Earnings by Earnest: 4Q 2018

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 4Q 18 we looked at Express, The Children’s Place, and Blue Apron.

Express | Earnings Call 03.13.2019

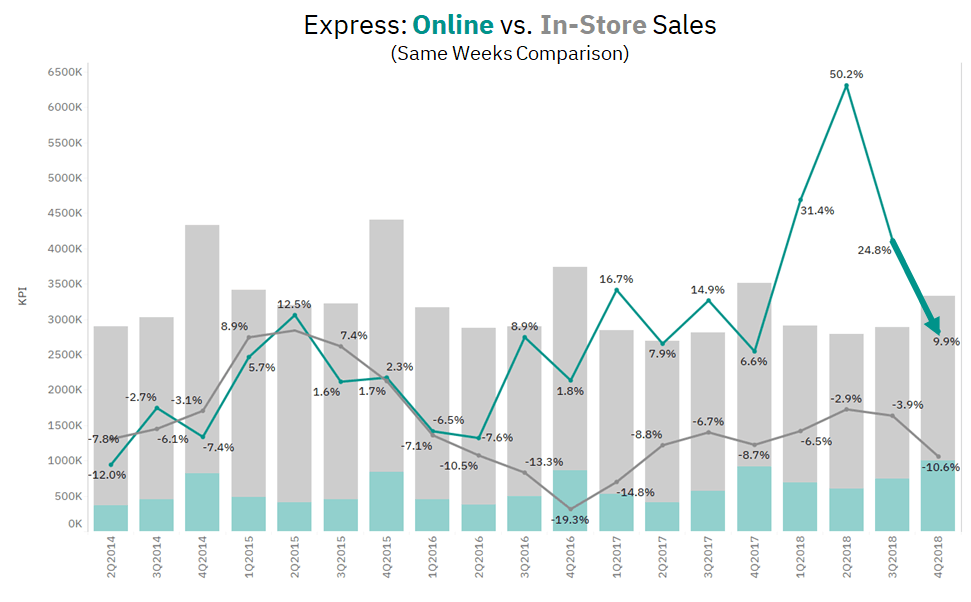

“E-commerce comparable sales increased 5% in the fourth quarter on top of 17% growth in the same period a year ago.” – Matt Moellering, Interim President and CEO, and EVP and COO

Express reported a significant deceleration in the online channel, with e-commerce comparable sales coming in at 5% versus double-digit growth reported for the past several quarters. We tracked this slowdown in our data (Earnest shows a ~15% sequential deceleration in online sales vs. company reported 12%).

The Children’s Place | Earnings Call 03.5.2019

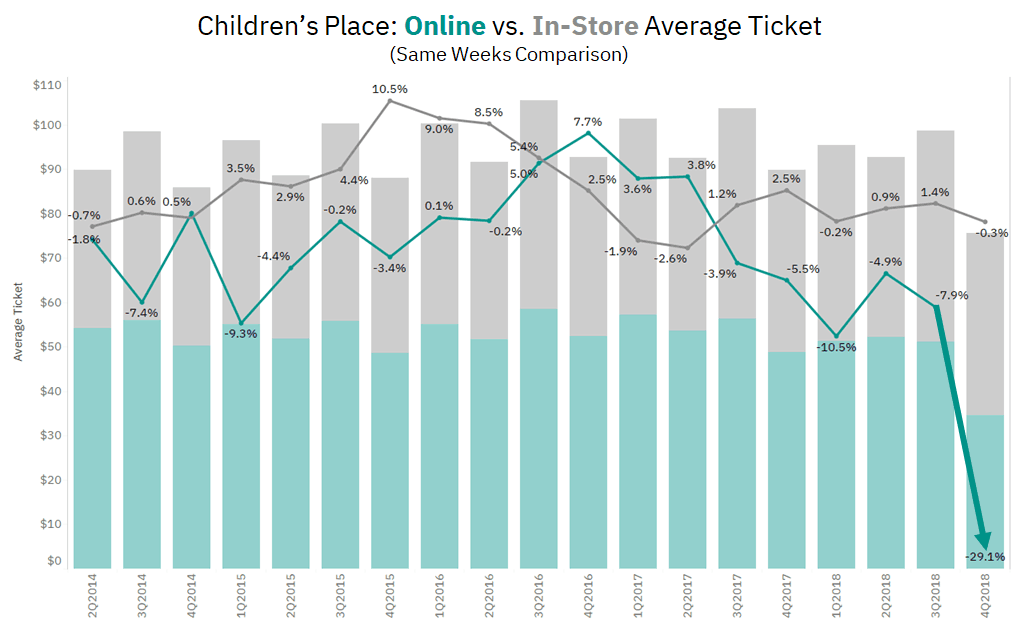

“Gross margins were also adversely impacted by the increased penetration of our e-commerce business.” – Mike Scarpa, Chief Operating Officer and Chief Financial Officer

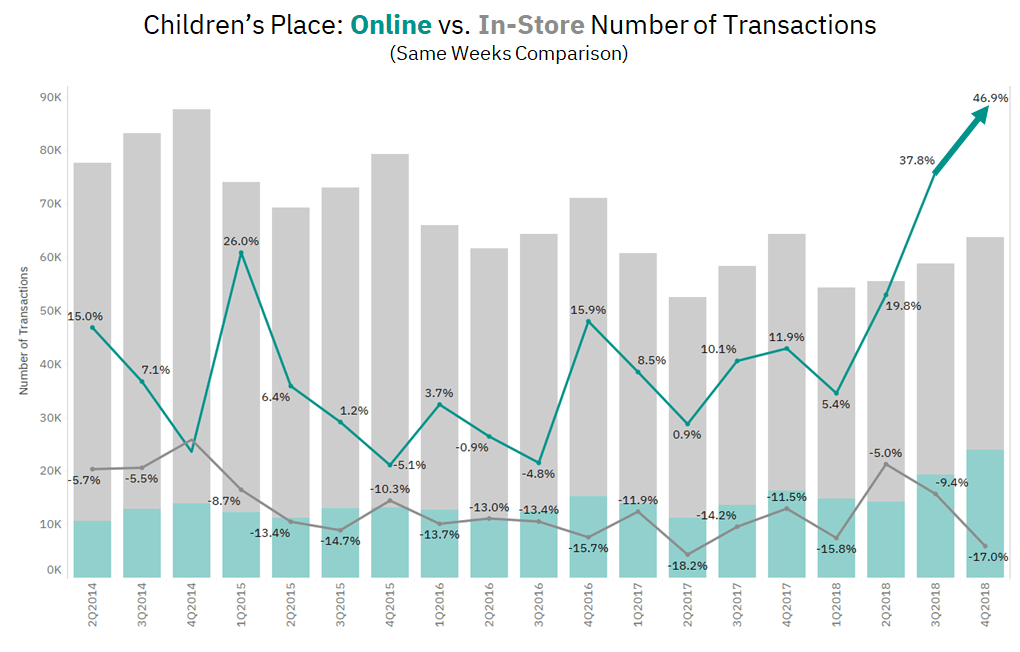

Average ticket for online sales decelerated by ~20% into 4Q18, while the number of transactions accelerated by ~9%.

Earnest data suggests The Children’s Place drove 4Q18 e-commerce sales through promotions, which potentially exacerbated online’s already-negative impact on margin.

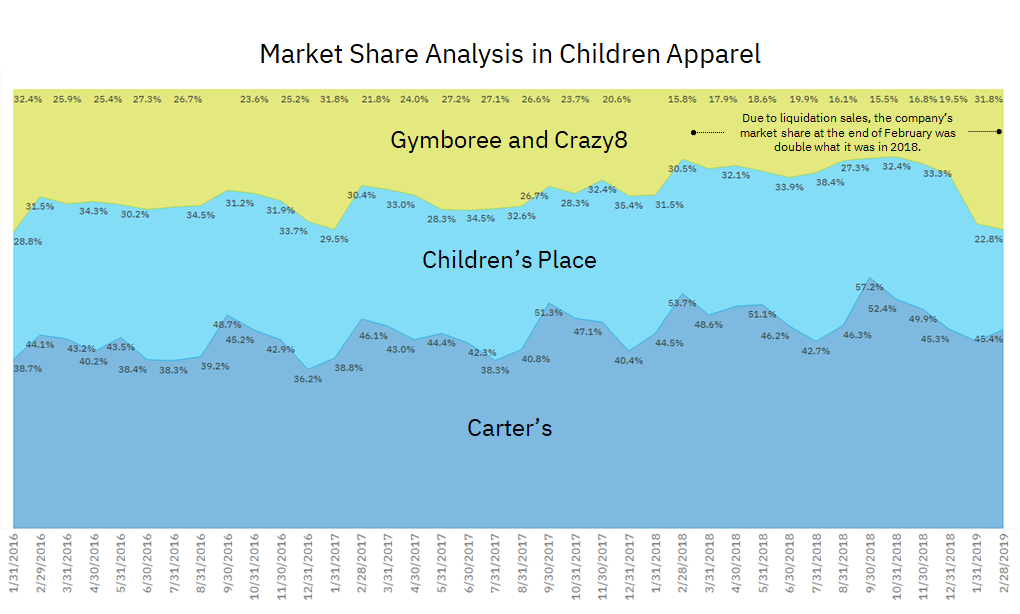

“Acquiring the Gymboree Assets will give us the opportunity to exercise greater control over our ability to capture a larger portion of the estimated $600 million of market share left behind by the total liquidation of Gymboree and Crazy 8.” – Jane Elfers, President and Chief Executive Officer

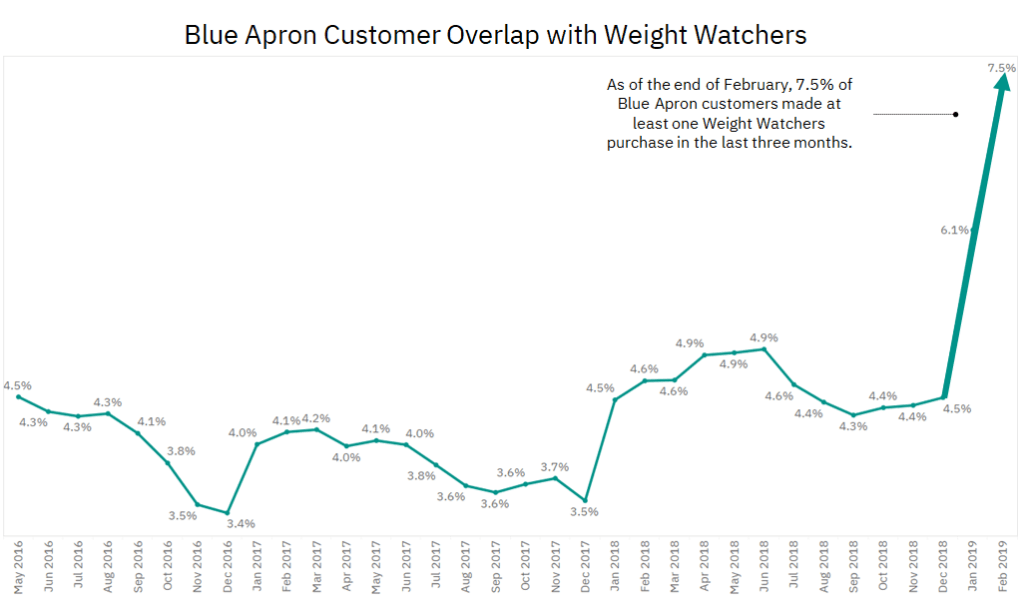

Blue Apron | Earnings Call 01.31.2019

“As you know, in late December, we launched an exclusive national direct-to-consumer partnership with WW, formerly known as Weight Watchers…While the results are still very early, this partnership has shown higher-than-expected demand to-date. And we have been encouraged by the favorable response and interest in this offering demonstrated by both new and existing Blue Apron customers.” – Brad Dickerson, Chief Executive Officer

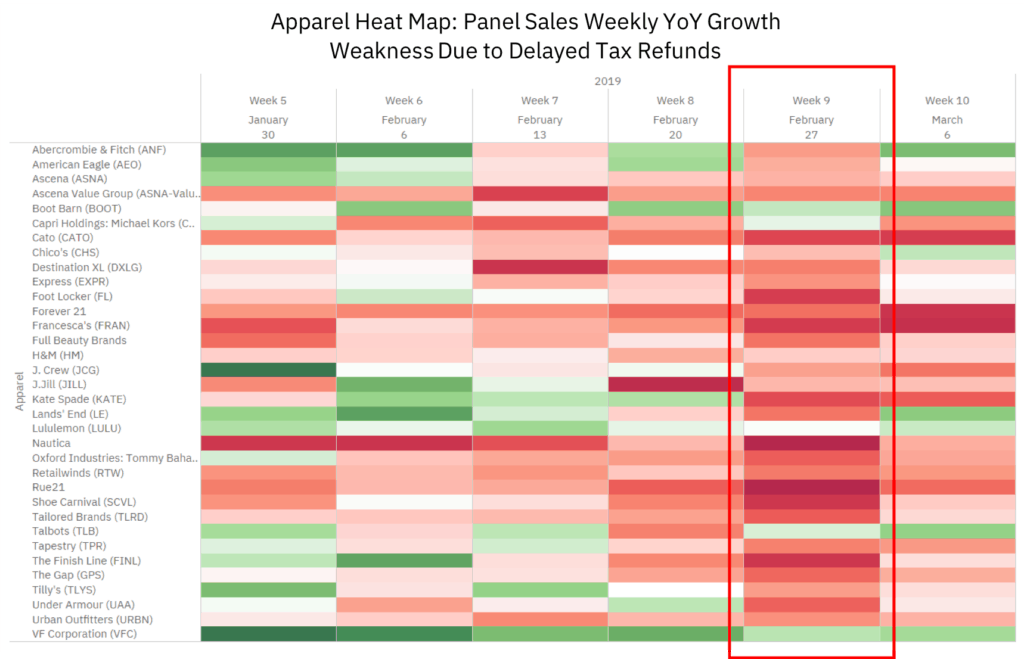

Impact of Tax Refund Delays on Apparel

General slowdown due to tax refunds reported by multiple companies on their earnings calls.

“We’ve got the competitive pressures of what happened in February with significantly delayed tex refunds , and we’ve also got the pressure of the web.” – The Children’s Place 4Q18

“Although we are planning a mid-single digit comp gain in each quarter, we are keeping an eye on the impact on the top line from the slower pace of tax refunds, combined with the lower average refund size compared to a year ago.” – Foot Locker, 4Q 2018

“The apparel area is the one that is suffering the most right now. Actually, we’ve seen a lot of strength in a number of categories. Home is doing quite well, as is beauty and shoes. So it’s not an across the board drop in sales. But apparel has to kick-in…It may have some other influences like tax rebates has been talked about, those sorts of things.” – Urban Outfitters 4Q18

“Due to the uncertainty around the timing, aggregate amount and average size of IRS refunds this tax season coupled with Easter shifting back three weeks, total sales to increase in the range of 7% to 9%.” – Burlington 4Q18

For more details about this analysis or our EarnestQuery product, please schedule a demo or reach out to [email protected]