Frontier, Peloton, and Old Navy among More Exposed Brands As Student Loan Payments set to Resume

Download full report: Evaluating the Impact of Student Loan Payment Resumption on Consumer Spending.

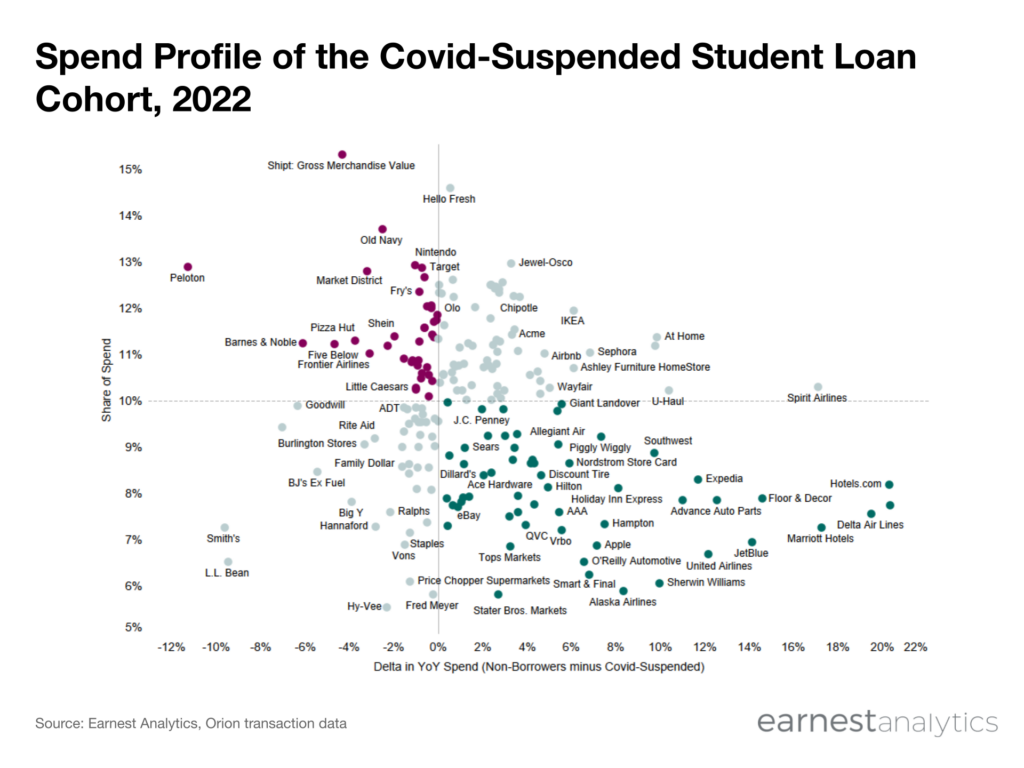

Student loan payers who suspended payments during Covid will have to resume those payments come October. That cohort of shoppers made up more than 10% of spending at several national brands in 2022 (above the dotted line). Their spending also outperformed non-borrowers at several brands (left of the solid line), suggesting that their lack of payments may have buoyed their spending in recent years. That leaves dozens of national brands that benefited meaningfully from the pause in student loans, and that may be more exposed to that shopper base as payments resume.

Within Travel, Frontier Airlines was the most sensitive to the Covid-Suspended cohort in 2022, with 11% share and 2 points of outspending from the cohort. In contrast, Alaska Airlines and United Airlines both had 7% share and 10 points of under-spending. Airbnb had a high 11% share from the cohort but with 4 points of underspending.

Within the Home sector, Peloton was most sensitive, with 13% share and 11 points of outspending from the Covid-Suspended cohort; Sherwin Williams had 6% share and 10 points of under-spending. IKEA, Ashley, HomeGoods, Wayfair, and Lowe’s all had 10%+ share from the cohort but the cohort also underspent Non-Borrowers by ~5 points.

Most Apparel and Department Stores had over 10% share from the Covid-Suspended cohort: Old Navy had the highest share at 14%; Nordstrom Full Price had the lowest share at 8%. Old Navy and Burlington each had 3 points of outspending from the cohort, while most others saw minimal to underspending.

Download full report: Evaluating the Impact of Student Loan Payment Resumption on Consumer Spending.