2024 Fitness spending fell on weak at-home sales

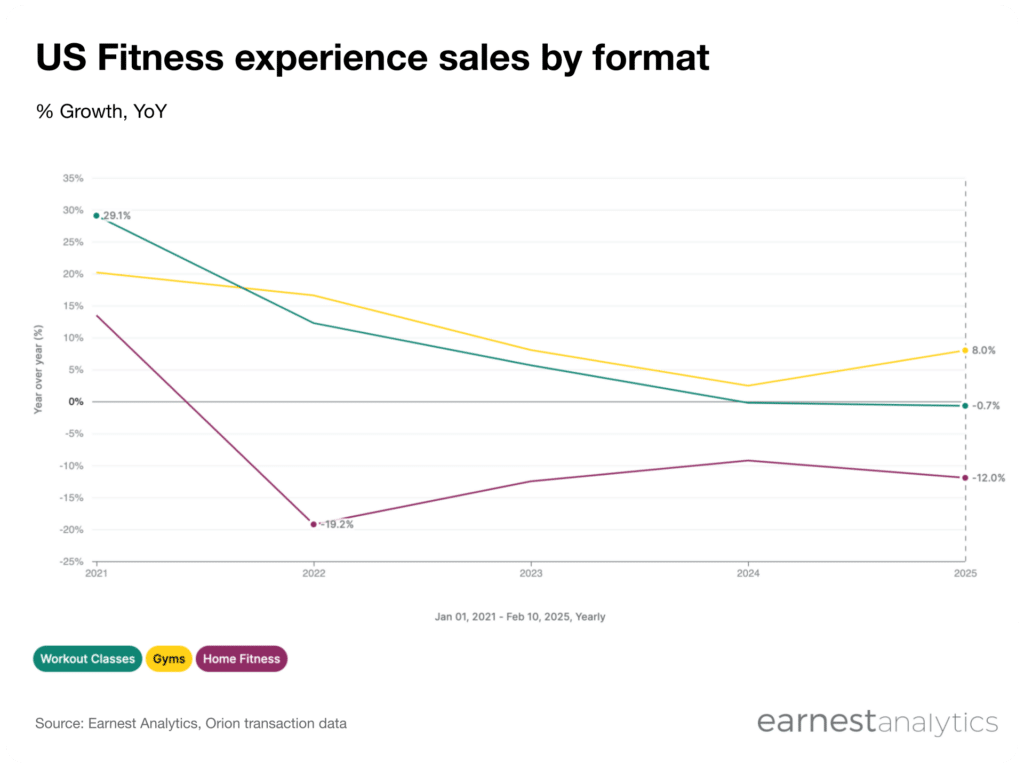

Consumers spent 0.2% less at fitness brands in 2024 vs 2023 according to Earnest credit card data (see data in Dash). It was the first year since the pandemic that consumers’ fitness spending shrank, including Workout Classes, Gyms, and Home Fitness. However, the actual picture of consumer fitness and wellness spending is more nuanced.

Gyms and Workout Class spending is stabilizing

Consumer spending grew 2.5% YoY at Gyms and shrank 0.2% YoY at Workout Classes in 2024. This still marks a deceleration from the double-digit growth in both formats in the years directly after the pandemic. Out-of-home fitness spending seems to have largely stabilized so far in 2025 though.

The main source of fitness spending weakness came from Home Fitness. Spending on home workout apps and hardware fell for the third consecutive year in 2024, -9.2% YoY. This actually represented an improvement from 2023, when spending fell 12.5% YoY. The home fitness format is still likely digesting the strong pull-forward effect of the pandemic. Gym closures and work from home initiatives drove consumers to invest in home workout hardware, much of which has long useful lives and small or no subscription payment.

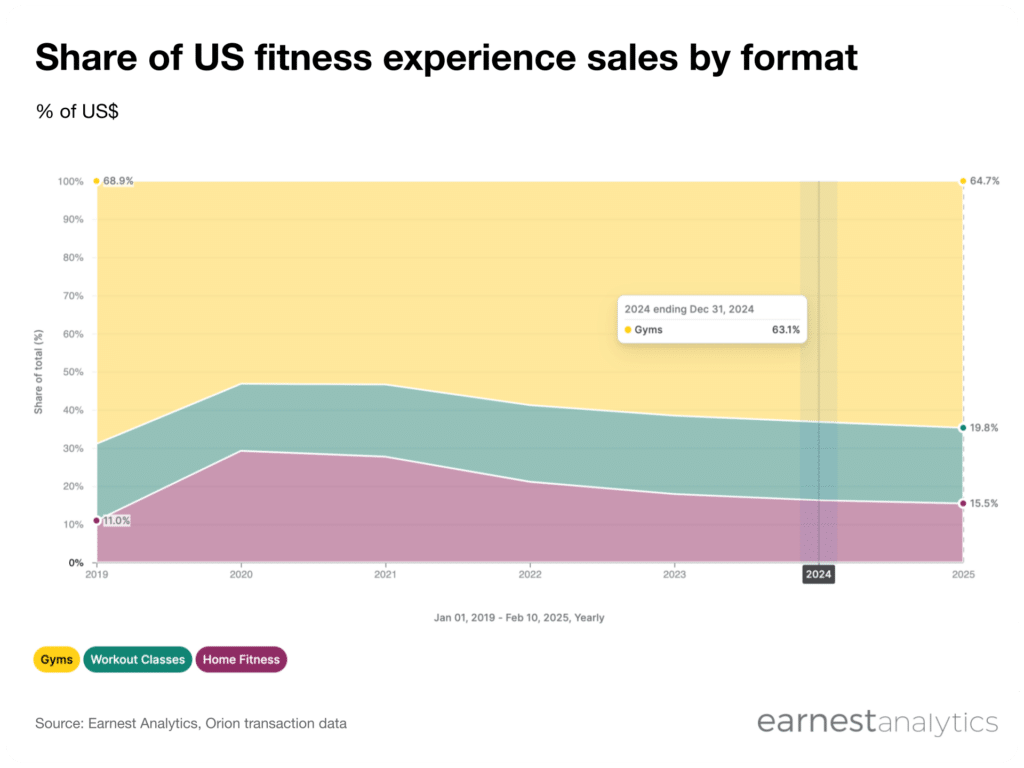

Out-of-home represents 84% of consumer fitness spending

Gyms dominated consumers’ fitness spending in 2024. Over 63% of fitness spending happened at traditional Gyms during the year. Workout Classes commanded 21% of spending in 2024. Together, consumers spent nearly 84% of fitness dollars on out-of-home services. This represents a continued improvement since the pandemic, but is still 5% below 2019 levels.

Home Fitness represented 16% of 2024 fitness spending in 2024. The format continues to lose fitness spending share so far in 2025.