Lennar cements lead over competition in 2Q amidst high interest rates

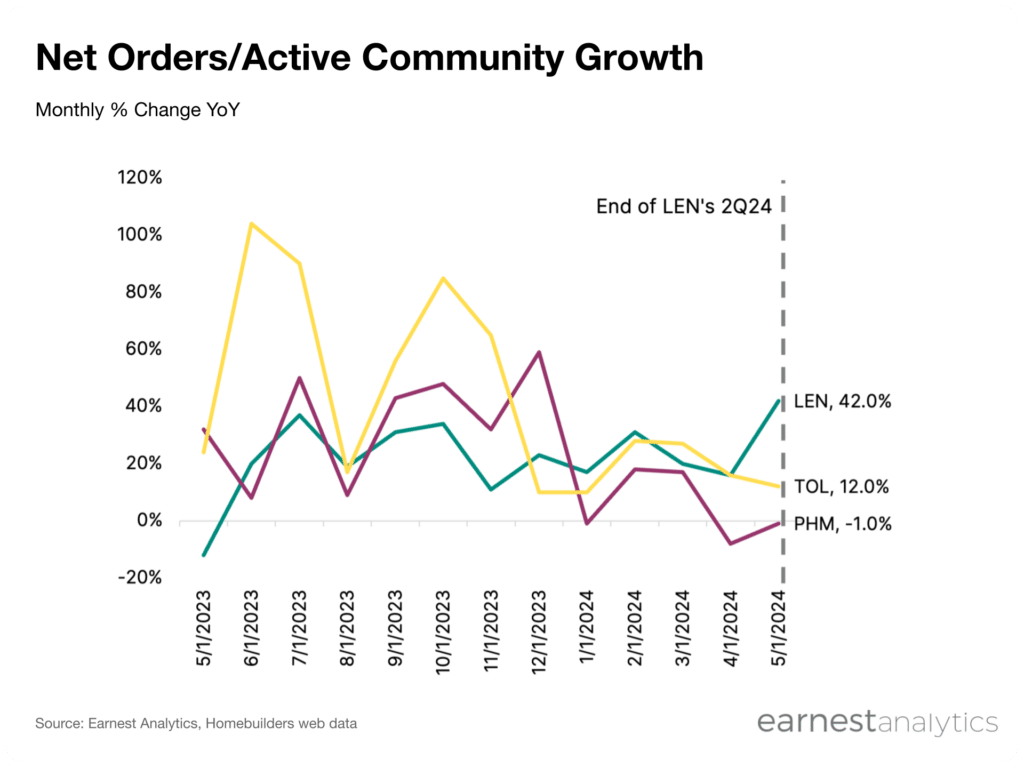

Lennar’s monthly sales pace increased from 5.8 to 6.5 homes per community, accelerating 11.6 points to 42% YoY from the end of February to the end of May 2024, according to Earnest homebuilder data.

Outperforming competition like PulteGroup and Toll Brothers, Lennar’s sales pace at the end of May exhibited its highest growth since March last year. In their latest earnings call, LEN highlighted their promotional strategies to “match” sales pace to production pace, despite high interest rates wavering around 7% in April and May. Lennar’s strategic use of sales incentives seems to have been effective, leading to second quarter earnings that outperformed consensus expectations.

Contact sales for details.

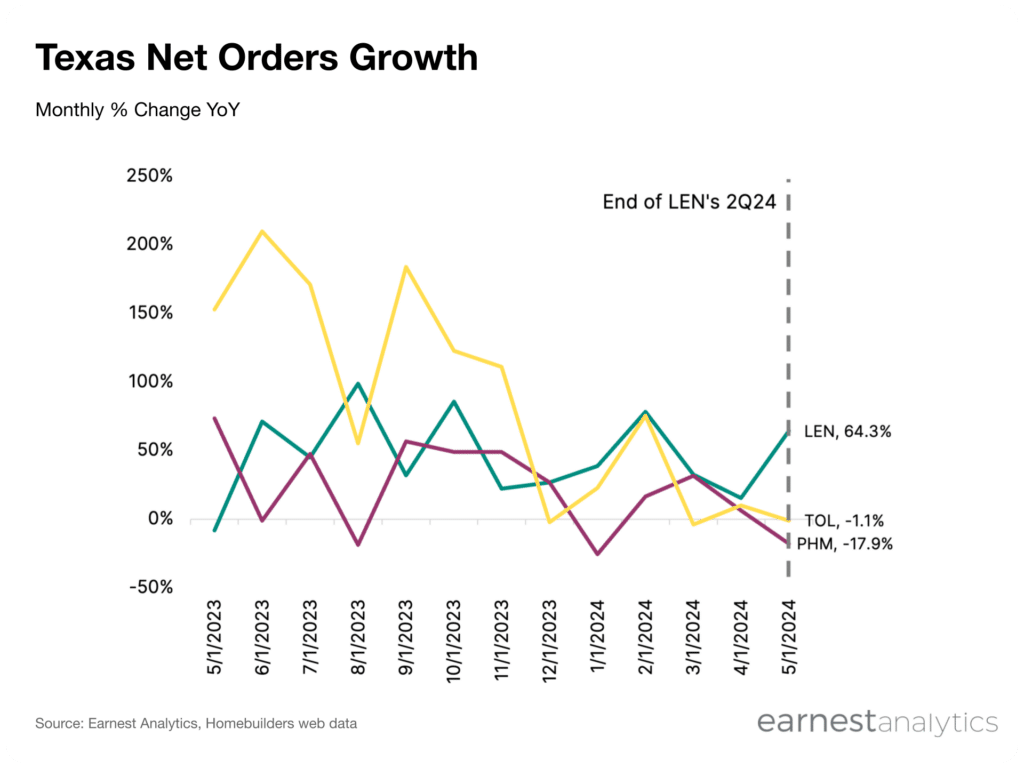

Lennar’s Texas and East regions (primarily consisting of Florida) are the biggest drivers of the sales pace growth in Q2, and those regions outperformed Lennar’s competitors over the same period. According to Lennar’s latest earnings call, we can expect for them to continue expanding in those regions in Q3.

Lennar’s net orders for Texas ending May 2024 exhibited 64% growth, while Toll Brothers and PulteGroup saw flat and negative growth, respectively, in the same period. In PulteGroup’s latest earnings call, they note an uptick in competitor inventory in the Texas and Florida markets.

Contact Sales for details.

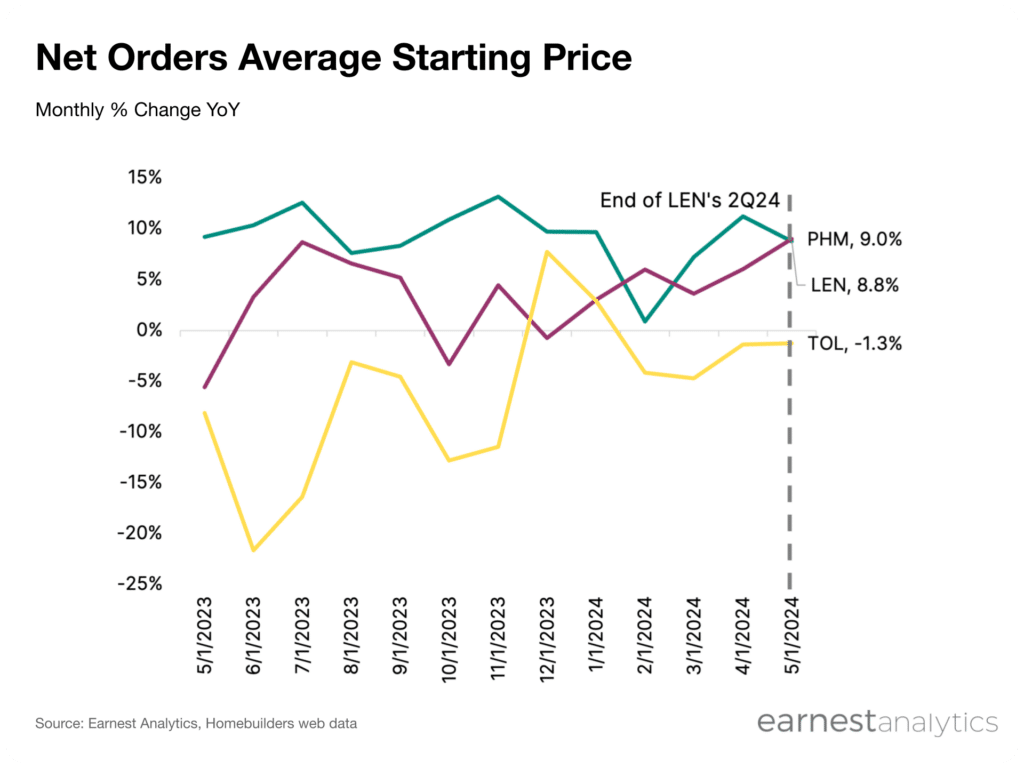

Additionally, Lennar’s average order starting price accelerated 7.9 points to 8.8% YoY from the end of February to May. Meanwhile, PulteGroup and Toll Brothers saw a relatively smaller increase, accelerating roughly 3 points over the same period.

Contact Sales for details.

Request information on Homebuilder data