Earnings by Earnest: 3Q 2020

Powered by Earnest Data Products

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 3Q 2020, we looked at Shopify, Wayfair, PulteGroup, and Cheesecake Factory.

Shopify

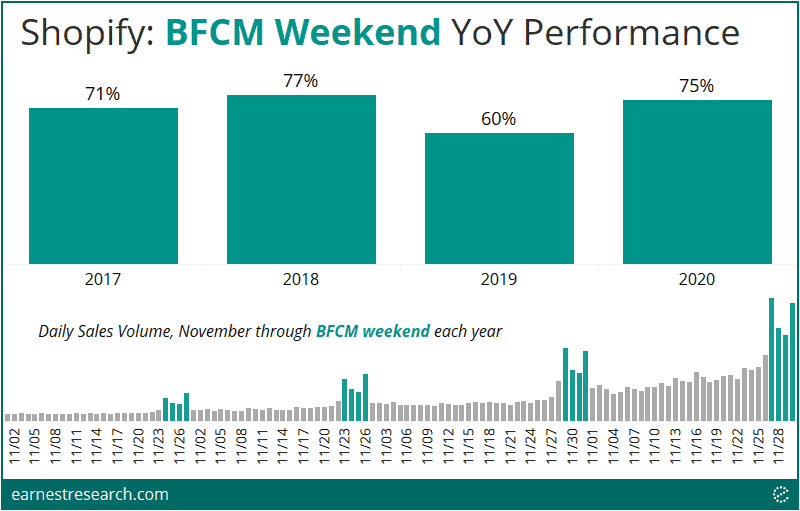

From November 27 through November 30, total sales grew by 76% from the $2.9+ billion reported for Black Friday/Cyber Monday weekend in 2019…. In addition to this record-setting weekend, we saw holiday shopping start earlier than ever before, with daily total sales increasing 19 days before Cyber Monday, nearly two weeks earlier than previous years.

Shopify, 6-K Press Release on 12/1/20

Earnest Data showed spending on the Shopify platform increased 75% over the Black Friday Cyber Monday weekend, a strong 15 point acceleration from the BFCM weekend in 2019, and roughly in-line with growth levels seen in years prior. We note that daily sales volume did noticeably pick up in the middle of November this year, indeed days earlier than prior years, a reflection of the pandemic-driven shift to e-commerce with its associated early BFCM deals this season.

Wayfair

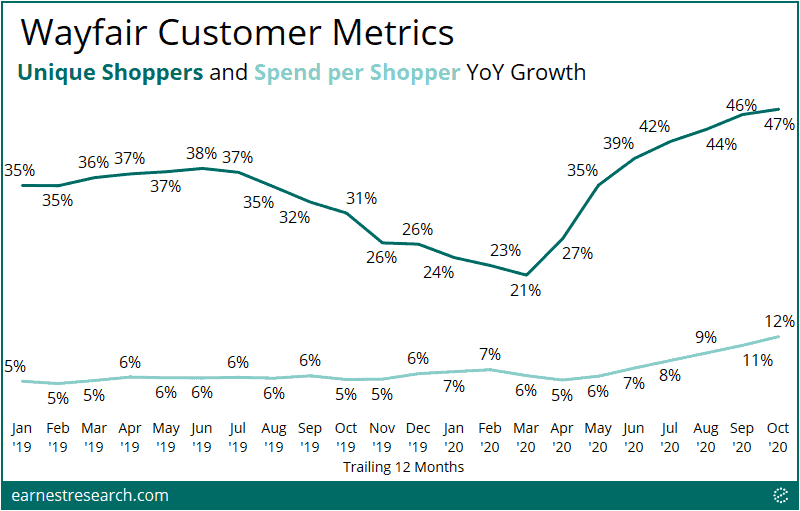

At nearly 29 million customers, our LTM active customer count was up 51% year-over-year. We saw average order values normalize some after a dip in Q2 with LTM net revenue per active customer hitting a new peak this past quarter.

Niraj S. Shah, CEO

Earnest Data shows a material improvement in customer growth from the onset of the pandemic: the last few months saw growth reach just under 50% YoY, relative to the ~ 20% to 35% growth levels seen since January 2019. Spend per customer also reached unprecedented levels recently, at 12%, relative to the usual mid single digit growth. There was indeed a slight dip in the spring months (2Q20) which reversed shortly thereafter and began to accelerate around June.

PulteGroup

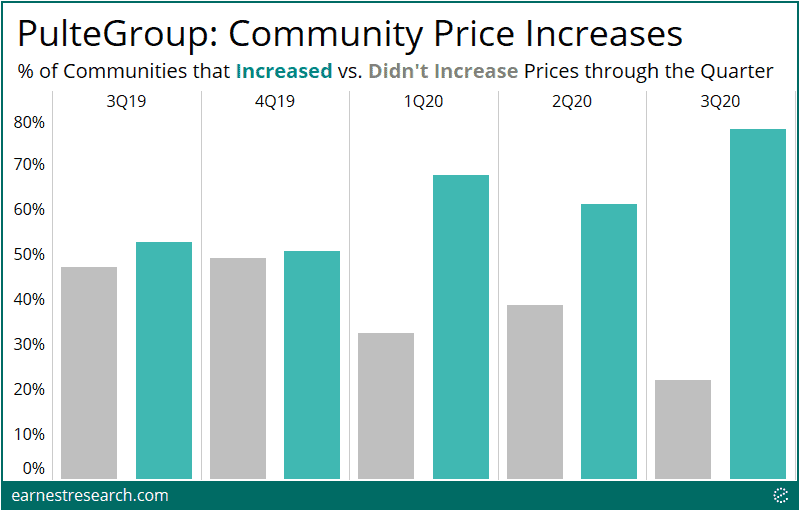

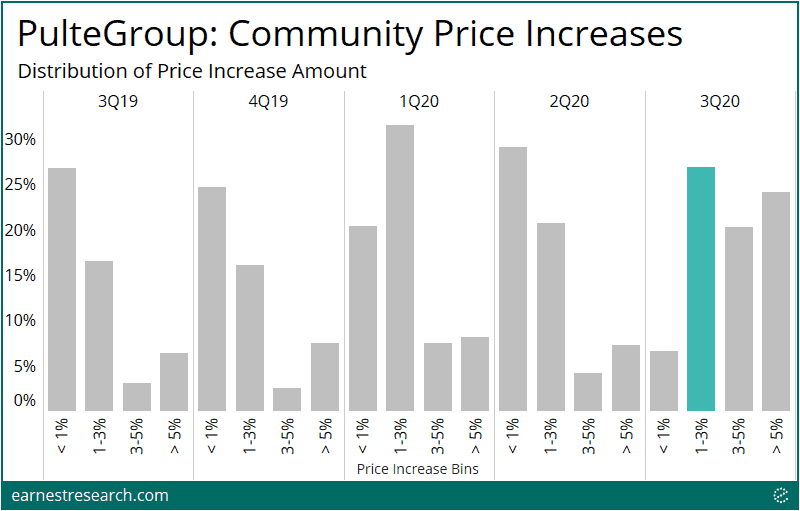

Given the positive supply-and-demand environment, we have taken the opportunity to raise prices across most of our communities. In fact, more than half of our divisions increased prices across their entire portfolio, with the typical increase realized in the quarter being in the range of 1% to 3%

Ryan R. Marshall, CEO

Earnest Data shows that ~80% of PHM communities raised their base price between the beginning and end of 3Q20; in prior quarters it was ~ 50 to 70% of the portfolio. The most typical price increase was indeed between 1% and 3% this quarter (27% of communities); when usually the most typical price increase is < 1% (except for 1Q20 which also saw a 1-3% increase most common). Also notable this quarter is that 20% of communities saw a 3-5% price increase, and 24% of communities saw > 5% price increase; both a sharp lift* relative to the typically small amount (~3 to 8%) of communities that usually see such high price lifts.

Cheesecake Factory

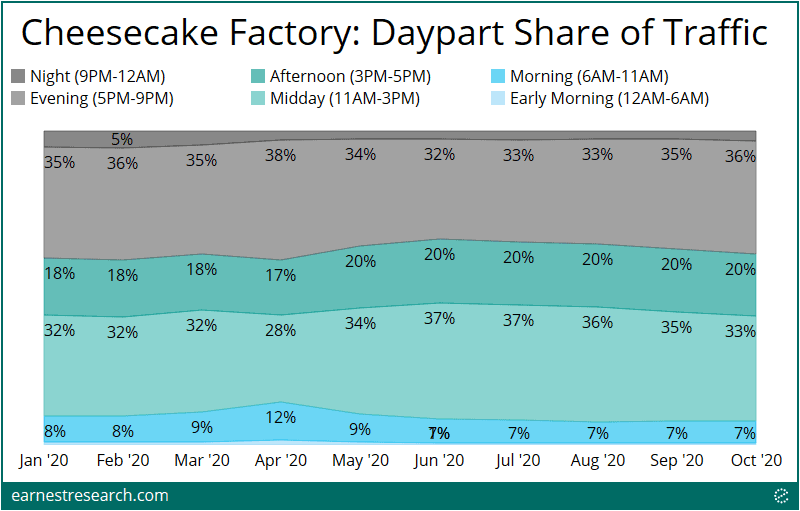

Daypart

In turn, our marketing team has capitalized on the Cheesecake Factory’s broad appeal across consumer demographics to produce effective on-brand marketing campaigns to raise awareness in the off-premise channel and drive sales with a particular emphasis on the typically slower dayparts. Our $15 lunch special, which included a slice of our legendary cheesecake, saw tremendous guest response, thereby increasing awareness of our lunch offerings while successfully driving sales to the late afternoon shoulder period.

David M. Gordon, President

The pandemic certainly shook up the daypart distribution of foot traffic to Cheesecake outlets: Midday (32% of visits pre-pandemic) and Afternoon (18%) visits grew ~2 to 5 points at the expense of Evening (35%) and Night (5%). There was indeed a trend towards normalization over the past few months, but lunch (midday) and late afternoon are still attracting a slightly higher share of traffic than they did pre-pandemic.

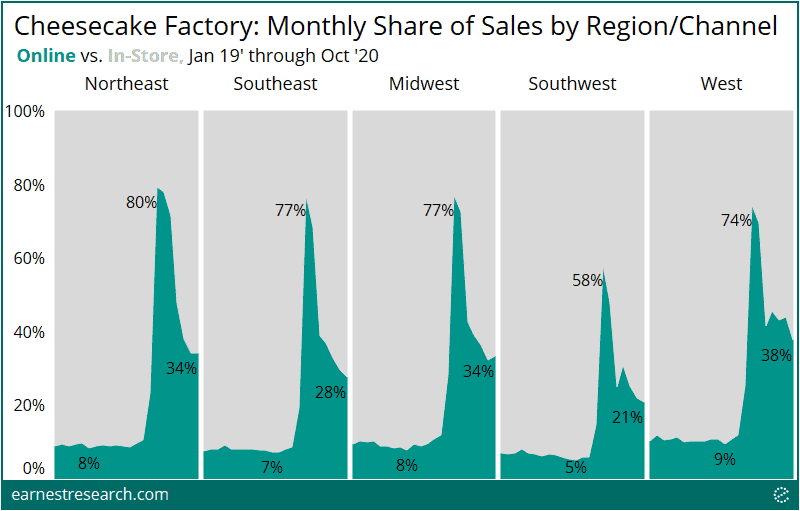

Off-premise

As I’ve mentioned, we’ve continued to sustain strong momentum in the off-premise channel. Even with a meaningful increase in in-person dining capacity, quarter-to-date, we continue to maintain nearly 90% of elevated COVID off-premise sales at Cheesecake Factory restaurants with reopened Dining rooms…Q: any sort of regional performance? A: I think probably similar to the industry as a whole, capacity is a component of that. And so in those geographies where it’s either opened up faster or more, certainly…some of those areas would be in the Southwest Texas and the Southeast and the Mid-Atlantic.

David M. Gordon, President

Spend online at Cheesecake (delivery + online platforms) has certainly remained elevated post the pandemic peak, relative to the high single-digit online share pre-pandemic. In geographies where dining rooms have reopened faster – such as the Southeast and Southwest – online shares have understandably normalized down further, currently at <30%, while the West, Northeast, and Midwest are currently seeing shares >30%.

Notes

*This lift may be partially overstated in the data as an increase in community base price may reflect the cheapest homes being sold out, due to high demand throughout Covid, but not reflect the same home increasing its price.