January 2025 US Consumer Spending: fuel sales grew as spending slowed

Access chart in Dash.

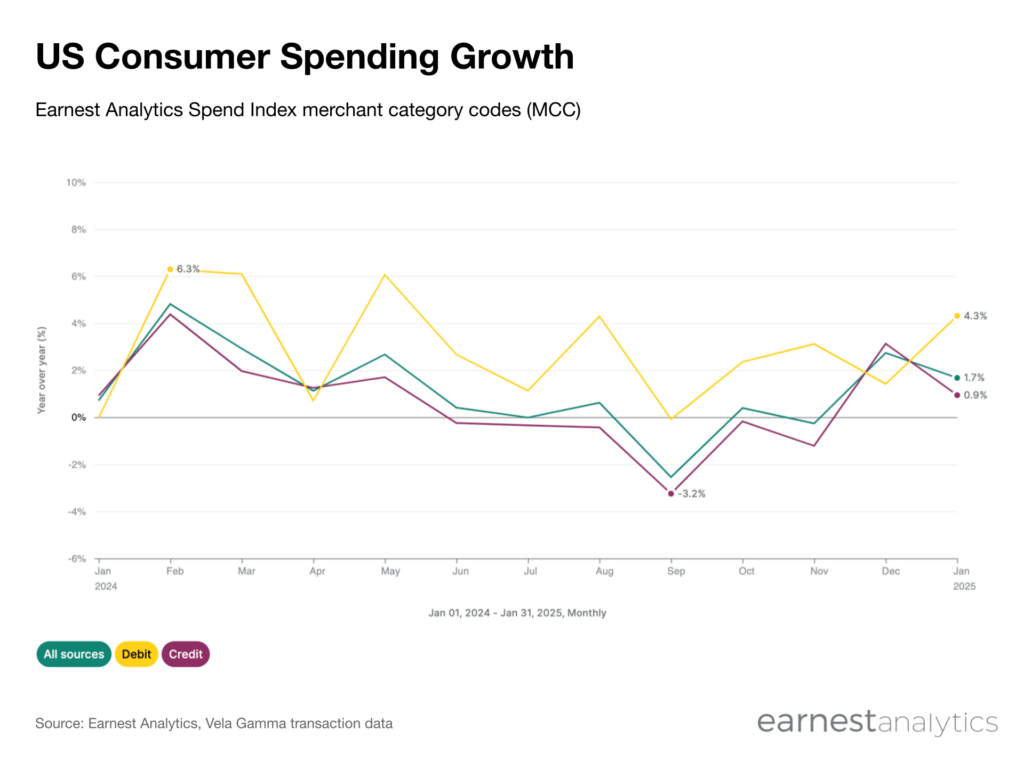

January 2025 US consumer spending grew 1.7% YoY according to the Earnest Analytics Spend Index powered by Vela Gamma transaction data. An acceleration in debit card spending more than offset a deceleration in credit card spending.

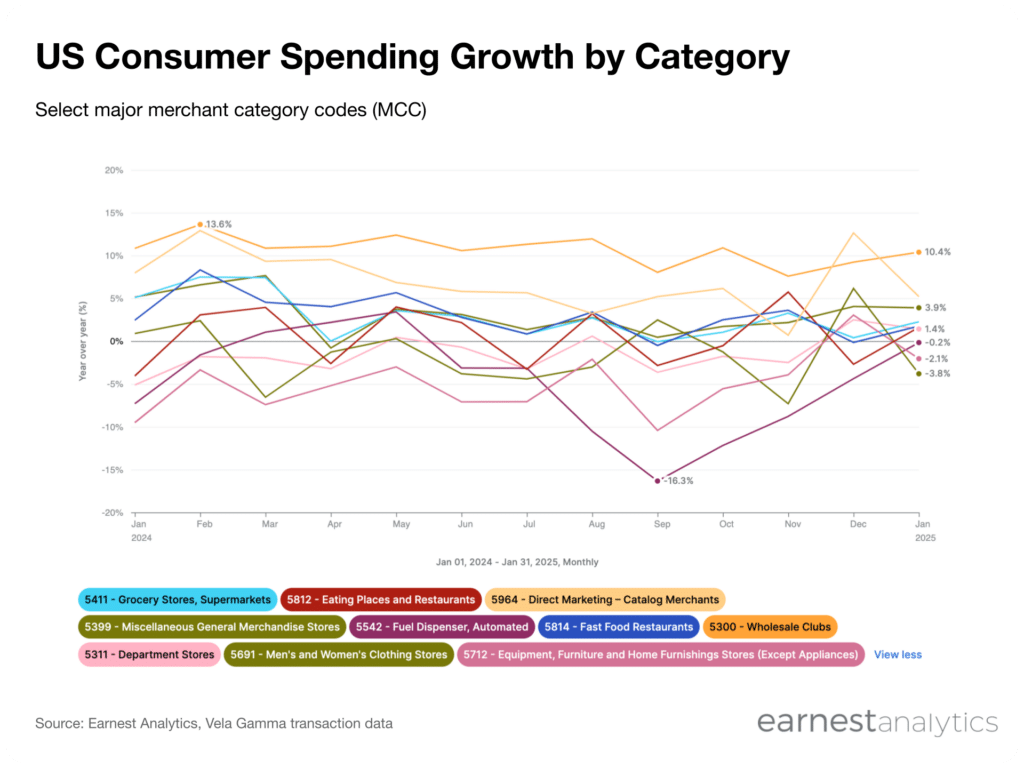

Results from US consumer spending by merchant category codes (MCC) in descending order of total sales:

- Grocery Stores, Supermarket (5411), which includes major grocers like Kroger and Publix, accelerated to 2.3% YoY growth

- Eating Places and Restaurants (5812), which includes casual restaurants like Olive Garden and Chili’s accelerated to 1.6% YoY growth

- Direct Marketing–Catalog Merchants (5964), which includes online ecommerce like Amazon and Temu, decelerated to 5.2% YoY growth

- Miscellaneous General Merchandise Stores (5399), which includes Walmart and Target, decelerated to 3.9% YoY growth

- Fuel Dispenser, Automated (5542), which includes Shell and Exxon, accelerated to -0.2% YoY growth

- Fast Food Restaurants (5814), which includes McDonald’s and Chick-fil-A, accelerated to 1.8% YoY growth

- Wholesale Clubs (5300), which includes Costco and Sam’s Club, accelerated to 10.4% YoY growth

- Department Stores (5311), which includes Nordstrom and Kohl’s, decelerated to 1.4% YoY growth

- Men’s and Women’s Clothing Stores (5691), which includes Old Navy and Abercrombie, decelerated to -3.8% YoY growth

- Equipment, Furniture, and Home Furnishings Stores except Appliances (5712), which includes Wayfair and Williams Sonoma, decelerated to -2.1% YoY growth

Access chart in Dash.

About the Earnest Analytics Spend Index:

The Earnest Analytics Spend Index (EASI) is an alternative data-driven measure of consumer spending that tracks spend across 89 merchant category codes (MCC), encompassing thousands of US merchants. The near real-time data is derived from the credit and debit spend of millions of de-identified US consumers. Advantages of using EASI include faster macro signals and insight into geographic, shopper income, and credit vs debit trends.

Historical numbers can vary due to methodology updates.

Request macro trends details