As holiday consumer spending falls, TikTok Shop grows

TikTok Shop grew without promotions

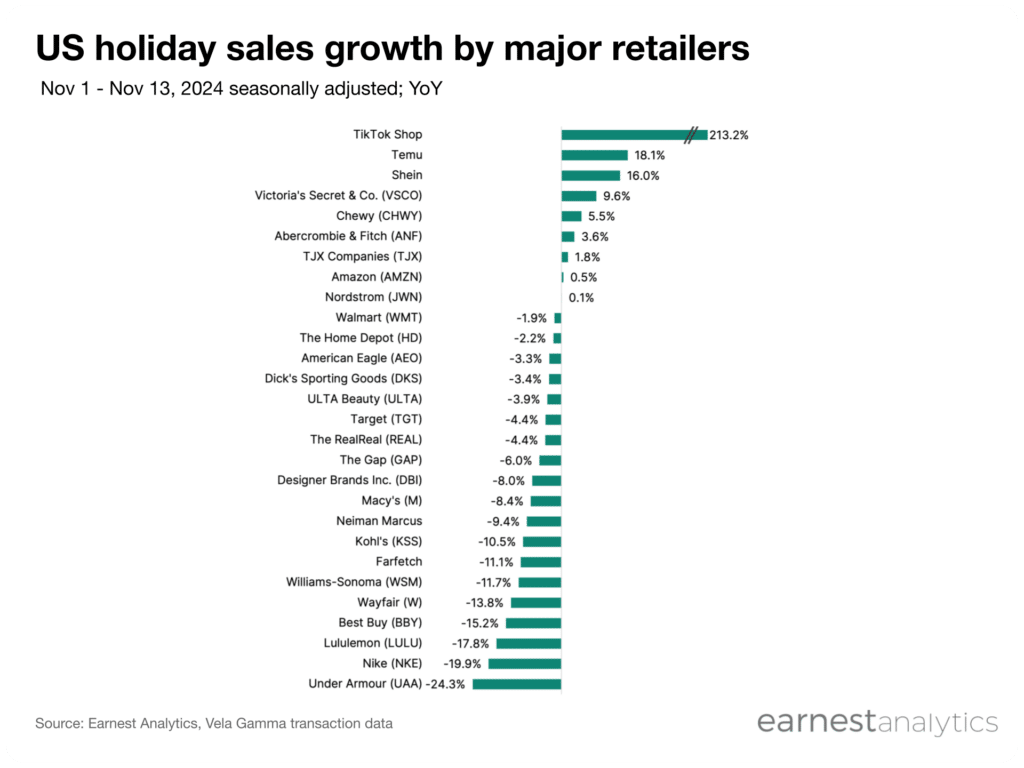

According to Earnest’s holiday consumer spending data, Chinese ecommerce brands have so far outperformed other retailers this holiday season. TikTok Shop sales grew 213.2% YoY in the period, off an already sizable base last year. Consumers spent slightly more with their debit and credit cards at TikTok Shop than they did at HomeGoods. (See chart on the following page).

TikTok Shop did not participate in early October sales events, but the holidays come after its successful July promotion.

Temu could win holiday party spending

Sales at deep-discount ecommerce brand Temu grew 18.1% YoY in the first 13 days of the shopping season. The sales success comes despite slow customer growth in recent months. Temu is also poised to further pick up hobby and party supplies spending that tends to peak during the holidays.

Ecommerce pet brand Chewy stood out as the fastest growing major non-discount ecommerce brand, +5.5% YoY. Amazon followed in the first 13 days of November, +0.5% YoY. Nordstrom sales were flat YoY.

Shein, Victoria’s Secret, and Abercrombie lead apparel

Shein’s back-to-school sales growth underperformed other apparel brands. But the fast fashion retailer’s steady customer growth buoyed its early holiday results as shoppers keep joining the platform. The retailer grew 16.0% YoY compared to 2023.

Mall brands continued their resurgence in the first two weeks, led by Victoria’s Secret (+9.6% YoY) and Abercrombie (+3.6% YoY). Victoria’s Secret’s performance is a turnaround compared to recent holidays and follows its revamped fashion show in October.

Abercrombie continued its back-to-school outperformance in the preliminary holiday shopping period. The company’s focus on 25-34 year olds and emphasis on changing pants trends helped it outperform in 2023. Abercrombie looks set to do the same this year.

Athleisure and Department Stores lag

Athleisure lagged other retail categories in the prelim holiday period. Under Armour (-23.3% YoY), Nike (-19.9% YoY), and Lululemon (-17.8% YoY) posted the biggest declines in the period. Best Buy and Wayfair also posted mid-teens declines, though that could have been influenced by demand pull-forward from pre-season sales.

Department stores largely lagged behind the rest of retail. Macy’s, Neiman Marcus, and Kohl’s sales all fell high single to low double digits YoY.

Download full holiday report