Eyewear market share 2024: Luxottica loses sales to Warby Parker

In the eyewear market, Luxottica is losing share to Warby Parker and other small brands according to Earnest credit card data. EssilorLuxottica (“Luxottica”) still commands the largest share of retail sales through its various retail outlets. However, the company is losing ground to DTC eyewear companies like Warby Parker in the US.

Luxottica lost share to Warby Parker and small brands

The US eyewear market remains both fragmented across numerous glasses brands and highly concentrated under the Italian-French conglomerate Luxottica. The lifestyle company, which also recently acquired a streetwear brand Supreme, controls nearly 28% of the US eyewear market. As of 3Q24, Luxottica’s retailers included industry leaders LensCrafters (14.8% share), Sunglass Hut (9.5%) and Oakley (1.6%).

Publicly owned National Vision is the second largest eyewear provider in the US after LensCrafters.

1-800 Contacts holds a 10.3% market share, solidifying its position despite Warby Parker expanding into contact lenses since 2019.

Warby Parker holds 7.2% market share, up from 6.8% in 4Q23, as its DTC approach gains traction. Other players include Zenni Optical and Pearle Vision, each with 3.8%, and Ray-Ban, another Luxottica brand, at 2.2%.

Meanwhile, “Other” small retailers represent 32% of the market. While major players dominate, the market remains open to a long tail of smaller and newer entrants. Warby Parker’s growth reflects the evolving landscape, as brands catering to online and value-driven consumers continue to gain ground.

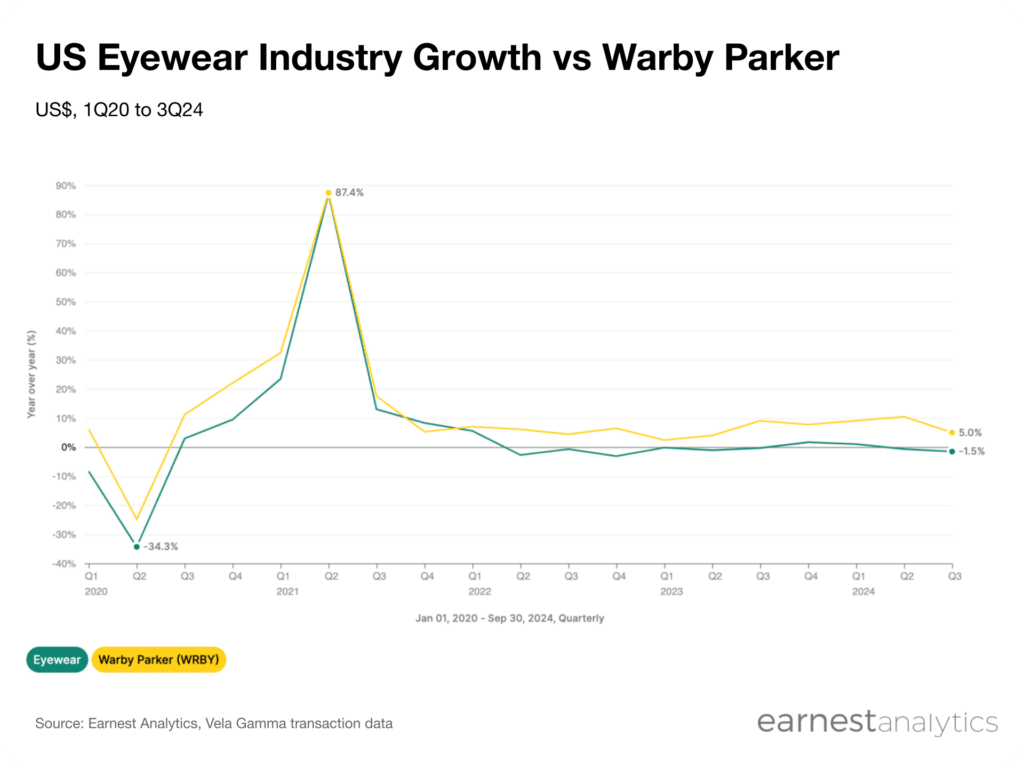

Warby Parker is outgrowing other eyewear retailers

From 1Q20 to 3Q24, Warby Parker consistently outpaced the broader US eyewear industry in year-over-year growth. The industry declined 34.3 points in 2Q20 during the early stages of the COVID-19 pandemic. Warby Parker, however, managed to sustain a relatively steadier performance due its online enabled approach.

Warby Parker’s growth peaked in 1Q21, accelerating 87.4 points as it captured demand in the post-pandemic recovery. This growth notably outpaced the industry, highlighting Warby Parker’s strong positioning as consumer demand rebounded.

In the quarters that followed, on average, Warby Parker maintained a higher YoY growth rate than the US eyewear industry. In 3Q24, Warby Parker grew 5 points, while the US eyewear industry contracted 1.5 points. Warby Parker’s growth trajectory reflects its disruptive influence in the eyewear market. The company leveraged its DTC business model and younger appeal to outperform traditional players, even as the overall market stabilized.

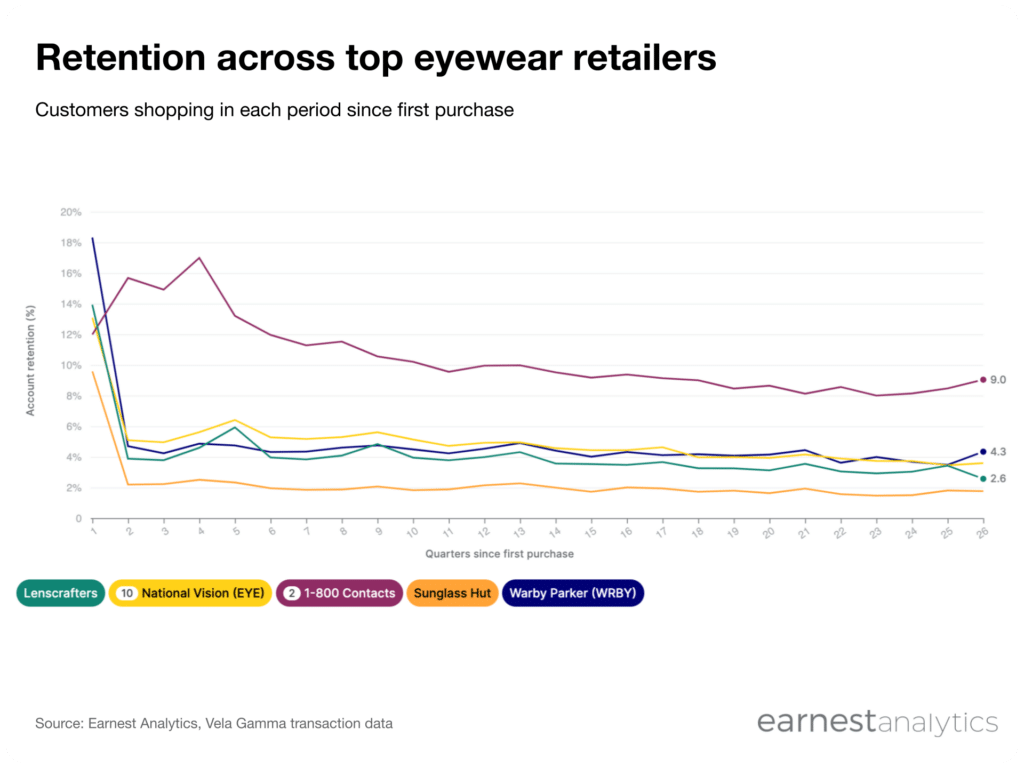

Warby Parker retains more customers than other eyewear retailers in market

Warby Parker has a higher retention rate than other major retailers. As measured quarterly from the first purchase, Warby Parker’s retention stabilizes at 4.3%. This is higher than traditional brands such as National Vision (3.6%) and LensCrafters (2.6%). Warby Parker’s high retention underscores Warby Parker’s appeal, likely fueled by its DTC model and style-conscious forward designs.

1-800 Contacts is the only major eyewear brand in the US with higher retention than Warby Parker. This is likely due to the subscription model many contact wearers use.

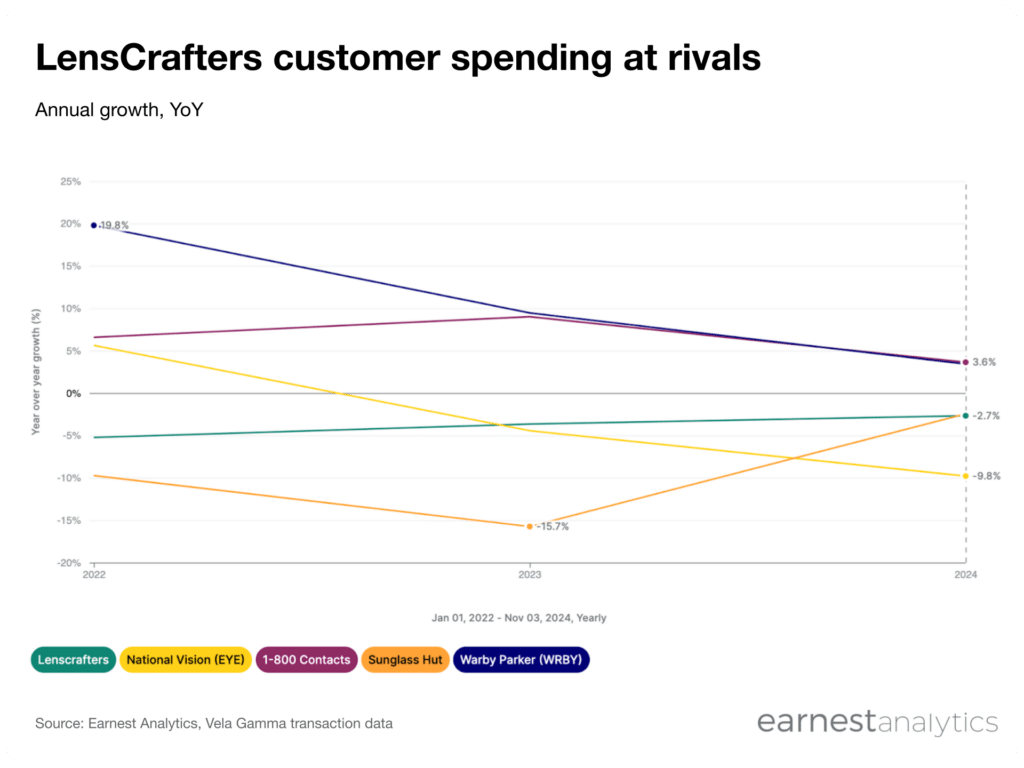

Eyewear market shifting to Warby Parker, 1-800 Contacts

In recent years, LensCrafters customers have moved their spending toward Warby Parker and 1-800 Contacts. In 2024, LensCrafters customers spent 3.4% more YoY at Warby Parker and 3.6% more YoY at 1-800 Contacts.

Conversely, LensCrafters’ own customers spend 2.7% less YoY so far in 2024. LensCrafter’s customers also spent 9.8% less YoY at rival National Vision. If this trend continues, Luxottica’s LensCrafters brand will continue to lose eyewear share.