Levi’s DTC focus attracting higher income shoppers

Access chart in Dash.

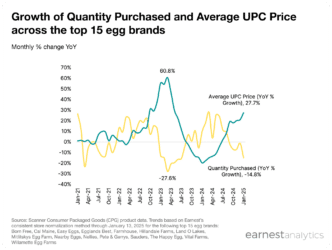

Levi’s increased focus on its DTC channel is attracting wealthier shoppers to the brand, according to Earnest credit card data. Levi’s has worked to grow its own channels and reduce dependence on department stores in recent years. The result was 8% lower sales, but boosted profits in its first quarter of 2024. Apart from benefitting margins, the DTC channel is successfully bringing a new shopper mix to the brand. As of June 17, year-to-date sales among $195k+ income earners (quintile 5 above) grew over 25% YoY at Levi’s online and in-store. This after high income earners were one of the biggest drags on growth as recently as 2020. The highest income earners now account for around 42% of Levi’s DTC sales. Shoppers earning $195k+ comprised 32.5% of Kohl’s and 37.1% of Macy’s sales so far in 2024 (see Kohl’s and Macy’s data in dash).

While the DTC shift appears successful at attracting higher income groups, inflation may be having an outsized impact on lower income cohorts. Shoppers making under $60k grew their spending the slowest at Levi’s DTC channels in the face of persistently high inflation, while shoppers earning just above the US median household income at $90k-$135k are also growing their Levi’s DTC spend slower than other cohorts despite a boost from tax season.

Still, Levi’s DTC focus could help the brand retain and grow high income shoppers leaving department stores. Shoppers making over $195k were the worst performing segment by sales growth at Macy’s, one of Levi’s largest wholesalers, in 2023 and so far in 2024.

Track Apparel & Accessories spending for free