonald’s customers, +7.1% YoY to $166. Taco Bell customers generally spend about 20% less than McDonald’s customers at each respective brand (see data in Dash).

McDonald’s customers’ spending at Dutch Bros (+8.1% YoY), Pluckers Wing Bar (+4.9% YoY), Toppers (+6.5% YoY), Starbucks (+5.6% YoY), and Whataburger (+3.7% YoY) all outgrew their spending at McDonald’s. Pizza chains Domino’s, Papa John’s, Pizza Hut, and Marco’s all lost spending by McDonald’s customers compared to the prior year.

Track Fast Food spending for free