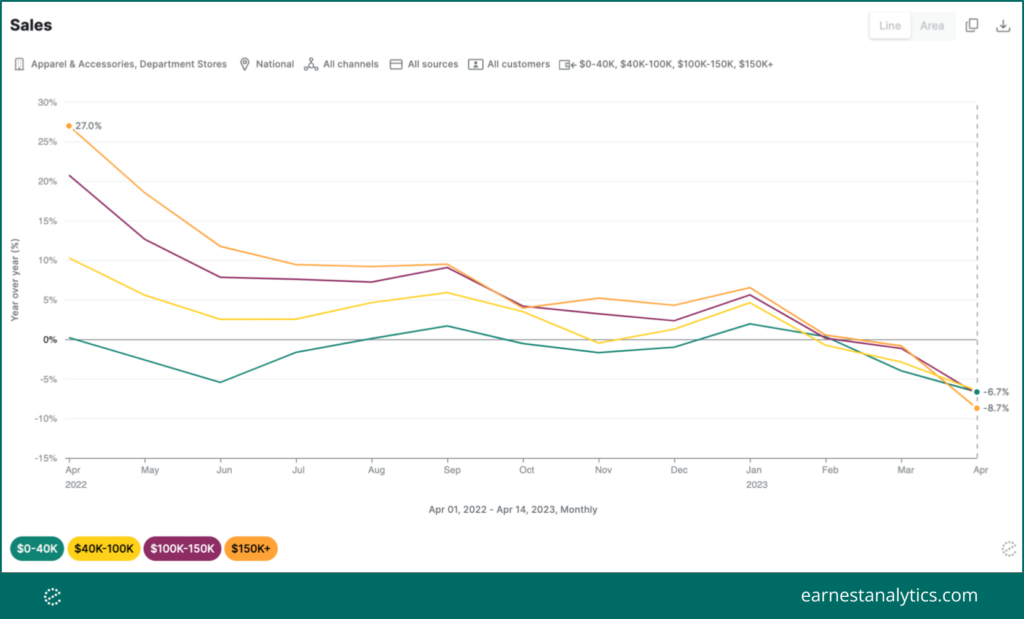

High-income earners slowing apparel spend fastest as tax season ends

After years of outperformance, shoppers earning $150k or more a year are slowing down apparel and department store spend faster than any other income segment in April, according to Earnest credit card data. 12 months ago, shoppers earning $150k a year or more were spending nearly 27% more YoY at apparel retailers and department stores. Meanwhile, shoppers earning under $40k a year spent roughly the same on apparel as they had the year prior. As recently as March 2023, shoppers earning more than $40k per year still outperformed the lowest income spenders in terms of YoY growth. That trend reversed in the first two weeks of April 2023.

This magnitude of a spending slowdown is somewhat surprising during tax refund season. Department stores were some of the biggest benefactors of tax refund spending in early 2023. The deceleration suggests that the bulk of the tax refund benefit has already been realized by apparel and department stores. It also suggests that the broader consumer spending slowdown in March may, in large part, be due to higher income households pulling back.