Holiday spending is flat so far in 2024, TikTok Shop pulls ahead

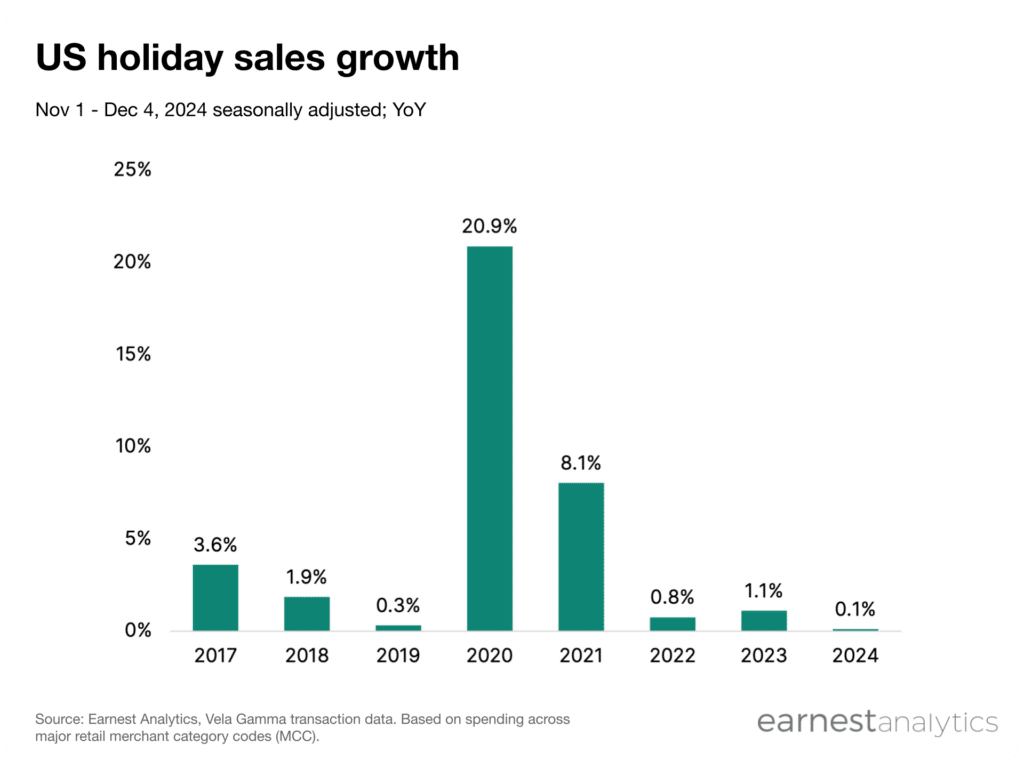

Holiday spending flat compared to 2023

Holiday consumer spending grew 0.1% YoY between November 1st and December 4th according to Earnest credit card data. This marks a deceleration from 2023, which had notched 1.1% YoY growth by this time.

Still, positive spending growth is a reversal from the early holiday period. Consumer spending fell 1.4% YoY in the first 13 days of November. Early weakness could have been the result of holiday promotion cadence.

Retailers began holiday promotions earlier during the pandemic to account for longer delivery times as more customers bought online. Many retailers continued to move their holiday promotions earlier and earlier in recent years. The resulting promotions likely pulled sales forward into October from the traditional start to holiday shopping in early November.

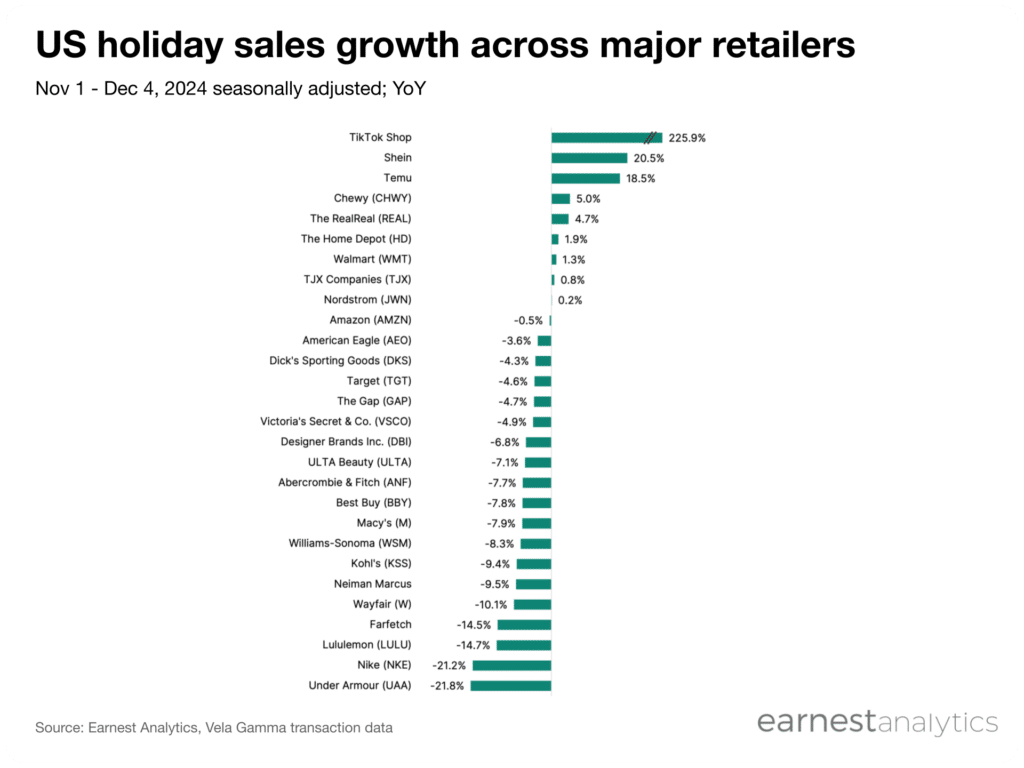

TikTok Shop, Shein, and Temu still winning

Chinese ecommerce brands continued to outperform other retailers this holiday season. TikTok Shop sales grew 225.9% YoY in the period, accelerating slightly from the early holidays. TikTok Shop did not participate in early October sales events, but the holidays come after its successful July promotion. The social media platform also won share in the first three weeks of November from other ecommerce names.

Shein’s back-to-school sales growth underperformed other apparel brands. But the fast fashion retailer’s steady customer growth buoyed its early holiday results as shoppers keep joining the platform. The retailer grew 20.5% YoY compared to 2023, a 4 point acceleration from the first 13 days of November.

Sales at deep-discount ecommerce brand Temu (PDD) grew 18.5% YoY in the first half of the shopping season. The platform’s success comes despite slow customer growth in recent months. Ecommerce pet brand Chewy (CHWY) stood out as the fastest growing major non-discount ecommerce brand, +5.0% YoY.

The RealReal (REAL) picked up steam around Cyber-5 for a total of 4.7% YoY growth between November 1st and December 4th. This is an acceleration from -4.4% YoY in the first 13 days of November.

The Home Depot (HD), Walmart (WMT), TJX Companies (TJX), and Nordstrom (JWN) all grew between 0.2% to 2.0% YoY in the same period. All accelerated from slow starts to holiday shopping in early November.

Amazon sales decelerated following Cyber-5, ending at -0.5% YoY.

ULTA Beauty (ULTA) fell 7.1% YoY, but still largely outperformed department stores.

Mall brands Abercrombie (AEO) and Victoria’s Secret’s (VSCO) outperformed in the preliminary holiday period. But both slowed to negative territory in the full first half of the holiday season.

Department stores largely lagged behind the rest of retail. Macy’s, Neiman Marcus, and Kohl’s sales all fell high single to low double digits YoY.

Athleisure continued to lag other retail categories in the prelim holiday period. Under Armour (UAA), Nike (NKE), and Lululemon (LULU) posted the biggest declines in the period. New DTC athleisure brands like Alo Yoga continue to disrupt the space.

Best Buy and Wayfair also posted mid-teens declines, though that could have been influenced by demand pull-forward from pre-season sales.