Health grocers find their niche among Gen Z, Millennials

Key Takeaways

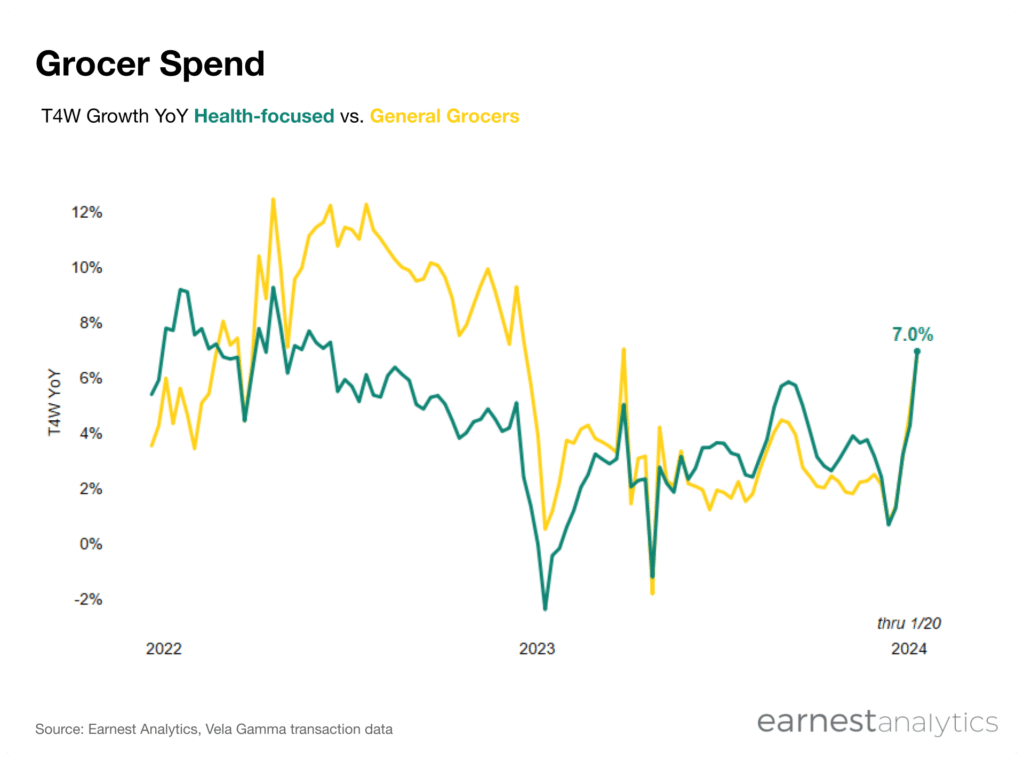

- Health-focused grocers outperformed general grocery chains since late 2023

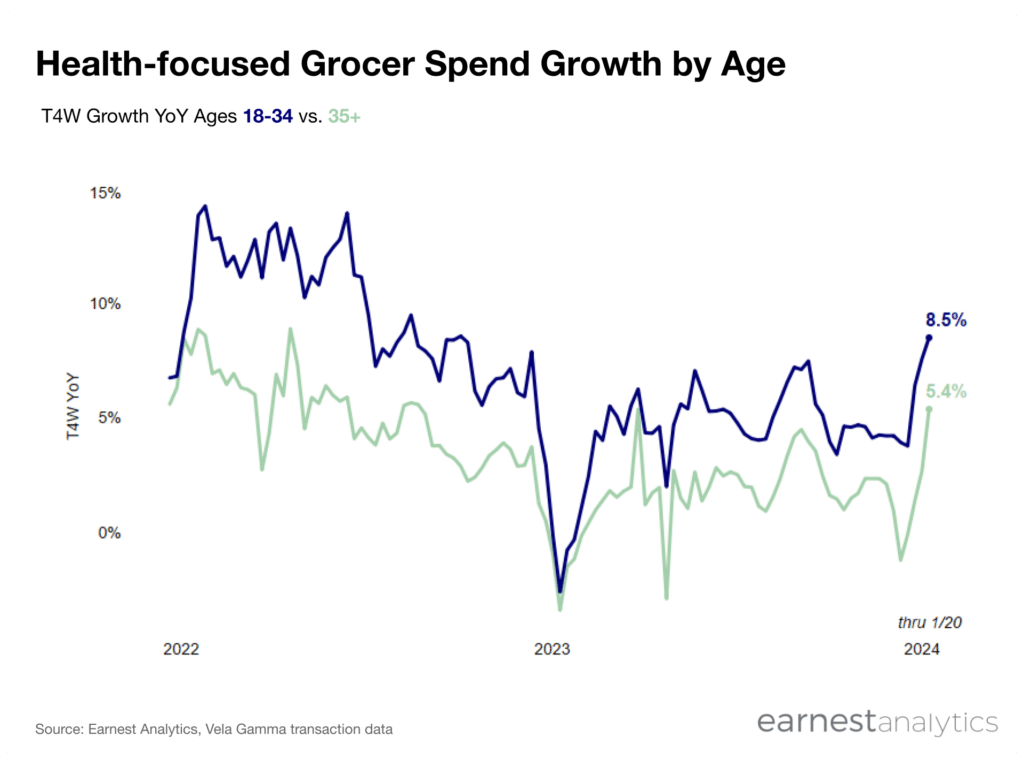

- Gen Z and Millennials aged 18-34 consistently outspent ages 35+ at health-focused chains

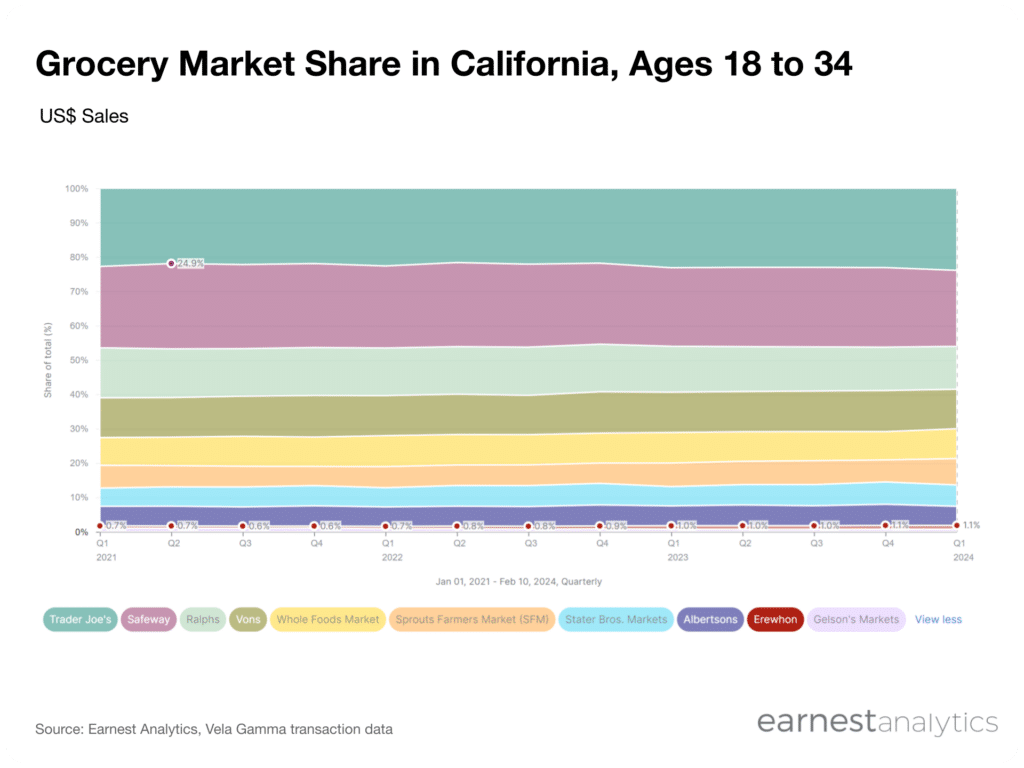

- Erewhon’s 10 California stores command 1.1% of the state’s market share, where Trader Joe’s and Safeway dominate, among ages 18-34

Health grocers outperforming general grocers

Contact Sales for information.

Health-focused grocery stores (Natural Grocers by Vitamin Cottage, The Fresh Market, Sprouts Farmers Market, and Whole Foods Market) outperformed the general grocery sector (including major chains like Kroger, HEB, and Publix, etc. but excluding Instacart) since June of 2023 according to Earnest credit card data. Growth in general grocery spend has been partially subdued from lapping high inflation in 2022; a dynamic to which health-focused chains appear to have been less sensitive.

By late January 2024, health-focused grocers reached 7% YoY growth, underscoring consumer demand toward healthier grocery options and possibly indicating a long-term market share capture from traditional grocers.

Health grocers sales growth driven by Gen Z, Millennials

Contact Sales for information.

Gen Z and Millennial consumers consistently outspent their peers at health-focused chains. This multi-year outperformance has been material, ranging from ~1 to 5 points of outspending amongst ages 18 to 34. In the four weeks ending Jan 20th, ages 18 to 34 grew their spending 8.5% YoY, three points higher than the 5.4% growth amongst ages 35+.

California market share (ages 18-34)

Access chart in Dash.

Market share shifts among ages 18 to 34 have perhaps been most apparent in California, one of the largest health-focused grocery markets. Since 2021, general grocers Safeway and Kroger-based Ralph’s lost ~2 points of share, while Whole Foods, and Sprouts have each maintained or slightly-grew their respective shares of 8% and 7%, respectively.

Of note is the small but growing health-focused chain Erewhon. With only 10 locations, primarily in Southern California, this organic upscale grocer has already taken 1.1% of share among ages 18 to 34 in a large grocery California market, suggesting a strong brand impact and customer loyalty.

Track Grocer spending for free