Eggspensive: Breakfast CPG prices surge

Key takeaways:

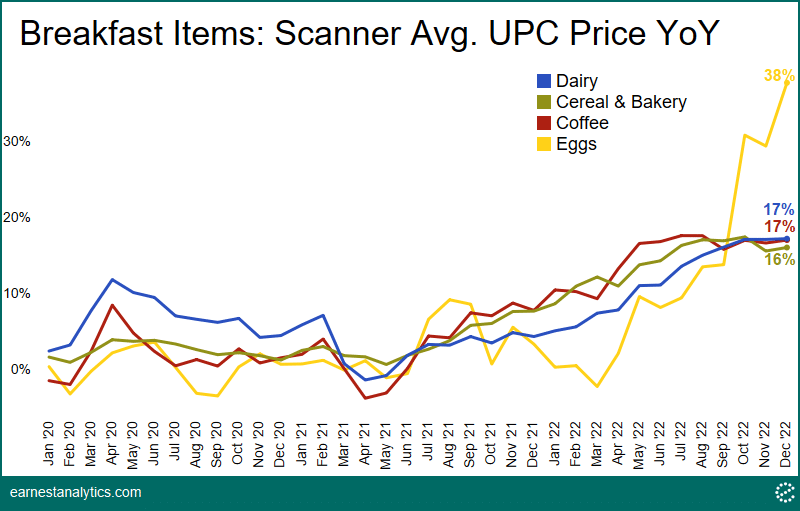

- Dairy, cereal & bakery, and coffee UPC prices posted double digit increases in 2022

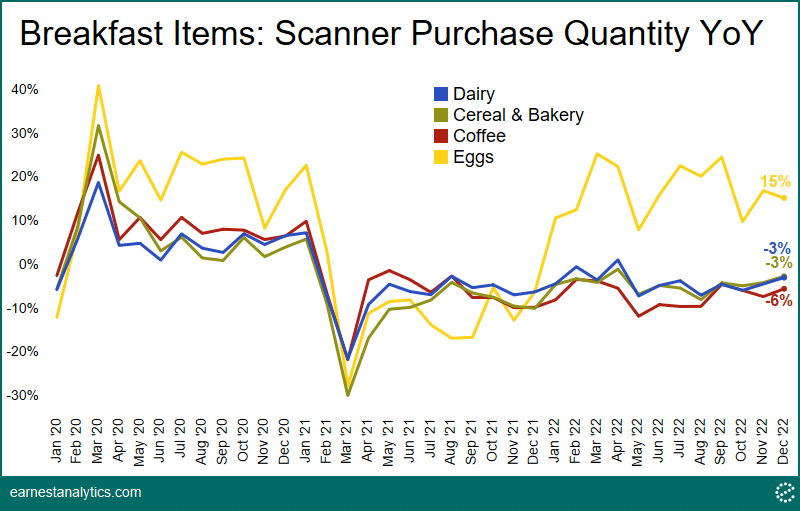

- Those higher prices generally resulted in declining purchase quantities

- The outlier was eggs, with UPC prices surging 40% YoY and little pullback in demand

Breakfast got expensive

Breakfast grocery prices accelerated to new heights at the end of 2022 according to Earnest Scanner Consumer Packaged Goods (CPG) data. The average UPC size among various breakfast categories began accelerating in July 2022, marking the beginning of the inflationary period, and climbed to new heights by year end. In December 2022, dairy (cheese, margarine/butter, yogurt, misc.) UPC prices grew 17% YoY, cereal & bakery (cereal, baking mixes/needs, crackers, cookies, breads) rose 16%, and coffee grew 17%. Eggs surged 38% driven by a widely reported avian influenza outbreak across the country.

Higher prices mean fewer items at checkout

These inflationary pressures resulted in declining purchase quantities, or the number of items in checkout baskets, according to Earnest Scanner data.

Dairy, cereal, and coffee checkout quantities continued to decline low to mid single digits in 2022. This trend followed roughly similar declines in 2021, which was down primarily due to pandemic-driven grocery strength in 2020. Eggs didn’t see much of a pull back in 2H22 despite soaring prices, with a low price elasticity reflecting its essential nature for consumers.*

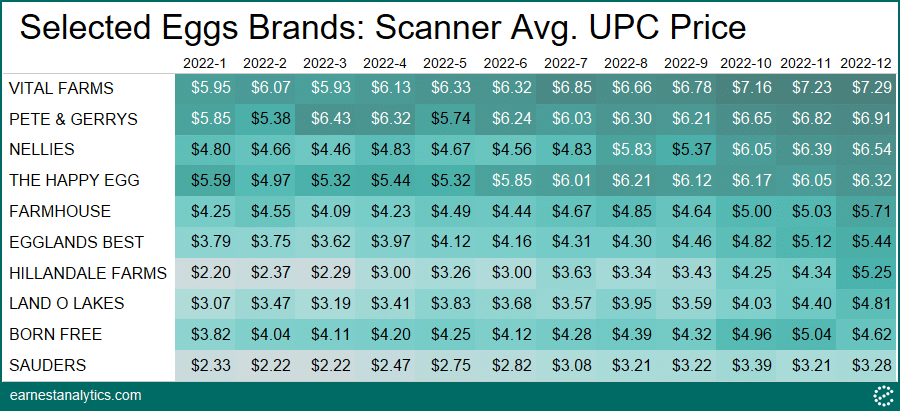

Varied egg prices with most now above $5

Egg prices ranged from $3 to $7 per unit in December 2022, compared to $2-$3 earlier in the year. As of December 2022, only Land O Lakes, Born Free and Sauders eggs remained under $5 among ten leading national egg brands. Egglands Best hit $5.44 in December 2022, up from $3.79 in January 2022. The most expensive brands include Vital Farms, Pete & Gerrys, and Nellies, with average prices now above $6.50.

Notes

Earnest Scanner enables users to track sales, units, and pricing at the manufacturer, brand, and category levels (e.g. “Campbell Soup Co. (CPB)”, “Goldfish” and “Crackers, Cookies & Bread”) across the CPG space with a 1-day lag. The data offers granularity at the household level and additional demographic attributes, allowing for longitudinal cohorting analyses and a multitude of use cases based on demographic segmentation.

Recent CPI figures from the Labor Department show decelerating growth in the breakfast categories mentioned in this post since 2022, including eggs which slowed to 36% YoY in March 2023 from 70% in January 2023.

For more recent Earnest data, please reach out to your account manager or Sales.

*Average prices captured in the Scanner data reflect the average price paid per UPC (Universal Product Code). It is not adjusted for UPC size (e.g. a one-liter bottle of Cola and a two-liter bottle of Cola each constitute one UPC in the data). Average prices can therefore be impacted by changing sizes of a particular packaged item (e.g. “shrinkflation”) as well as shifting consumer preferences relative to item size. In the context of recent sharp egg prices increases, it is possible that the low impact on UPC quantity sold in the data is partially driven by some consumers now buying smaller packs (i.e. a dozen instead of 24), resulting in unchanged UPC quantity hiding an actual decline in volume.

Available upon request: Addendum: Earnest Scanner Avg. UPC Prices Backtests to BLS’ CPI