Home Furnishing, Auto Parts, and Electronics benefiting most from tax season despite late start, fewer refunds

Key Takeaways

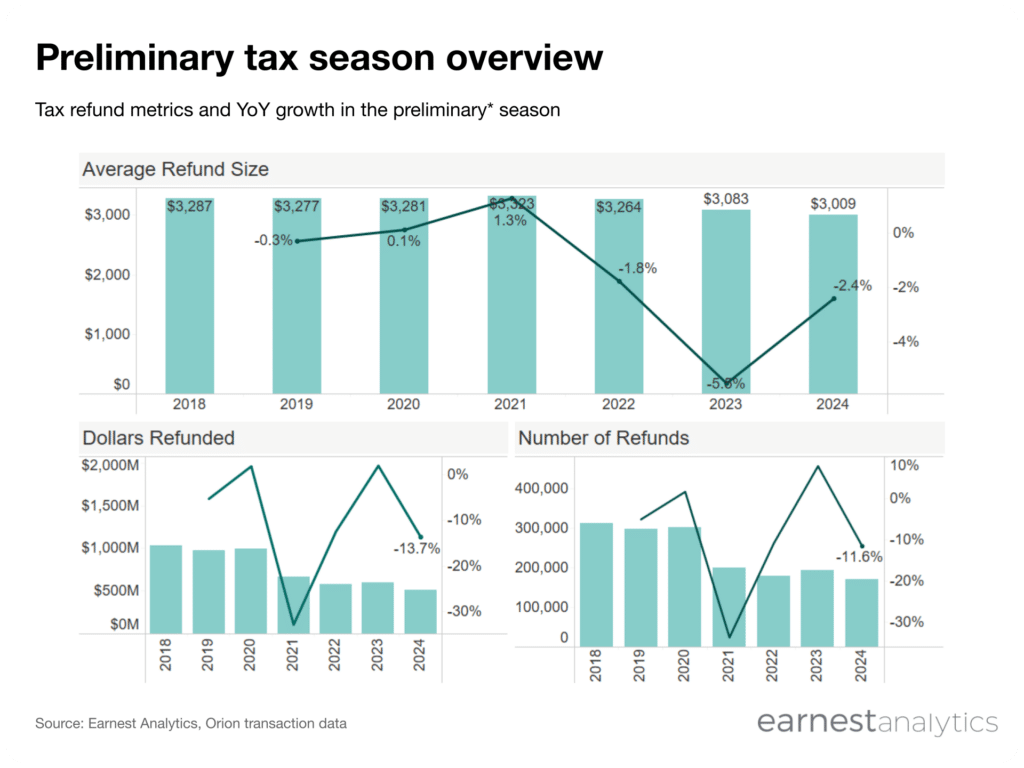

- Total refunds fell ~12% YoY as the season began a week later than 2023. On a same-days basis, refunds fell ~5% YoY

- The number and value of refunds are down 30%+ from pre-Covid levels as more taxpayers wait to file

- Home Furnishing, Auto Parts, Apparel, and Electronics are the biggest beneficiaries of early 2024 tax refunds

- Nordstrom, Nike, Wayfair, Macy’s, and Best Buy are benefitting the most from tax refunds so far, each with 10+ points of outspending from recipients

Fewer refunds in consumers’ pockets, Taxpayers wait later to file

Through the first 33 days of the tax filing season*, the number of refunds and their average size fell 11.6% and 2.4% YoY, respectively, in Earnest Analytics’ IRS Payments dashboard, in-line with reported figures**. The declines are primarily due to a later start: the IRS began accepting and processing tax returns on January 29, 2024, one week after the January 23rd, 2023 start date last year.

While this calendar mismatch accounts for a large portion of the declines, when adjusting for this, the number of refunds still fell 4.7% YoY across the same number of days in both years in the data, and the average size fell 4.4%. Importantly, consumer spending may potentially soften with fewer tax refunds in consumers’ pockets, whether the reason is calendar-related or organic.

The number of refunds and their value are materially down vs. pre-COVID levels (2019) across the initial 33 days into each season. There are 33% fewer refunds vs. the same period in 2019, suggesting a significant number of taxpayers continue to wait until later in the season to file, a trend that has persisted since covid. Additionally, the average size is down 9%, to just over $3,000, in the Earnest data.

Available to clients in the IRS Payments dashboard. Contact sales for details.

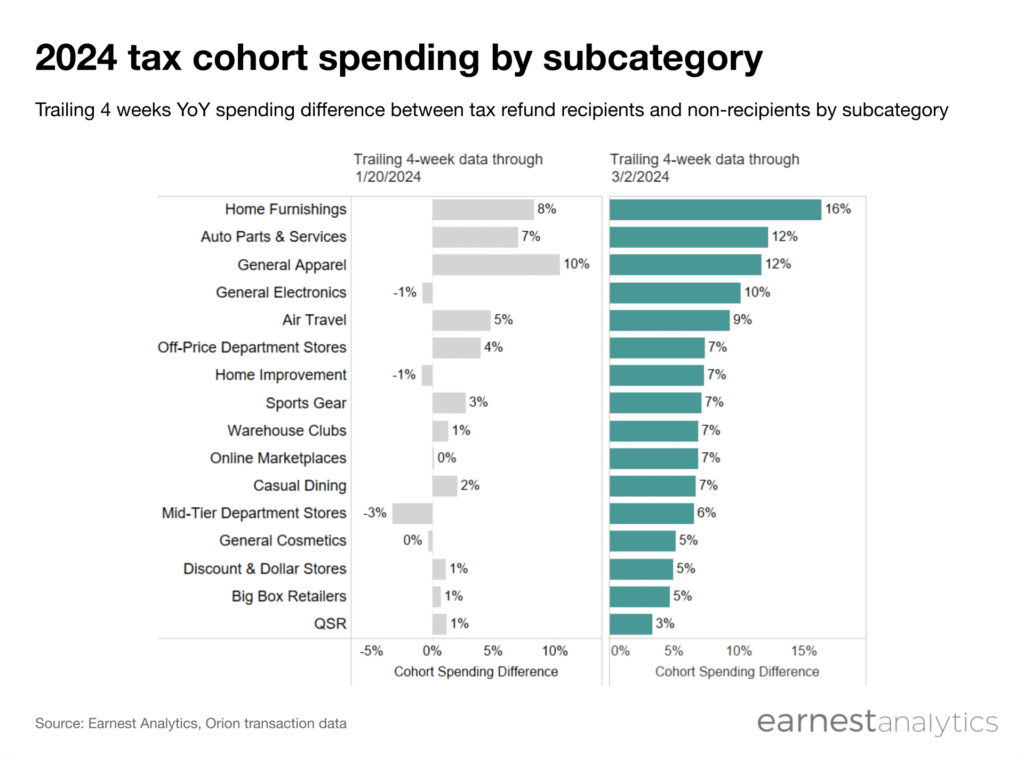

Home Furnishing, Auto Parts, Apparel, Electronics, and Air Travel largest lift relative to pre-tax season

Consumers who received a tax refund in the preliminary 2024 tax season outspent their peers on a YoY basis across most categories in the four weeks ending March 2, 2024. Home Furnishing, Auto Parts, General Apparel, and General Electronics experienced over 10 points of additional outspending compared to the four weeks ending January 20, 2024 (week prior to the beginning of tax season). The outperformance follows a relatively soft holiday period for these categories, indicating certain consumers may have delayed discretionary purchases until their refund. General Apparel saw double-digit outperformance by tax refund recipients, but the lift was more modest relative to pre-season spend. On the other hand, Home Improvement and Online Marketplaces saw high single digit outperformance by tax refund recipients and with strong lifts vs. pre-tax season spend.

Available to clients in the IRS Payments dashboard. Contact Sales for details.

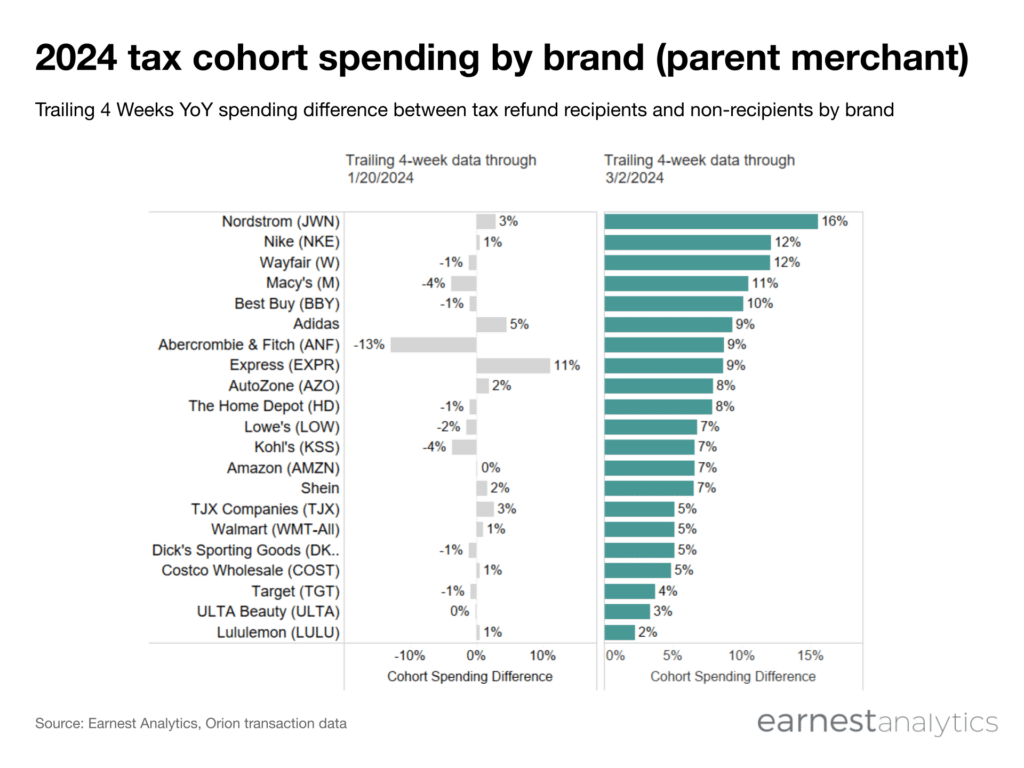

Nordstrom, Nike, Wayfair, Macy’s, and Best Buy benefitting most

Tax refund recipients outspent by the widest amount at Nordstrom, Nike, Wayfair, Macy’s, and Best Buy, which all experienced over 10 points of outperformance from the tax refund cohort in the four week period ending March 2, 2024. Interestingly, Nordstrom, Nike, Macy’s, and Abercrombie, saw more outspending by tax refund recipients than many of their Apparel peers, including Lululemon, TJX, Shein, and Kohl’s.

Available to clients in the IRS Payments dashboard. Contact Sales for details.

Notes

*Preliminary dates in this analysis are defined as in the IRS’ filing statistics: 1/29/2024-3/1/2024 for the ‘24 season, 1/23/23-3/3/23 for the ‘23 season, 1/24/22-3/4/22 for the ‘22 season, 2/12/21-3/5/21 for the ‘21 season, 1/27/20-3/6/20 for the ‘20 season, and 1/28/19-3/8/19 for the ‘19 season. Note the ‘21 season was delayed due to Covid and began late on 2/12. Also note the ‘24 season began one week after the start of the ‘23 season.

**The IRS’ filing statistics reported that the number of refunds issued declined 13.7% YoY (with direct deposits down 11.4% YoY) with the average size up 5.1%. Additionally, IRS reported total refunds issued declined 32% vs. pre-covid (2019) levels.