Madrigal cultivates Rezdiffra’s foothold in MASH as GLP-1 competitors seek approval

Key Takeaways

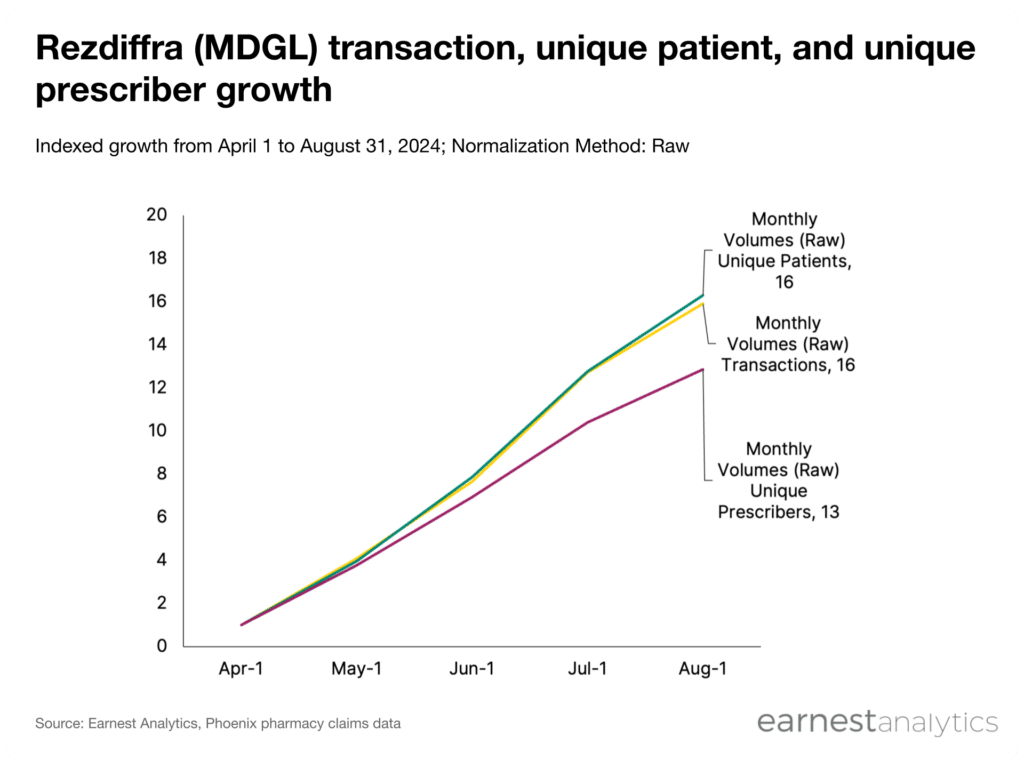

- Rezdiffra’s patient count grew 16x since April according to Earnest pharmacy claims data

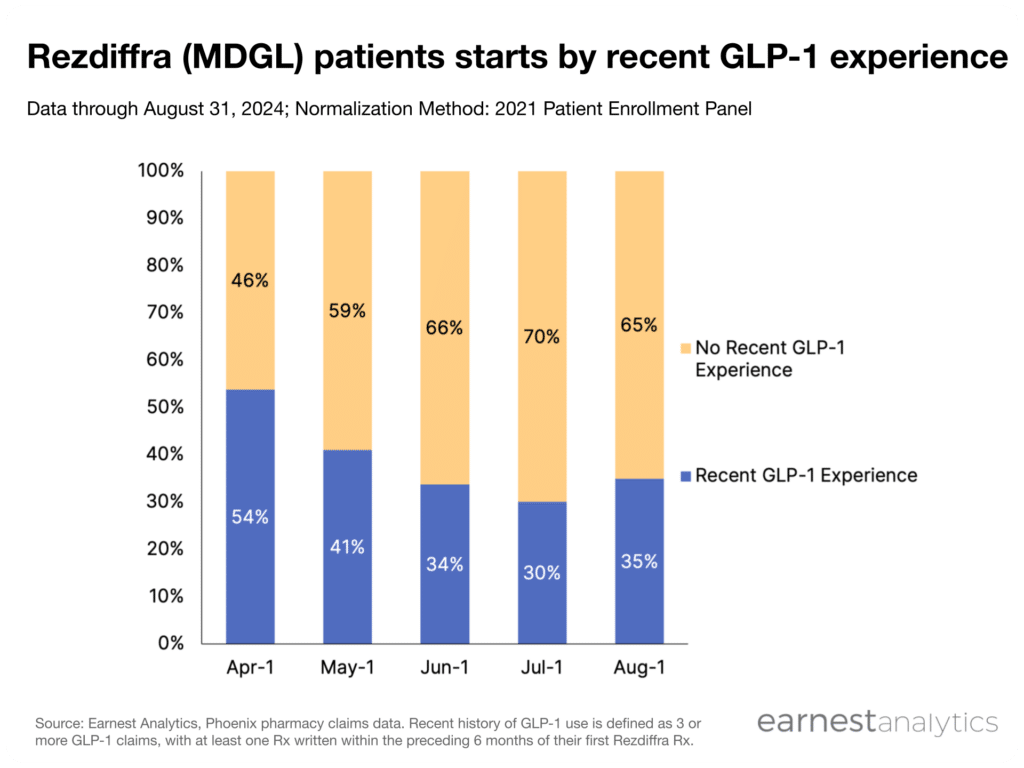

- 35% of Rezdiffra patients have been prescribed a GLP-1 recently

Rezdiffra (MDGL) was approved by the FDA in March 2024, as the first treatment approved for adults with noncirrhotic non-alcoholic steatohepatitis (NASH, now commonly referred to as MASH) with liver scarring. Madrigal Pharmaceuticals touted Rezdiffra’s initial launch as a success, citing “more than 2,000 patients on Rezdiffra” and that “approximately 20% of top targets wrote a Rezdiffra prescription” during their 2Q2024 earnings call.

Contact Sales for more.

Earnest’s Phoenix dataset reflects Rezdiffra’s continued growth across key performance metrics into 3Q2024. Prescriptions and unique patients both grew 16x, and unique prescribers grew 13x from April to August, 2024.

Contact Sales for more.

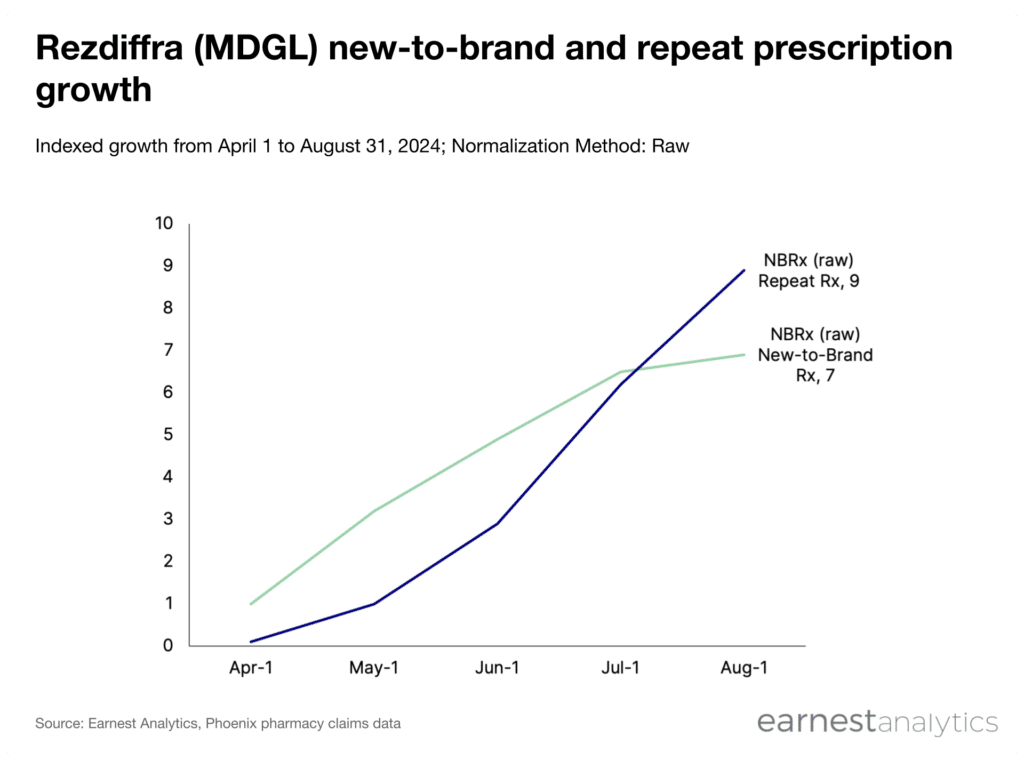

Comparing first time (NBRx) from refill prescriptions (repeat Rx), the rate of new patient additions began to plateau in July, with 7x indexed growth in NBRx observed in July and August. However, repeat Rx contributed significantly to growth over this period, surging from 6x to 9x indexed growth from July to August.

Contact Sales for more.

GLP-1s (e.g., Ozempic, Mounjaro, Wegovy) may have the potential to alter Rezdiffra’s growth trajectory, given that several GLP-1 agents are currently being studied in MASH with promising phase II clinical trial results (Boehringer Ingelheim’s survodutide, Lilly’s tirzepatide). Madrigal has speculated that GLP-1 drugs could positively influence Rezdiffra uptake by promoting diagnosis of MASH, with its CEO “hopeful that there’s going to be other products [approved] in NASH, because it helps to grow the market.” Conversely, analysts have viewed the potential approval of GLP-1 drugs in MASH as a future headwind. Numerous investors have questioned how Rezdiffra’s growth trajectory will shift in the event that GLP-1 efficacy overshadows Rezdiffra and have speculated that payers could require a GLP-1 step-through prior to Rezdiffra.

To date, Madrigal has declined to comment on the proportion of Rezdiffra patients taking GLP-1 drugs. Earnest’s Phoenix dataset suggests that ~35% of patients starting Rezdiffra had a recent history of GLP-1 use, a notably higher percentage compared to the 14% of clinical trial patients who were on a GLP-1. This suggests that the majority of current patients would not immediately qualify for a Rezdiffra prescription in the event a GLP-1 step-through requirement was implemented.

Tracking Rezdiffra’s growth trajectory over the coming months will be crucial for understanding its future potential as a blockbuster drug. With Earnest’s Phoenix dataset in hand, continue tracking Rezdiffra utilization trends and underlying drivers of growth in real-time.

Reach out for more information