Earnings by Earnest: 2Q 2020

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 2Q 2020, we looked at Six Flags, Lyft, Abercrombie, and Etsy.

Six Flags

“Revenue for the second quarter of 2020 was $19 million, with attendance of 433,000 guests, both a decrease of 96 percent compared to the same period in 2019. The decrease was due to the pandemic-related suspension of park operations for most of the quarter…Included in the Active Pass Base were 2.1 million members, compared to 2.6 million members at the end of 2019 and 2.4 million members at the end of the first quarter of 2020. Deferred revenue was $182 million as of June 30, 2020, a decrease of $53 million, or 22 percent, from June 30, 2019.”

-SIX 2Q20 8-K

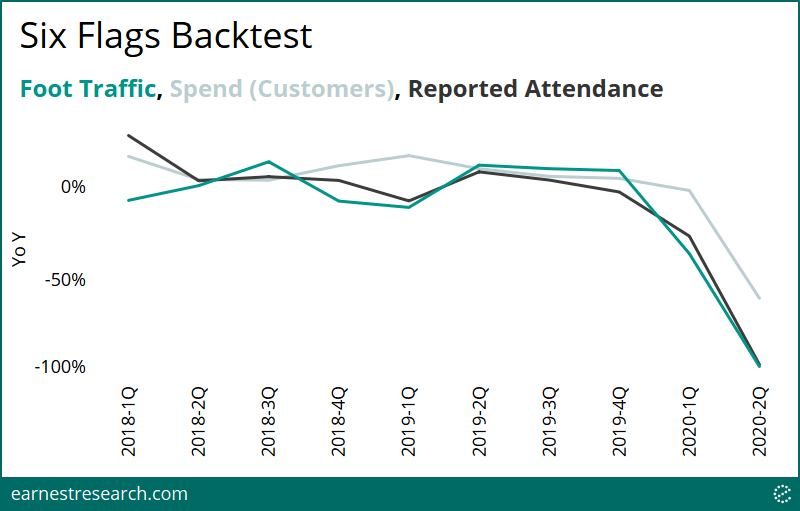

Foot Traffic data tracked SIX’s attendance decline better than Spend data due to deferred revenue dynamics. Parks closing due to the pandemic resulted in an attendance decline of 96% YoY, while Earnest Foot Traffic declined 97% and Earnest Spend declined 60% (relative to 1Q20’s attendance decline of 27%, Foot Traffic’s -36%, and Spend’s -2%). Earnest Spend data understated the decline due to the company’s lower deferred revenue decline, a metric that Spend data is more impacted by, while Foot Traffic is more aligned with Attendance.

Lyft

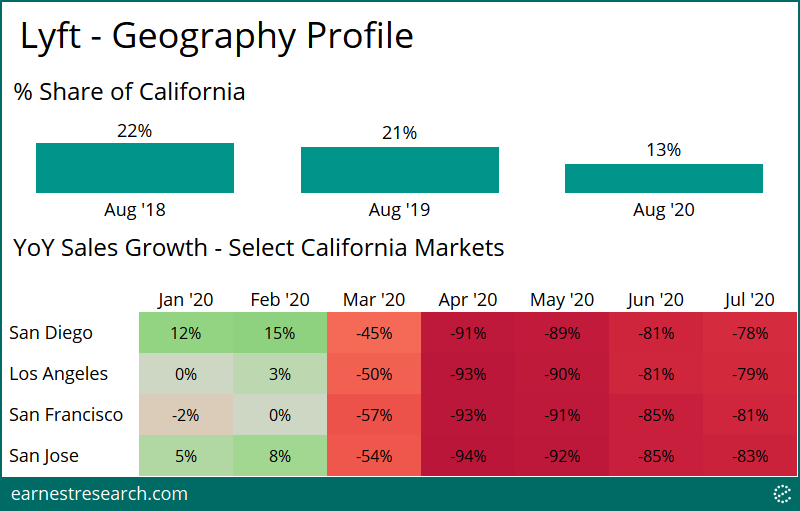

“So let me just give a little more color on California. I would say the West Coast is one of our weakest regions in terms of rebound. So if you look at month-to-date in August, California as a percentage of total rides was down over 5 full percentage points year-over-year, as John mentioned, out of 16% of total rides. In terms of specific data points, notwithstanding the recovery in other parts of the country in July, rideshare rides were down 75% in San Francisco, 72% in San Diego and 75% in San Jose. And in the most recent week, both San Francisco and San Jose were down 77% year-over-year.”

-Brian Keith Roberts, CEO

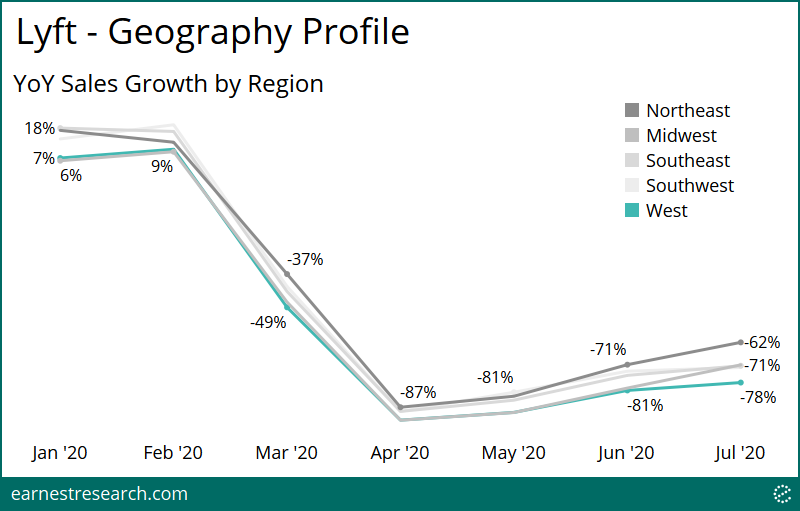

Earnest spend data shows Lyft struggling most in the West relative to other regions, underperforming the Northeast by ~15%. Drilling further into California, the previously popular Lyft state has seen ~8 points of share loss over the past year, and select California markets are declining around ~80% relative to the ~90% declines seen during April’s trough.

Abercrombie

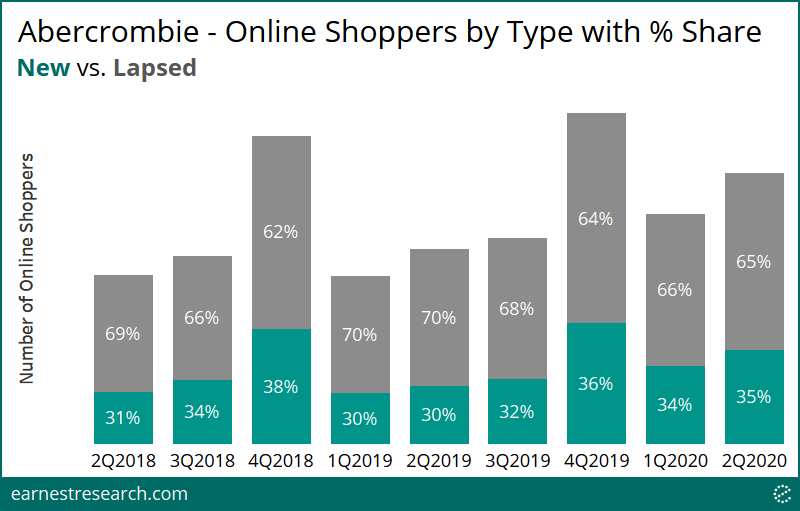

“Q: So could you just talk about the digital business? Very strong growth. And I’m curious, did you see the customer file grow as well? And is that customer — are you seeing a new customer? Is it a lapsed customer?… A: Yes, we did see our customer file grow. Obviously based on the strength of that business, we have seen new customer to file as well.”

-Fran Horowitz, CEO

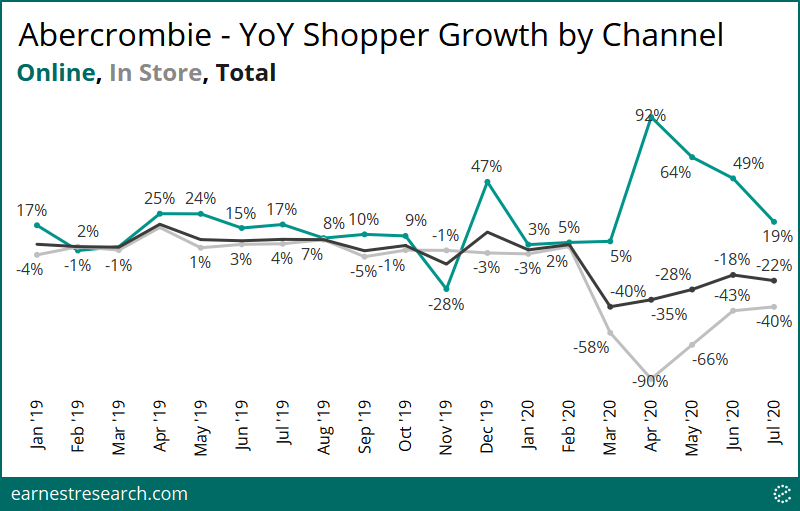

Earnest spend data suggests strong growth in the number of digital shoppers, surpassing 90% YoY during the height of the pandemic in April, and maintaining ~ 50% to 65% growth over the next two months. Digging deeper into the type of digital shopper, the breakdown of new (defined as shopping online at Abercrombie for the first time) vs. lapsed was slightly higher than prior quarters, at 35% in 2Q, yet is still lower than the breakdown seen during the company’s seasonally strong 4Q. In other words, 2Q20’s strong growth in the number of digital shoppers wasn’t driven by new online shoppers any more than new online shoppers usually contribute to digital growth.

Etsy

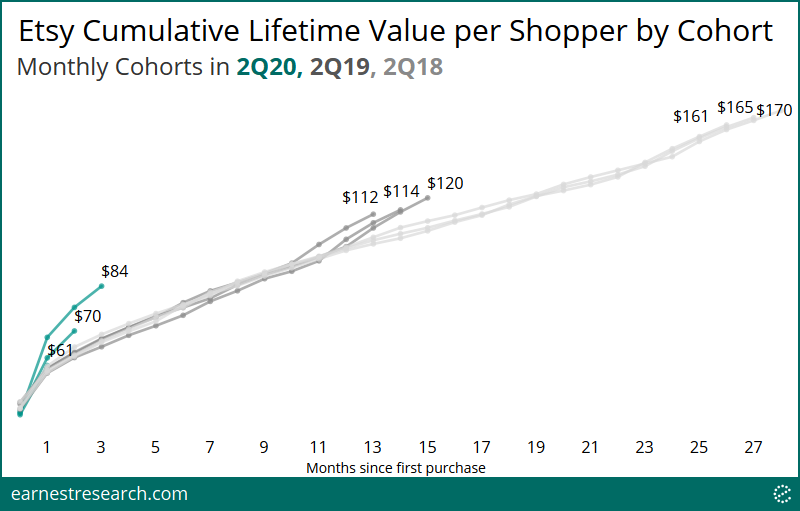

“Currently, our newer cohorts are performing better than our older cohorts, but this is an unusual time with fewer options for buyers…we’re not asserting that these newer cohorts will continue to outperform. However, we do feel confident that these cohorts will be at least as good as any cohort we ever acquired…you can see that our historical cohort trends have been extraordinarily reliable and predictable, driving a very steady recurring annuity of GMS in our base business…”

-Rachel C. Glaser, CFO

Total dollars spent by newly acquired Etsy shoppers in 2Q20 were materially higher than prior cohorts. The average shopper acquired in April 2020 spent $84 cumulatively over the subsequent three months (2Q), which is ~25% higher than April 2019 and April 2018 cohorts of ~$68 spent throughout their 2Q. Additionally, historical cohorts do indeed appear “reliable and predictable, driving a very steady recurring annuity of GMS” over their life.

For more details about this analysis or Earnest data products, please schedule a demo or reach out to [email protected]