Estimating the Long-Term Impact of Major Events: Evidence from COVID-19

By Shin Oblander (Columbia University) and Daniel Minh McCarthy (Emory University)

Register for a free webinar hosted by Earnest (1/12/23), in which we’ll discuss Shin’s and Daniel’s key findings.

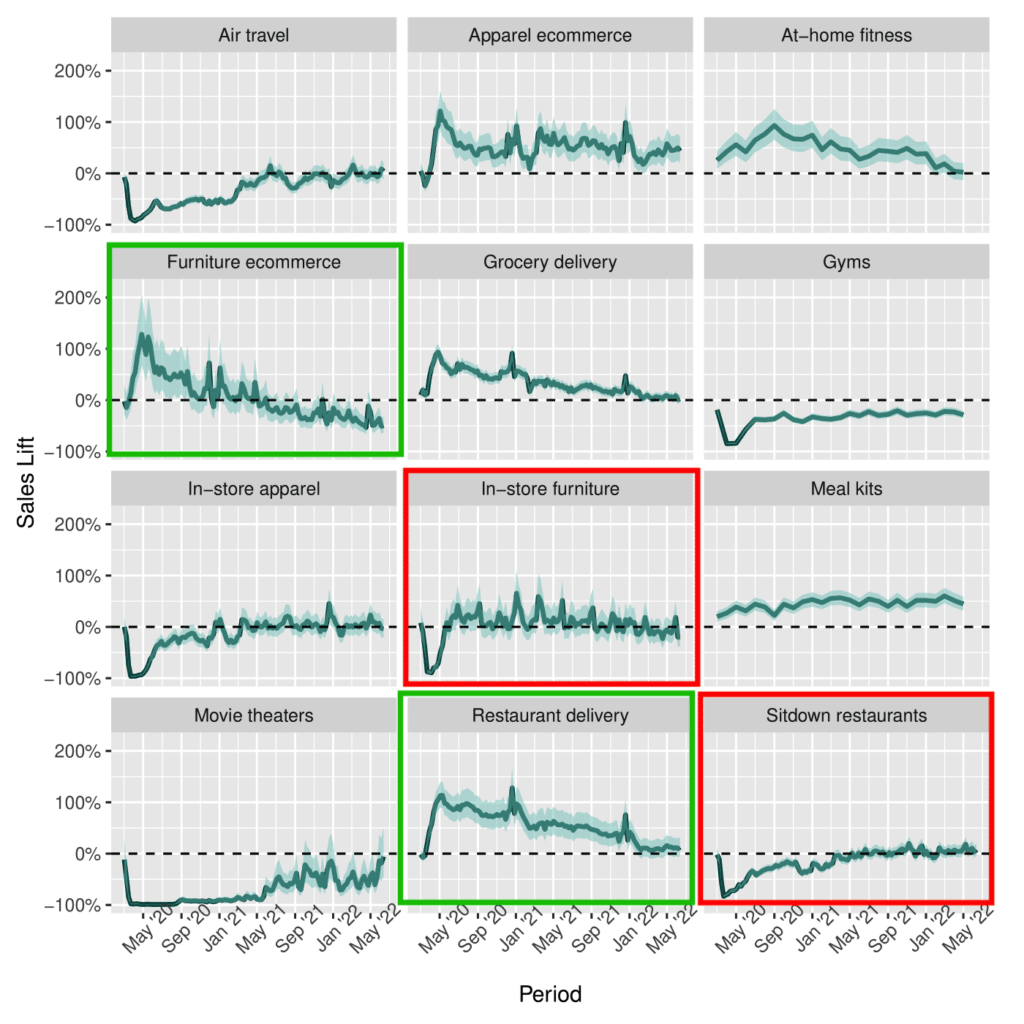

The COVID-19 pandemic disrupted consumer spending patterns in countless ways, driving us away from crowded venues and retail stores towards at-home alternatives such as delivery and e-commerce services. Our paper uncovers the short- and long-term impacts of COVID across 12 categories, revealing not only the effects of the pandemic immediately after its onset, but how those effects have evolved as we move into the “new normal.” We do so by first predicting what category-level activity would have been in the absence of the pandemic in these 12 categories, then comparing what consumers actually spent to this “no-pandemic baseline.” Finally, we assess systematic patterns that explain which categories experienced more enduring versus transitory shifts.

This problem is big and timely. The prospects (and even survival) of many companies within these industries hinge on where consumer demand is right now relative to where it would normally be in the absence of a pandemic, making this a not well understood yet top-of-mind issue for executives and investors. Examples of companies that are directly impacted by this work include but are not limited to Peloton, Wayfair, Instacart, DoorDash, AMC Entertainment, Planet Fitness, Blue Apron and HelloFresh. Our paper uncovers these effects by leveraging a unique and highly comprehensive dataset. We use rich customer-level credit card panel data covering over $20 billion in spending across 2.2 million individuals over 6.5 years from Earnest Analytics.

One of our main results is summarized in the figure above, which shows the estimated boost (or drop) in sales caused by the pandemic. We see, for example, that the pandemic caused sales to more than double in the short-run in the furniture e-commerce and restaurant delivery categories (green boxes). Conversely, COVID caused declines in excess of 80% at their non-digital counterparts, in-store furniture and sitdown restaurants (red boxes). However, we also see that by June 2022, sales in most categories – including the four aforementioned categories – reverted back to their no-pandemic baselines. In fact, furniture ecommerce (i.e., Wayfair) passed through this baseline, with sales cratering to 50% of its no-pandemic baseline. Pulled forward demand is the likely culprit for this poor performance, as people who bought furniture for their work from home offices in 2020/2021 don’t need more of it in 2022.

While in most categories, the “new normal” appears to be the same as the old normal, there are some notable exceptions. Categories involving routine/subscription purchases have seen more persistent shifts, with durable gains for meal kit companies (e.g., Blue Apron and HelloFresh), and stubbornly persistent losses for gyms (e.g., Planet Fitness). The same is likely true for at-home fitness companies like Peloton, except that the enduring gains that these companies may be receiving from subscription is likely being offset by the pulling forward of demand on their hardware sales – as with Wayfair, many of those people who bought Peloton bikes in 2020/2021 would have otherwise done so in 2022, but don’t need to anymore.

Our results call into question the belief that digitally native companies will experience lasting tailwinds (and store-based retailers, headwinds) from the pandemic. While recession may push all categories downwards (possibly for some time to come), the “light at the end of the tunnel” for most categories is what we would have expected in a normal no-pandemic world.

Register for a free webinar hosted by Earnest (1/12/23), in which we’ll discuss Shin’s and Daniel’s key findings.