Hobby and party supplies in an era of Temu

Access chart in Dash.

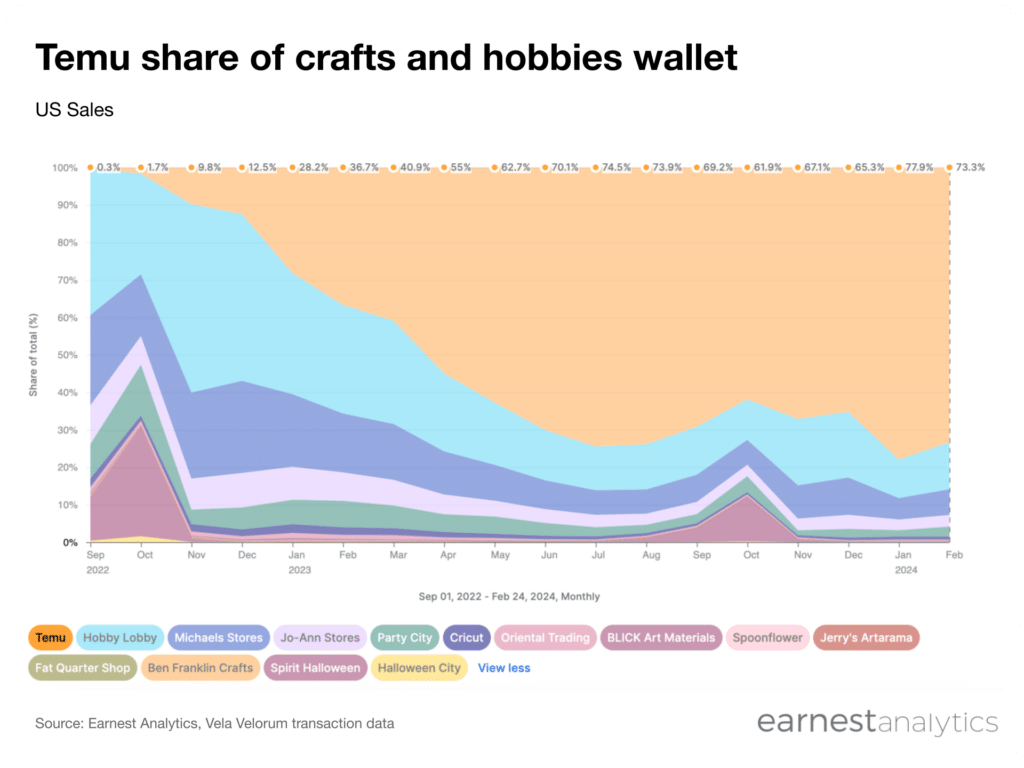

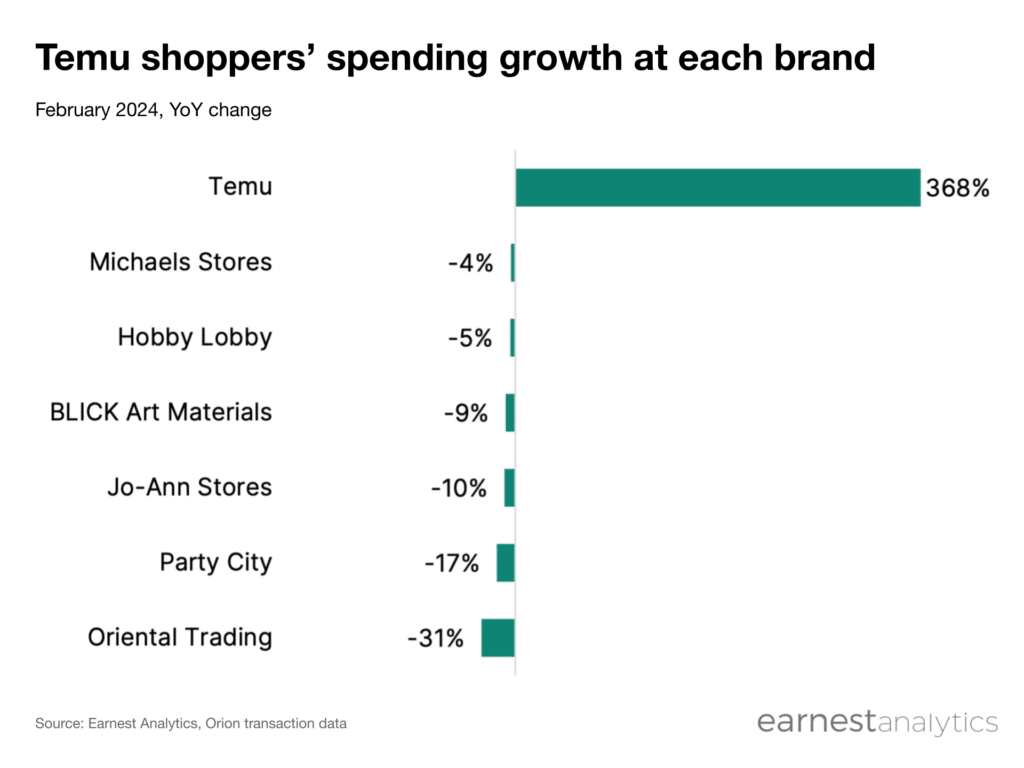

Temu customers spent 368% more in February 2024 than they did the year prior, pushing Temu’s share of wallet near 75% among major Arts & Crafts and Seasonal & Occasion brands. The deep discount ecommerce newcomer has made a name itself through gamified shopping that is taking on brick and mortar discounters.

Despite slowing customer growth, Temu is still winning wallet share in niche markets, like Arts & Crafts where its low cost model may prompt buyers to take a risk on single use or specialty items they would normally want to see in-store. This is likely also why Temu has become such a hit with wealthier customers with disposable income. So far some of the brands in the Arts & Crafts and Seasonal & Occasion space are more susceptible to disruption by Temu than others, but most are feeling some impact.

Access chart in Dash.

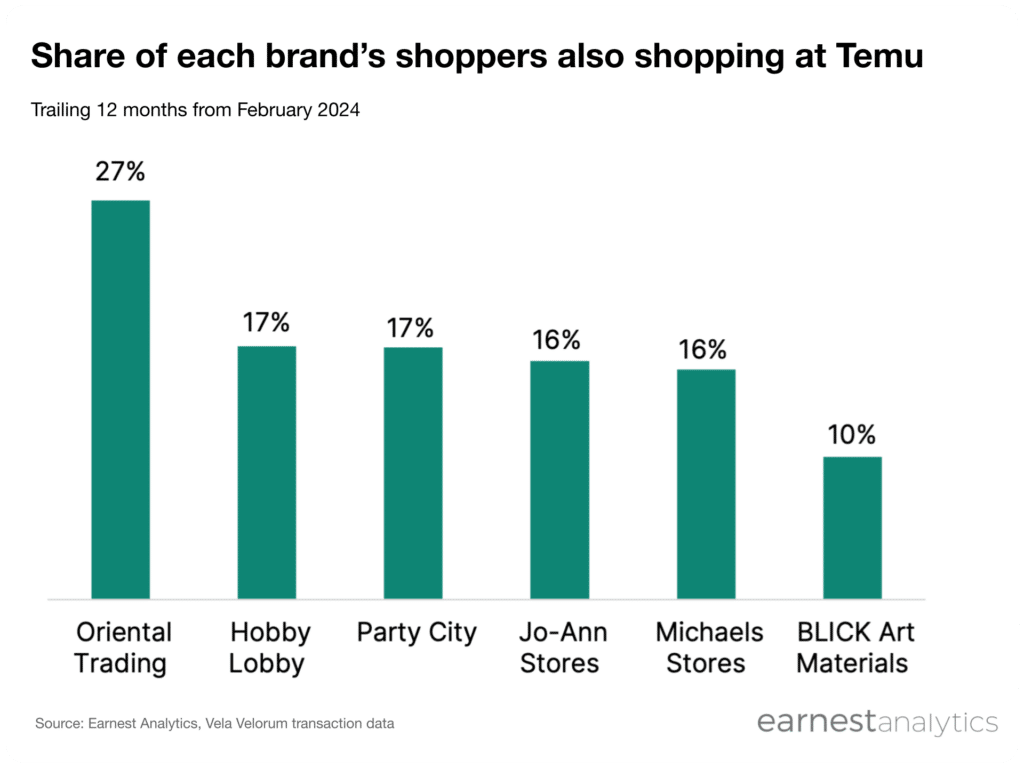

Oriental Trading shared 27% of its customers with Temu in the 12 months ended February 2024 according to Earnest credit card data. That’s the highest percentage of shared customers across major Arts & Crafts and Seasonal & Occasion brands, suggesting that it could be most at risk for disruption by Temu. This is followed by Hobby Lobby and Party City (17%), Jo-Ann Stores and Michaels Stores (16%), and BLICK (10%).

Access chart in Dash.

Oriental Trading customers who began shopping at Temu over the last year reduced their spend at Oriental Trading 31% YoY in February 2024 according to Earnest credit card data. Other occasional and hobby stores saw similar or more pronounced results by February among Temu shoppers including Hobby Lobby, Jo-Ann Stores, Michael’s, Oriental Trading, BLICK, and Party City.

So far Temu is seeing some success wrestling customers from niche party and supply companies that Amazon never did through a combination of low prices and gamified shopping.

Download Temu market impact report