Earnings by Earnest: 3Q 2018

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 3Q 2018, we looked at Chipotle, Home Depot, Target and Best Buy.

Chipotle 3Q 2018| Earnings Call 10.25.2018

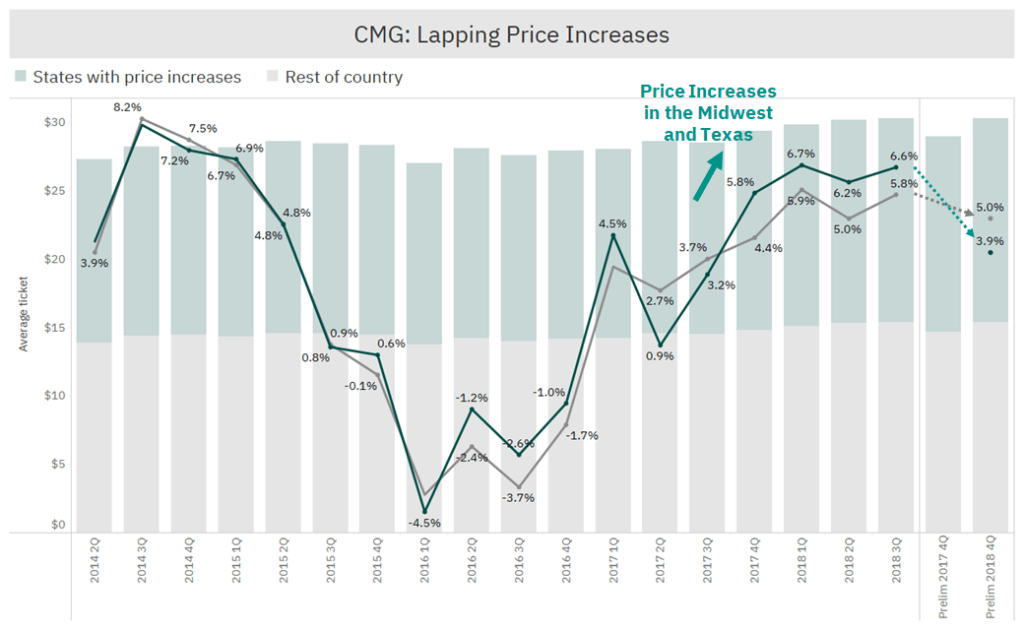

Looking to Q4, we’ll lap the price increase in about 1,000 restaurants in November, which will be a headwind to our overall Q4 comp by about 100 basis points… But with the growing pipeline of initiatives still early on in a stage-gate process, we’ll hold off in providing 2019 comp guidance until we have a better perspective of the timing and expected impact of each of these initiatives. – John R. Hartung, Chief Financial Officer

Earnest data shows the acceleration of average ticket in the Midwest and Texas in 4Q 2017, confirming that the comps get tougher as Chipotle’s quarter progresses.

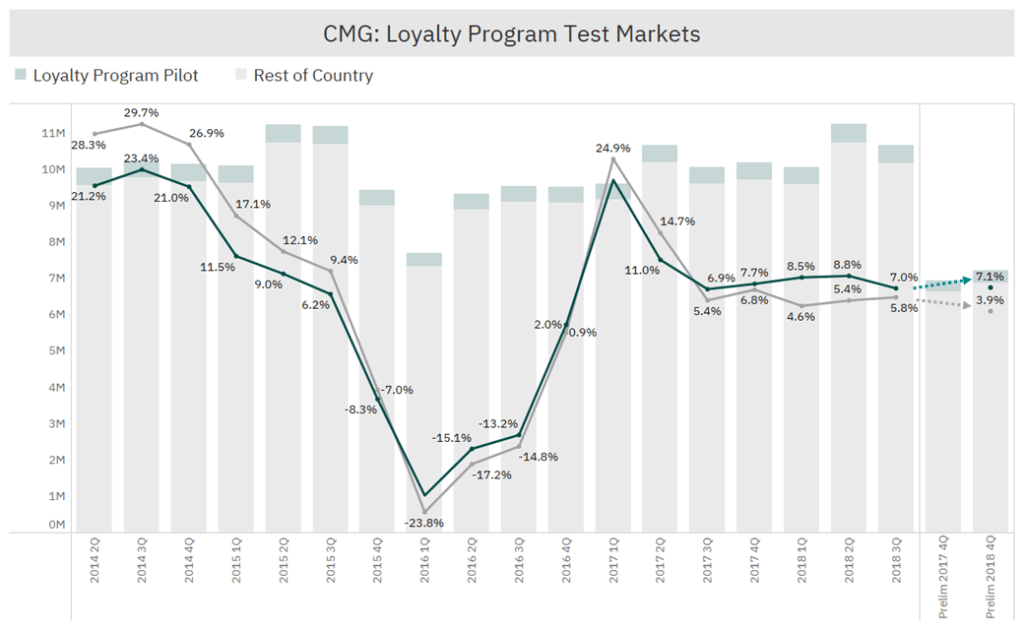

We’re also excited about our loyalty test, which launched in September in three test markets. It’s very early, but sign-ups look promising, and we’ll evaluate and learn from the loyalty test as it moves through the stage-gates in preparation for national launch during 2019. – Brian Niccol, Chief Executive Officer

Earnest data shows flattish trends in the preliminary quarter for sales in loyalty program pilot markets (Kansas City, Phoenix, and Columbus) compared to a ~200bps deceleration in the rest of the country.

Home Depot 3Q 2018 | Earnings Call 11.13.2018

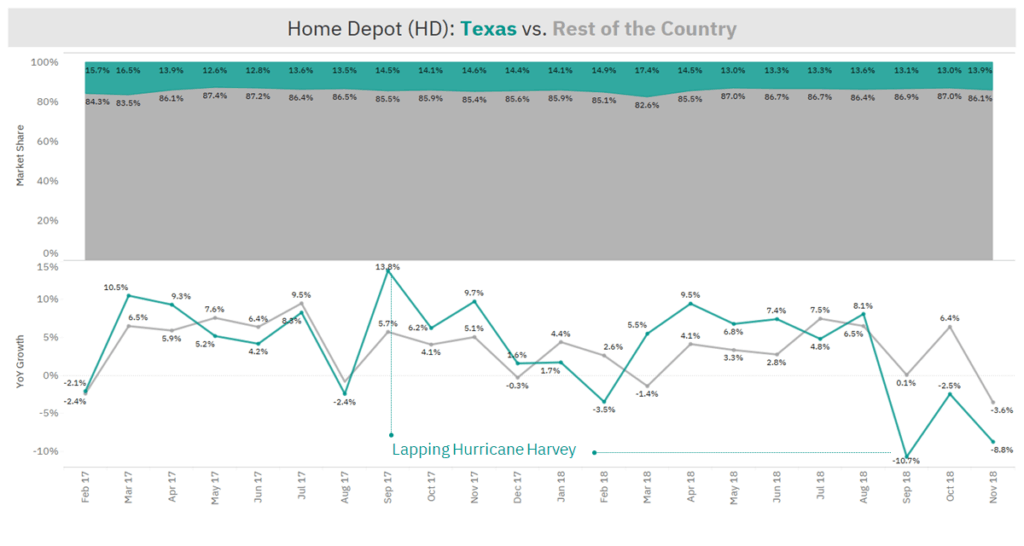

From a geographic perspective sales were strong across the U.S. All but one of our 19 regions posted positive comps. The exception was our Gulf region, which faced tough compares associated with the anniversary of Hurricane Harvey. – Craig Menear, Chief Executive Officer

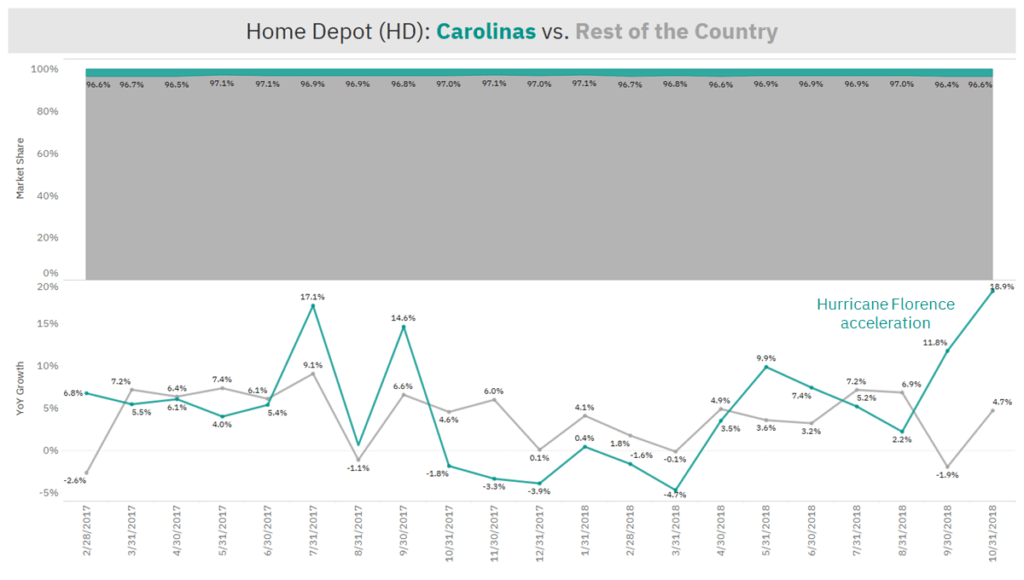

While this quarter brought Hurricanes Florence and Michael, the scope of devastation was more compact from a geographical perspective than what we experienced in prior years. – Craig Menear, Chief Executive Officer

3Q was tricky for companies with large exposures in areas that were hit by hurricanes Harvey and Irma in 3Q 2017 and hurricanes Michael and Florence in 3Q 2018. EarnestQuery breakdown of sales by geography was helpful in adjusting the reads of our data. For Home Depot, Earnest data shows the hard comp from hurricane Harvey in Texas, as well as the acceleration from hurricane Florence in the Carolinas.

Target 3Q 2018 | Earnings Call 11.20.2018

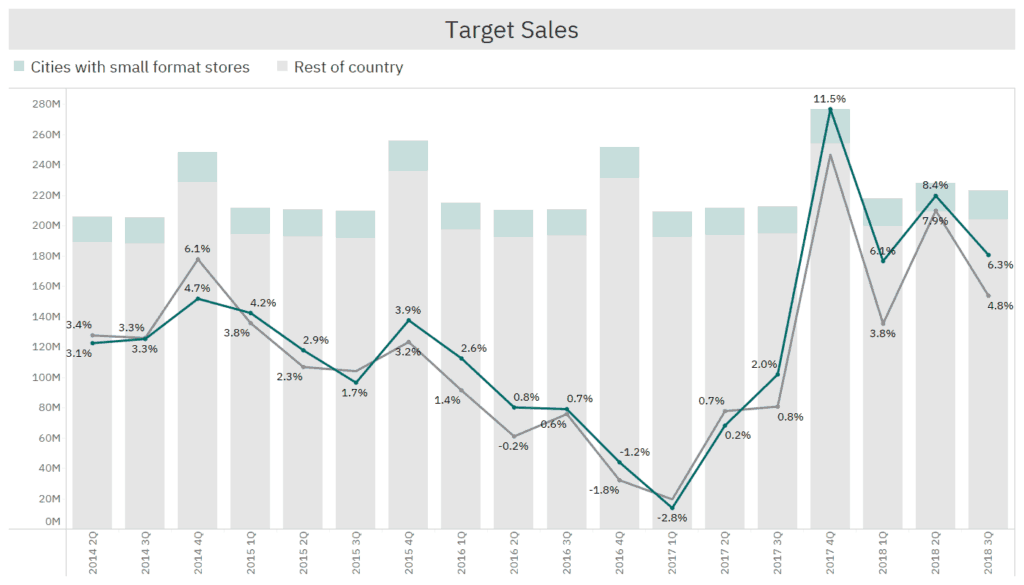

And finally, on top of comparable sales, new stores contributed more than 0.5 percentage points to our third quarter sales growth. This growth is being driven by new small format locations that we’re opening in dense urban settings and near college campuses across the country. We refer to these stores as small because of their square footage, but they really punched above their weight because of their high sales productivity. – Brian Cornell, Chairman and Chief Executive Officer

Earnest data shows that cities with small format stores outperformed the rest of the country over the last few quarters.

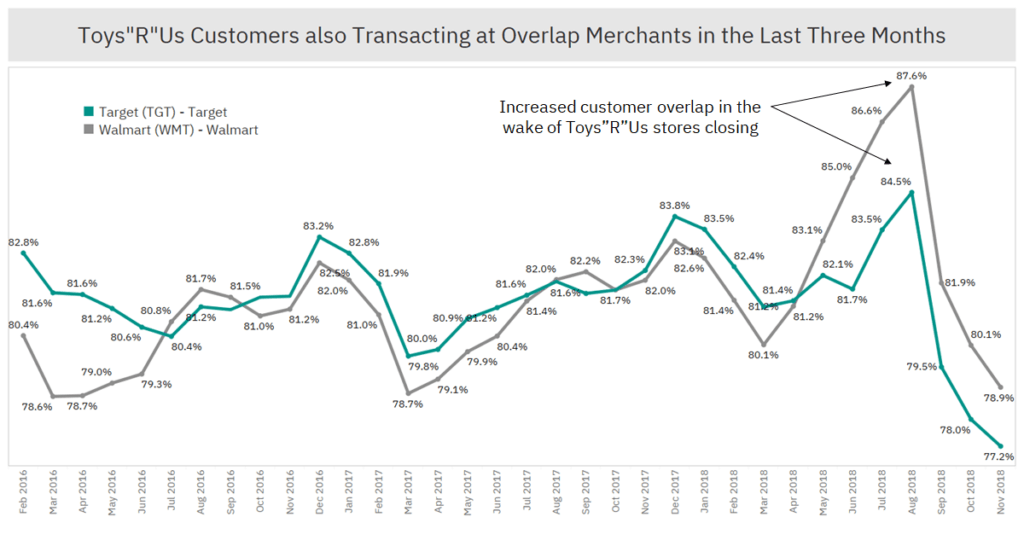

As you know, we’ve invested in the Toy category this year given the recent closures of Toys “R” Us stores around the country. So far this year, our Toy results have exceeded their expectations in terms of sales and share. – Mark Tritton, Executive Vice President and Chief Merchandising Officer

Earnest data shows that at the peak of liquidation sales, 84.5% of Toys ‘R’ Us customers shopped at Target at least once in the last three months. Walmart shows a slightly higher overlap at 87.6%.

Best Buy 3Q 2019 | Earnings Call 11.20.2018

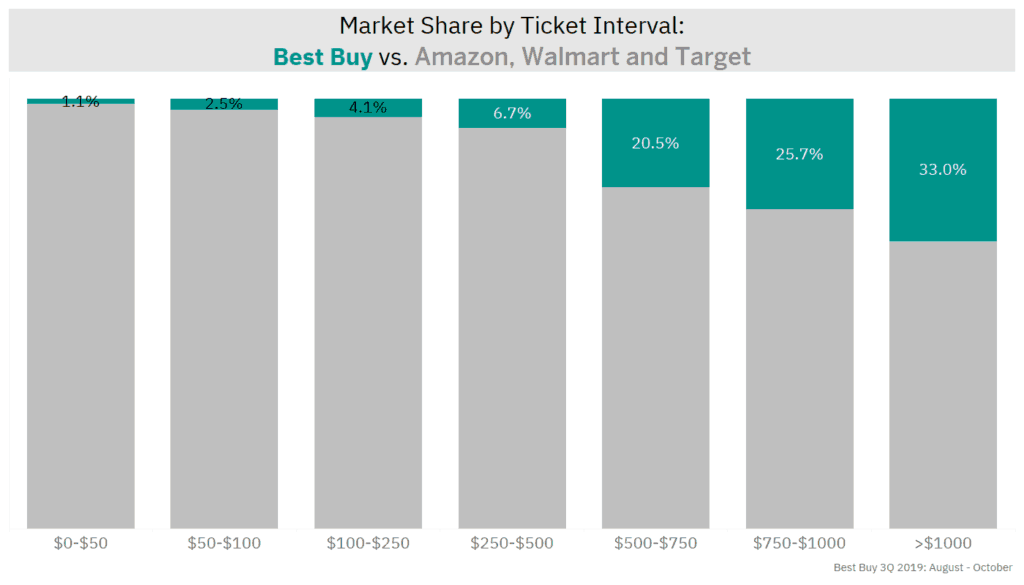

There is always room for some bigger TVs. – Corie Barry, Chairman and CEO

Buying a phone is actually a complex experience. And we do well, compared to other players, when the items that we’re selling are either very large or complex to buy. So– it’s a strength. – Hubert Joly, CFO

Earnest data shows that competitors (Amazon, Walmart and Target combined) dominate the market among lower ticket items. However, as the ticket size reaches ~$250, Best Buy becomes a visible player and takes market share.

For more details about this analysis or our EarnestQuery product, please schedule a demo or reach out to [email protected]