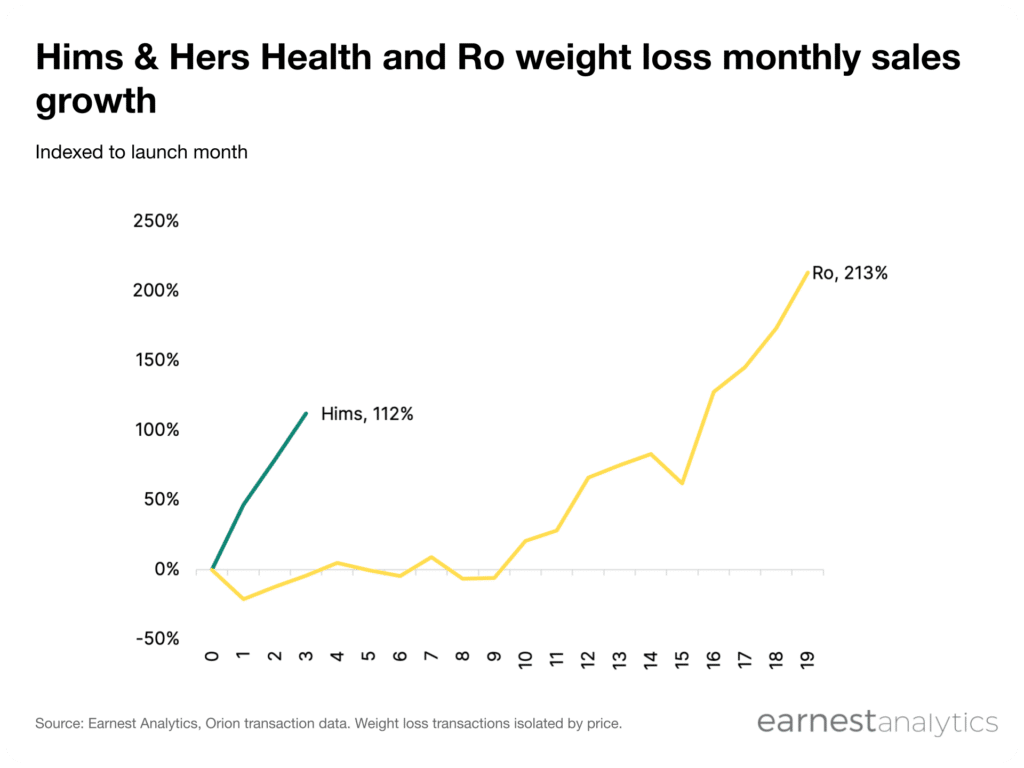

GLP-1s powering Hims & Hers Health, Ro sales growth in 2024

Weight loss sales by direct-to-consumer telehealth firms Hims & Hers Health and Ro grew 112% and 213% since their respective launch months, according to Earnest credit card spending. Founded with a narrow product assortment focused on hair loss and ED treatments, the two telehealth companies posted healthy growth post-pandemic before further accelerating in 2024. Both Hims & Hers Health and Ro grew over 60% YoY so far this year, with an over 28% YoY rise in average ticket prices indicating a shift in product mix driving this acceleration (see chart in Dash).

“Prescriptions via telehealth are significantly more common for patients taking obesity medicines” according to BMO analysts referencing Earnest healthcare claims data. This is likely driven by significant cultural awareness that drives patients to someone other than their primary care physician for weight loss treatment. That awareness has made GLP-1s one of the fastest growing products in telehealth companies’ portfolios.

Contact Sales for more.

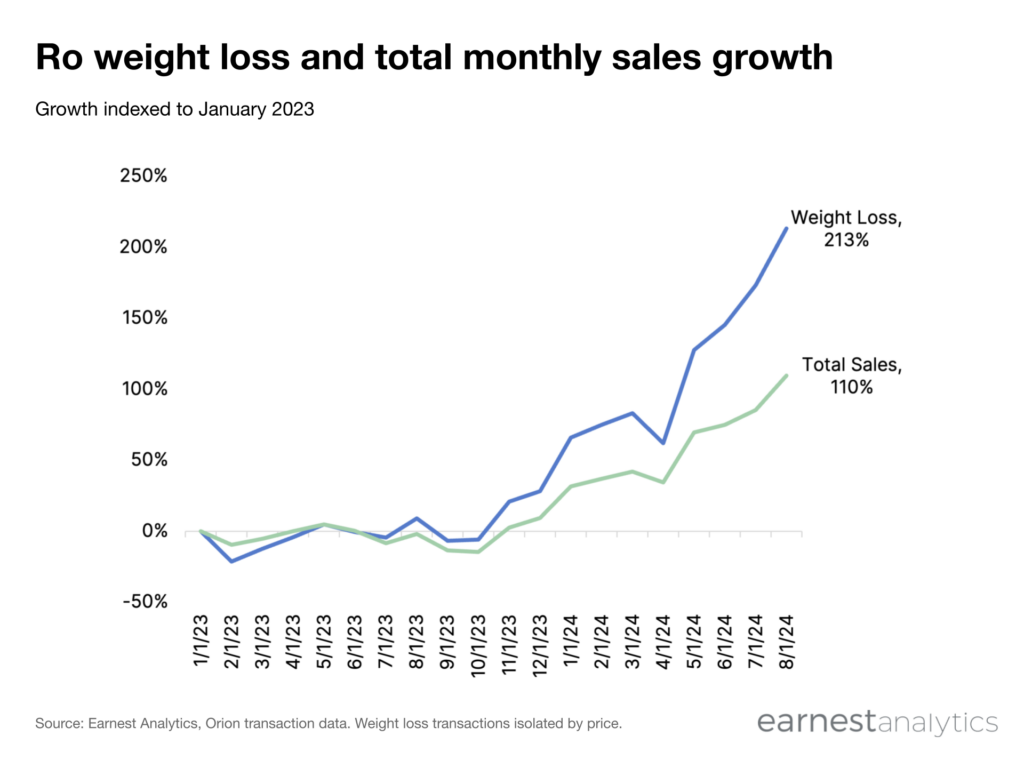

Ro (formerly Roman) launched its weight loss program, including GLP-1 medications, in January 2023. The weight loss program costs $145/month, with compounded GLP-1s starting at $299 or $399/month. Ro’s weight loss sales accelerated to 213% indexed growth by August 2023, outgrowing total sales by 103 points.

Contact Sales for more.

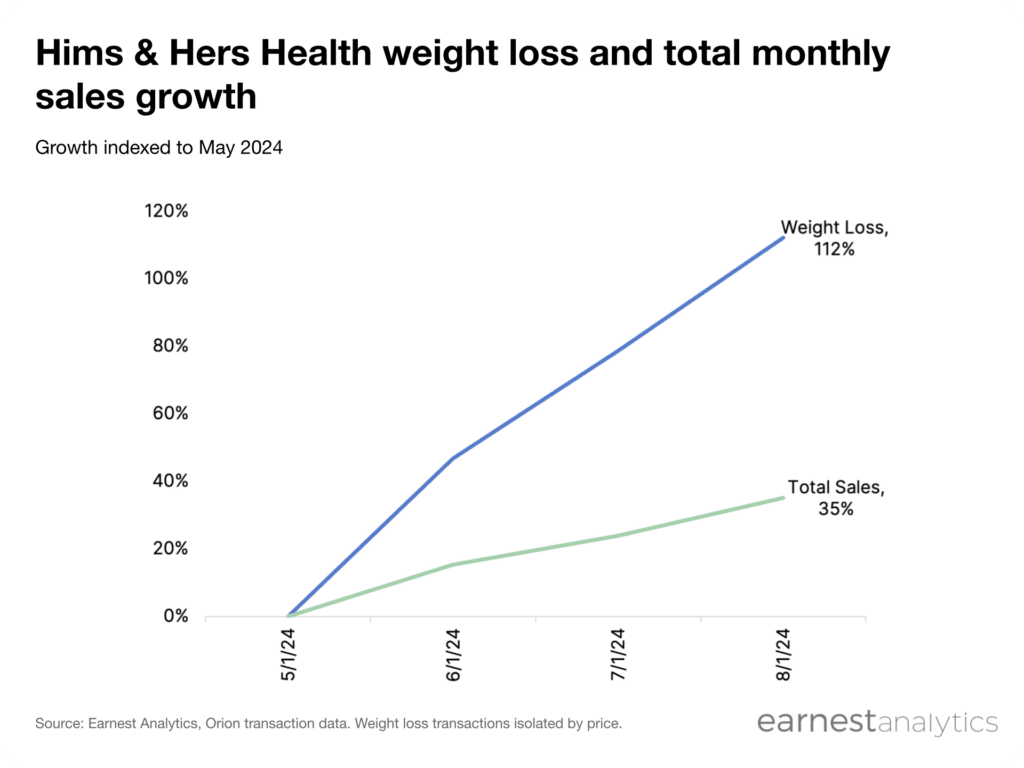

Hims & Hers Health began selling compounded semaglutide drugs online on May 20, 2024. Compounded semaglutide costs $199/month, while name-brand alternatives Ozempic and Wegovy are priced at $1,799/month and $1,999/month, respectively. By August 2024, indexed sales growth for weight loss products outpaced total sales by 77 points.

Contact Sales for more.

Since Ro’s weight loss program launched in January 2023, Ro average tickets increased 44% from $93 to $134 (see chart in Dash). Similarly, since Hims & Hers Health launched GLP-1 drugs in May 2024, the average ticket rose 27%, increasing from $124 to $158. These higher price points may become the new standard for telehealth firms that previously sold much lower priced, month-to-month subscriptions.

Track healthcare spending for free