Government Dollars for Claire’s

Teen/tween retailer Claire’s, known primarily for its fashion jewelry and ear piercing services, has filed for an IPO—several years after a private equity takeover and emergence from Chapter 11 bankruptcy. In its recent prospectus, Claire’s noted that for the first half of fiscal year 2021, North American sales grew 124.3% compared to 2020 and 23.2% compared to 2019; much of this was driven by ear piercing-related transactions.

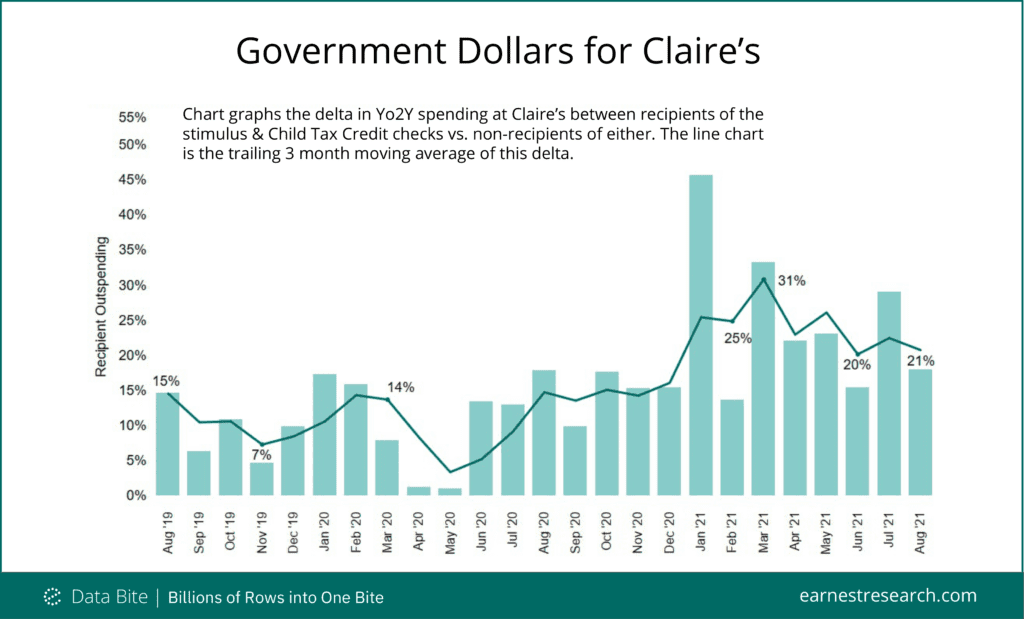

With Claire’s core demographic being Gen Z, we examined how the Child Tax Credit payouts, as well as the government-issued stimulus checks earlier this year, may have impacted spending. Pre-COVID, there was a 7-15% delta in outspending amongst the cohort that would eventually receive government aid—unsurprising, since this group consists of households with children. However, that delta nearly doubled to 20-30% in ‘21, once Child Tax Credit and stimulus checks* began to pay out. Indeed, Claire’s S-1 posits that the American Rescue Plan Act of 2021 “had a positive impact on [their] sales in the United States in the first half of fiscal year 2021.”

While it appears government aid has contributed to outspending at Claire’s, it’s uncertain what this growth means for the company’s long-term success. Will Claire’s turn out to be a comeback story, or will their recent growth prove to be merely a temporary bump?

[Analysis excludes ~20% of sales from those who received the stimulus checks but not the Child Tax Credit checks and another ~5% of sales from those that did not receive the stimulus but did receive the Child Tax Credit checks.]

*There was a noticeable lift in spending after the second and third stimulus checks were distributed in Jan and March of 2021, but not after the first check, which was distributed in April of 2020, since all of retail was effectively closed back then. See our stimulus research here to learn more about how the checks impacted the overall retail environment.