Home Goods, Wayfair Winning Customer Wallet Share from Bed Bath & Beyond

Sign up for free to see consumer home goods spending in Earnest Dash.

Key takeaways:

- Bed Bath & Beyond shoppers moved their home spending to Wayfair, Home Goods, and Ikea since 2020

- Bed Bath & Beyond brand affinities point to a lower income shopper compared to Wayfair, which makes them more susceptible to the “trading down” effect on inflation

- Home Goods has the highest overlap with Bed Bath & Beyond shoppers by far, and growing

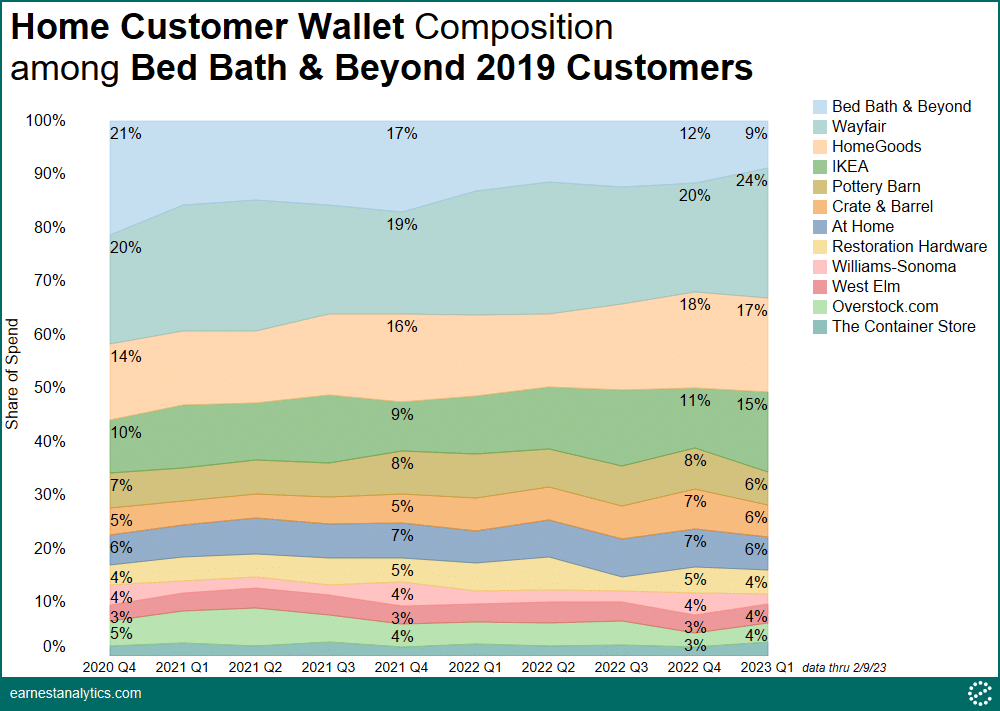

Wayfair, Home Goods, & Ikea Gain Most Wallet Share From Bed Bath’s 2019 Cohort

Powered by Earnest’s Orion transaction dataset. Access data in Dash.

Consumers who shopped at Bed, Bath, and Beyond (BBBY) in 2019 increased their spend fastest at Wayfair, Home Goods, and Ikea over the past few years according to Earnest Analytics’ Orion transaction data; each gaining more than 3 points of wallet share among Bed Bath’s 2019 customer cohort. The wallet share gains ramped in 2022 suggesting Bed Bath shoppers turned to these 3 home goods retailers at a higher rate following Bed Bath’s worsening financial struggles and a string of store closures. These trends may be an early indication of which retailers are best positioned to consolidate home spend as Bed Bath continues to rationalize the size of its retail footprint.

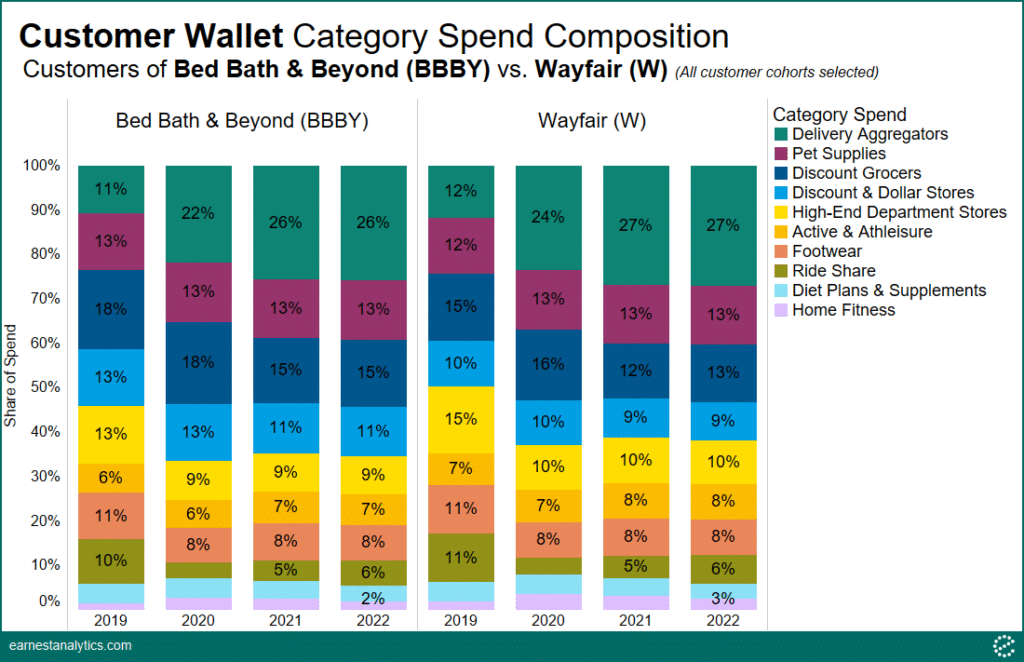

Category Wallet Reveals Lower-Income Bed Bath Customer Base

Powered by Earnest’s Orion transaction dataset. Access data in Dash – BBBY, W.

Across brand categories, Bed Bath customers tend to spend more at grocery and general merchandise discounters than Wayfair customers, hinting at a slightly lower income customer. Lower income customers have been trading down and reducing discretionary spend in recent months as inflation reduces disposable incomes. Higher exposure to this demographic could point to more impact from trading down effects or a general pull-back on discretionary purchases at Bed Bath. Wayfair’s customers tend to spend more on high-end department stores, home fitness, and athleisure brands, adding evidence to Wayfair’s relatively higher income, and more inflation-insulated, customer base.

Customers’ share of wallet at restaurant delivery aggregators represents the largest shift since pre-pandemic. This suggests that discretionary spending share may have shifted from durable and retail goods, to services and food over the last three years.

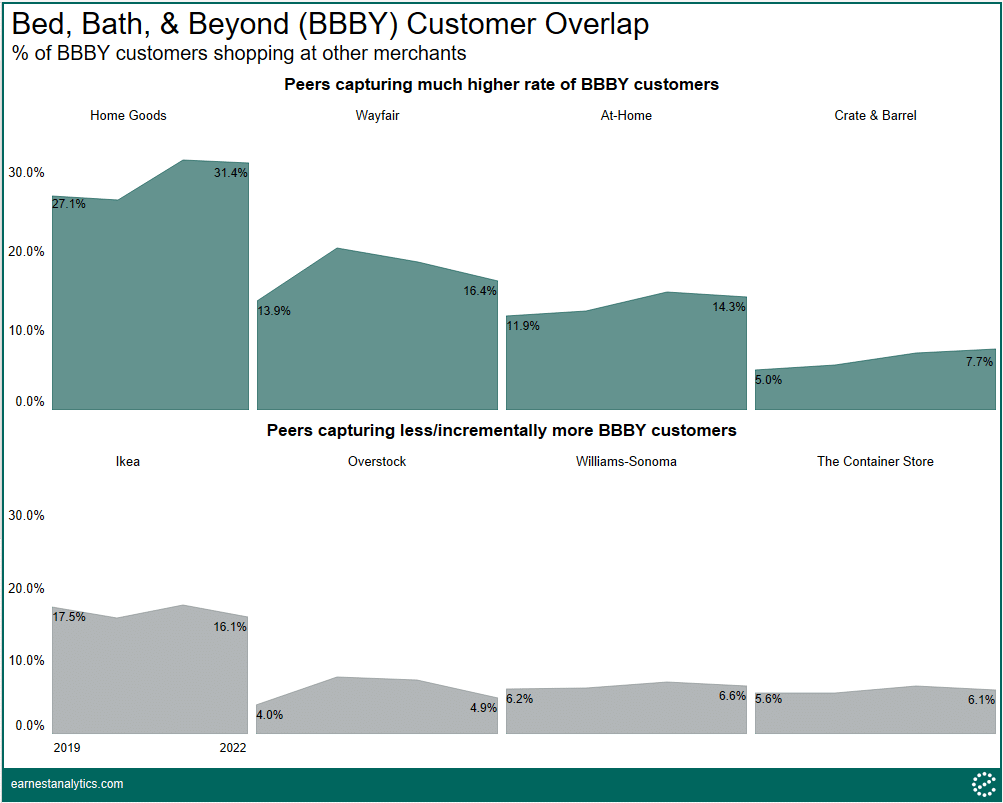

Home Goods, Wayfair, At-Home, and Crate & Barrel Captured A Much Higher Share of Bed Bath Customers In 2022 Compared To 2019

Powered by Earnest’s Orion transaction dataset. Data available via Earnest Direct.

We analyzed other home goods/decor peers Bed Bath customers shop at to identify which retailers have been successful capturing their shoppers amid operational woes. In 2022, 31.4% of Bed Bath customers shopped at Home Goods, 16.4% at Wayfair, 14.3% at At-Home, and 7.7% at Crate & Barrel; all at least 250 basis points higher than 2019 levels. Overstock, Williams-Sonoma, and The Container Store have slightly higher overlap than 2019, but the gains were more muted than peers and the percentage of customers shopping at each remained limited suggesting Bed Bath customers may increasingly favor other retailers for their home goods/decor needs. Ikea was one of the few retailers who experienced less customer overlap than 2019, albeit overlap remained relatively high in absolute terms and Ikea consolidated wallet share among Bed Bath customers (see wallet share above).