Instant grocery delivery app JOKR faces falling sales, fickle customers

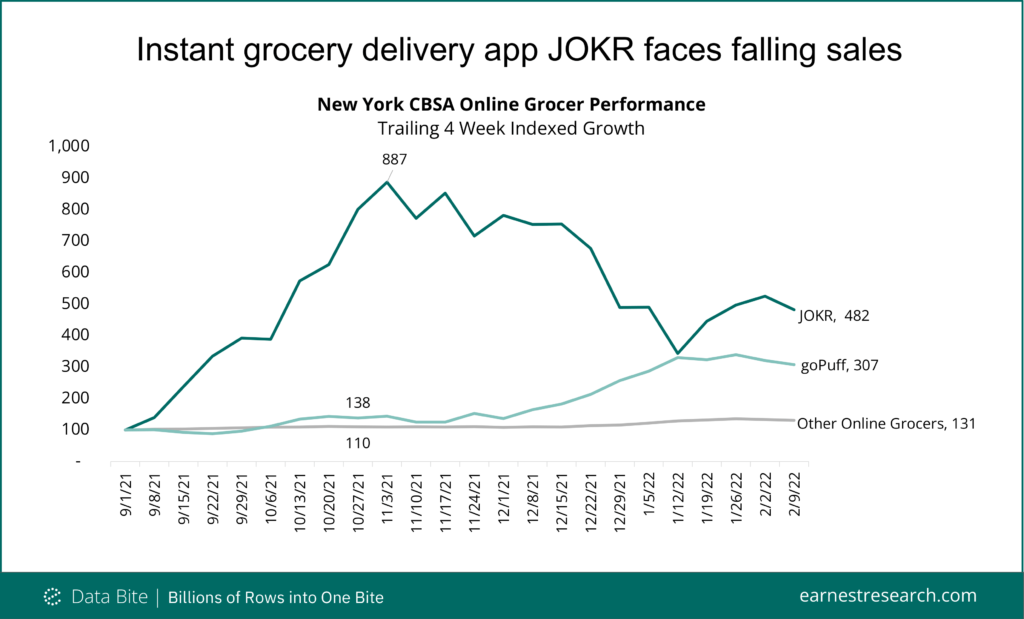

Instant delivery startup JOKR is reportedly looking to sell its New York operations owing to operational challenges in its largest US market. Earnest Analytics (FKA Earnest Research) credit and debit card data shows that JOKR’s New York area sales fell by half between early November 2021 and February 2022. Established competitor goPuff more than doubled sales in the region during the same period. News sources mostly attributed the retreat to the inability to secure the leases required to support JOKR’s proposed warehouse network. However, Earnest’s transaction data suggests that the service never really took root with new customers. Only 13% of JOKR customers added in October returned three months later, compared to 28% of goPuff customers.

The online grocery delivery market continued to grow in the New York area, as well as broadly across the US in late 2021, but not nearly at the rate it added customers and sales during the peak of the pandemic in 2020. The online grocery industry also lagged behind its convenience economy cousin—restaurant delivery—as customers returned to grocery stores in 2021. New York City is also mulling a ban on the advertising of “15 minute” delivery services, citing “worker and pedestrian safety concerns.” It appears the promise of sub 1-hour delivery has yet to materialize in most US markets due to both high costs and weak customer retention.