Low-income Consumers Shun Restaurants, Turn to CPG

“The first big trade down is the trade down from away from home to at home. If you’re looking at consumers over $100,000 a year income, you’re still seeing they’re going out to eat. But below that threshold, it’s not where it was pre-pandemic…there was a trade down into at-home meeting during COVID. And that has not fully reverted to away from home because the prices away from home have gone up so high that it’s a better value to continue to eat in home as people are trying to stretch their household balance sheet.”

– 4Q22 Earnings call, Sean M. Connolly, CEO

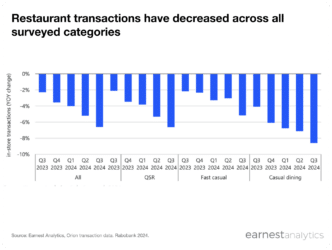

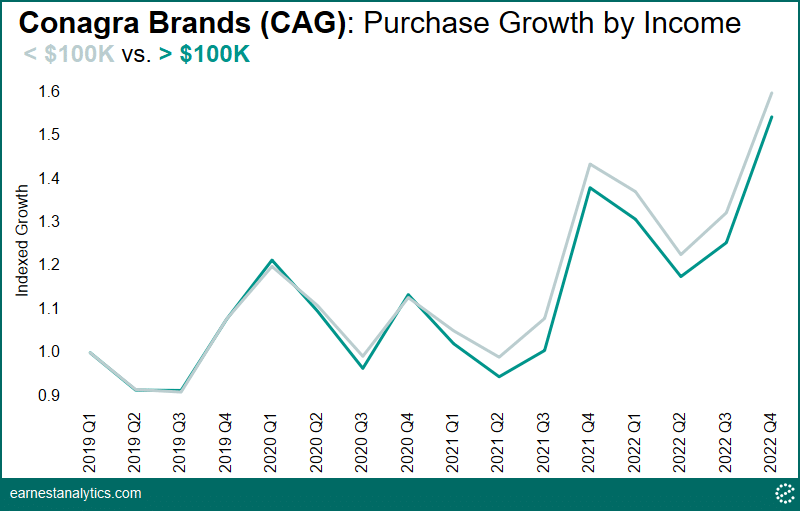

Low and middle income consumers are spending less at restaurants, and instead choosing to eat at home. According to CPG executives, this trend is benefitting their companies. Earnest Scanner data shows sustained sales outperformance among low income earners at Conagra Foods–maker of Slim Jim Jerky, Orville Popcorn, Hunt’s Ketchup, Bird’s Eye, and Marie Calendar’s frozen meals–beginning in calendar 2Q21 when inflation first started to ramp.

Since then, the gap in spending on packaged goods has only widened between high and low-income earners. This suggests low income consumers are trading down from food away from home to food at-home at a faster pace than higher income consumers in the face of inflation.