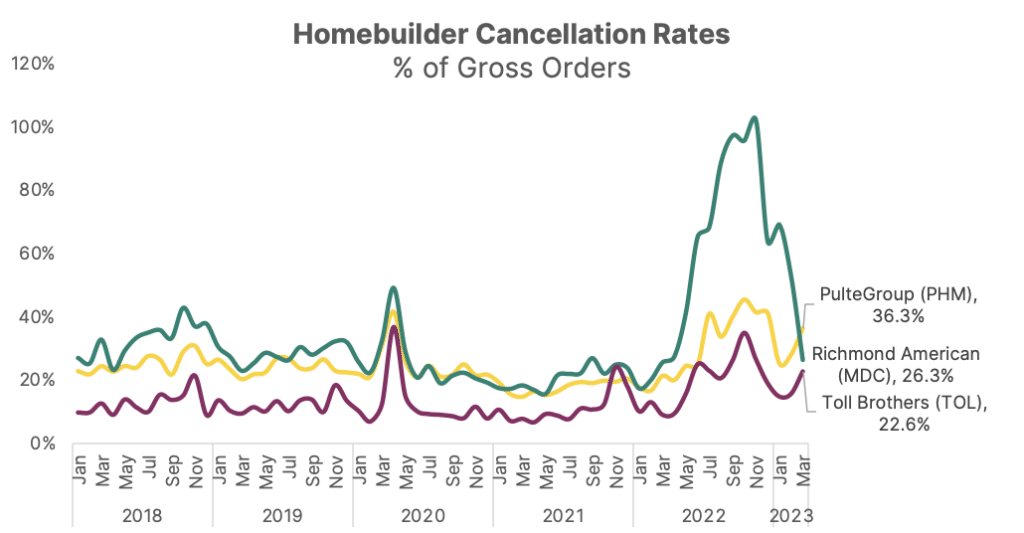

Homebuilders Rein-in Historically High Cancellation Rates

Consumer cancellations of new home builds at PulteGroup, Richmond American, and Toll Brothers slowed meaningfully in early 2023. Cancellation rates first began to climb in mid-2022 as increasing mortgage rates and economic uncertainty likely pushed more new homebuyers to abandon their orders. Since then the three major US homebuilders worked to mitigate higher cancellation rates.

Richmond American specifically mentioned in their 4Q22 earnings call that they “increased and expect to continue to increase our spec home construction starts to appeal to buyers who are willing to forgo some personalization with their homes in exchange for a faster close” in an effort to bring down prices. Management also mentioned requiring buyers to put down 5% instead of the previous 2%, hoping to create a “stable backlog” of more serious buyers. This is after Richmond American experienced the largest spike in home cancellations in 2022, driven mostly by California and Colorado. Meanwhile, sales in Texas, Florida, and Nevada, where PulteGroup and Toll Brothers have more exposure, were more resilient.

Contact Sales for more details on Earnest Homebuilders web data.

Notes

Homebuilder cancellation data may overstate reported cancellations relative to gross orders depending on how quickly and how often each website updates lot availability. Websites that are updated frequently may mark lots as “Sold” before the contract is signed and therefore observe higher cancellation rates when those lots return to “Available” before the contract is executed. This has no impact on Net Orders, which the data tracks more precisely.