Glossier’s Push to Win DTC Makeup Market

What will $80M and more brick-and-mortar stores do for Glossier’s business?

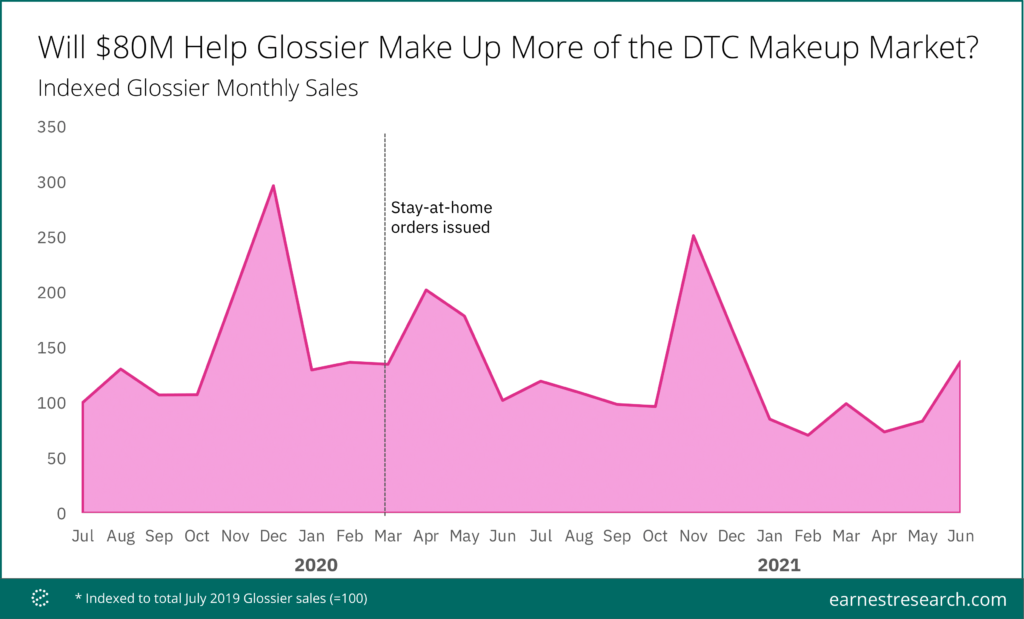

After a year in which consumers were decidedly makeup-free, Glossier’s announcement of an $80M Series E funding round coincides with an anticipated return to physical stores and offices. Earnest Analytics (FKA Earnest Research)’s transaction data reveals how the direct-to-consumer (DTC) brand fared through the pandemic, and why the influx of capital may have come at a crucial time for the business.

It’s been a bumpy two years for Glossier. Relative to July 2019, Glossier’s sales increased nearly threefold in December 2019. Following issuances of “stay-at-home” orders across the country, sales quickly doubled in April 2020, but the lift wasn’t sustained, and by June 2020, sales were flat compared to one year prior. This relative slowdown continued into November and December of 2020, where sales declined 16% against the prior holiday season. The trend through 2021 remained difficult, with indexed growth declining on average 18% through May. By June, however, sales were again ticking up. Could this be the start of a rebound?

In a statement following the funding announcement, Glossier CEO and founder Emily Weiss said, “customers want to move fluidly between immersive and personalized e-commerce and retail experiences,” and as part of that, Glossier plans to open dozens of new stores in the coming years. After deciding to close its three stores in August of last year, this represents a significant bet on brick-and-mortar as contributing to the brand’s growth strategy going forward.

Time will tell if Glossier’s post-funding execution can live up to its ambitions. How other DTC skincare and cosmetic brands like Thrive Causemetics, Milk Makeup, Youth to the People, and Ilia Beauty will see their business impacted by Glosser’s next phase of growth is a question for competitive analysis.