Earnings by Earnest: 2Q 2018

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 2Q 2018, we looked at Lululemon, Papa John’s, The New York Times, J.C. Penney, and Chipotle.

Lululemon 2Q 2018 Results | Earnings Call 08.30.2018

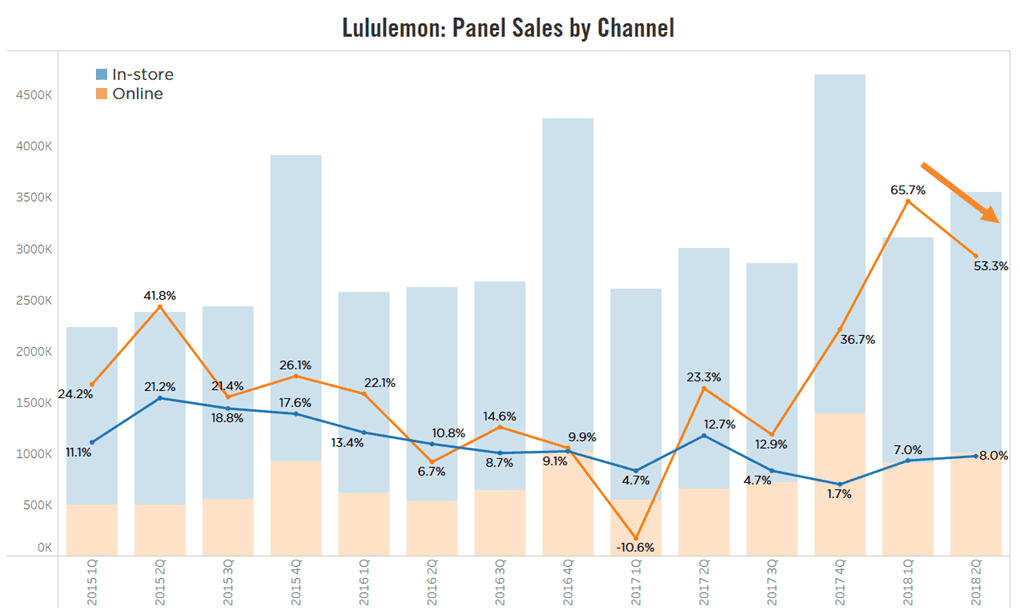

In our digital channel, we saw strong traffic and higher conversion that resulted in a 47% comp increase.

Earnest data shows Lululemon online sales decelerated by ~12% since last quarter, compared to Lululemon reported ~15%.

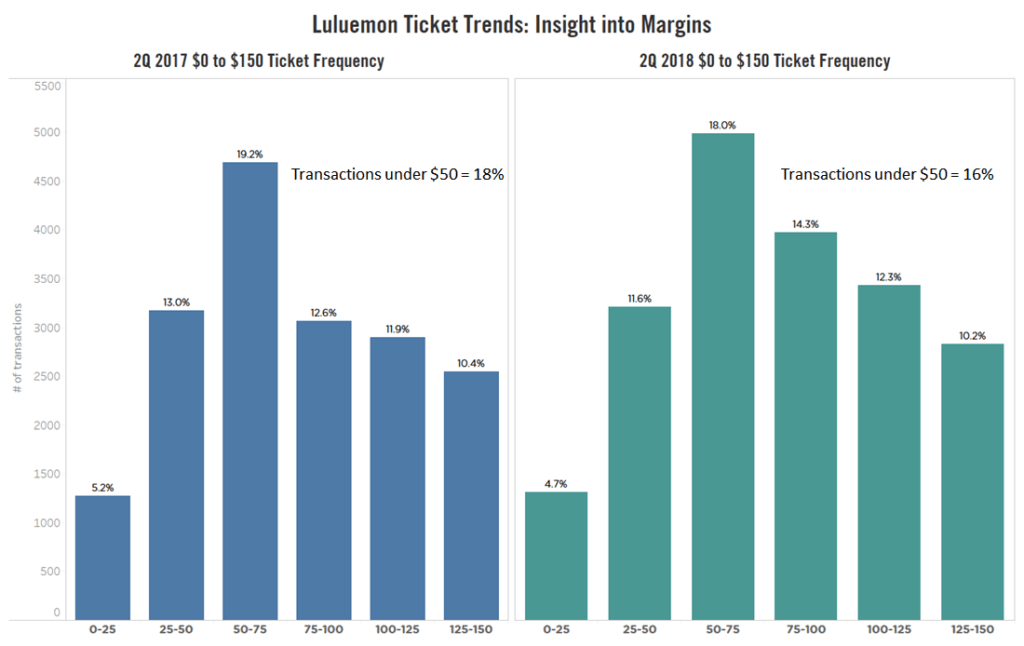

A 260 basis-point increase in overall product margin, resulting from lower product costs, favorability and product mix, and lower markdowns versus last year.

Earnest data shows a greater proportion of transactions in higher-ticket categories (above $50) in 2Q18 vs 2Q17, corroborating the reported slowdown in promotional activity. Transactions under $50 made up 18% of all transactions in 2Q17 whereas transactions under $50 made up 16% of all transactions in 2Q18.

Papa John’s 2Q 2018 | Earnings Call 08.02.2018

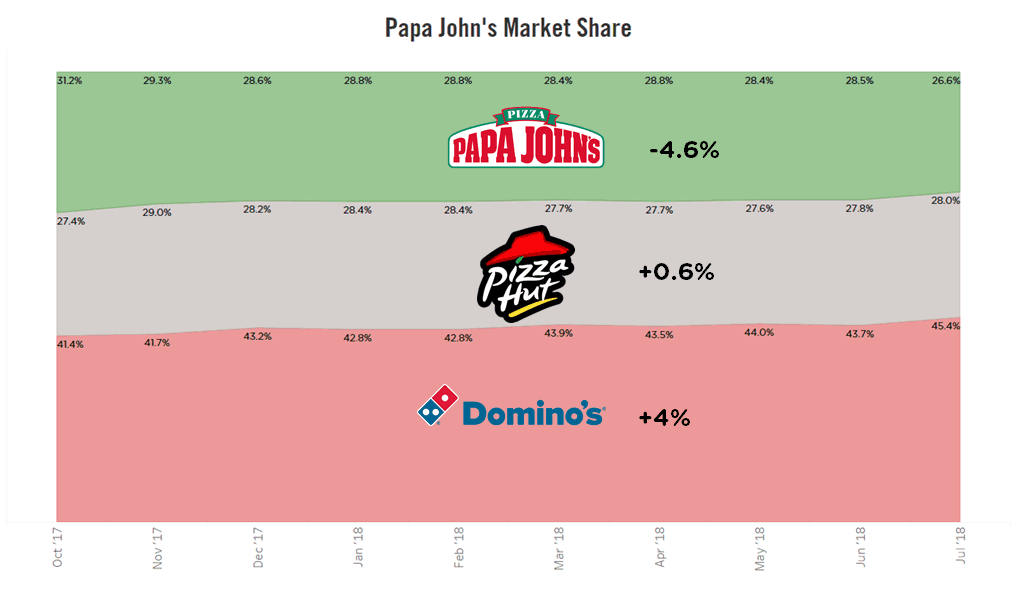

I’d first go back to November… the impact of consumer sentiment… we saw a very sharp decline…And again, after the July 11 article that came out from, again, very inexcusable and irresponsible comments from Mr. Schnatter, we saw another precipitous drop of roughly 4% [customer sentiment] from the trend.

Earnest data shows Papa John’s losing ~5% of market share against its main competitors since last October.

New York Times 2Q 2018 | Earnings Call 08.02.2018

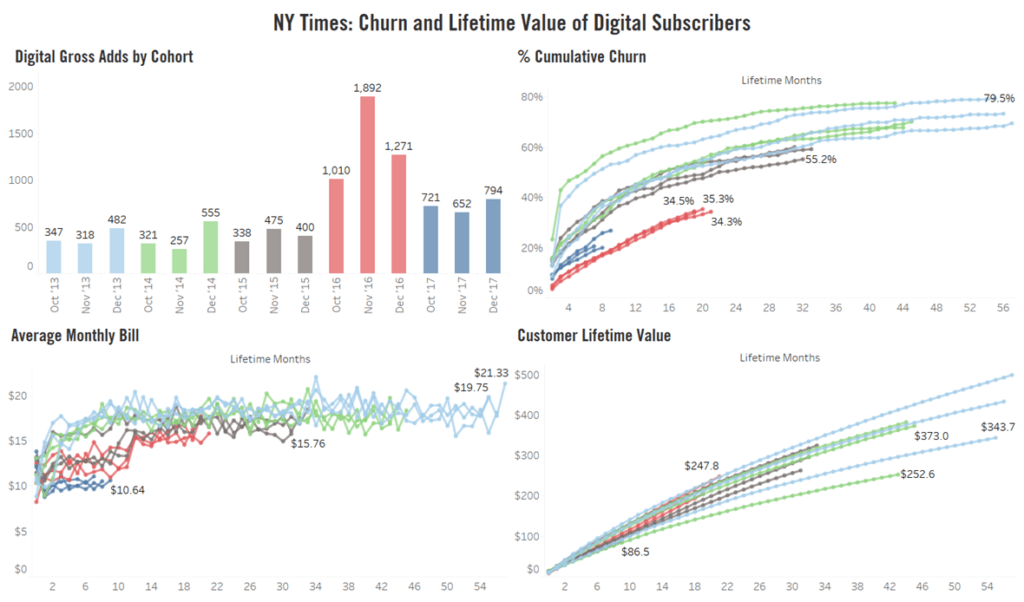

Can you talk a bit further about churn for your digital subs here? … Is the Trump bump – I mean, how are those people at the churn levels there versus what you can see in prior cohorts, et cetera?

… In general, all of the election cohorts, and we broadly sort of characterize them in two ways: those who came in right around the election, so just before and just after; and then the next, in the sort of post-election cohort. Those are retaining far better than any previous cohorts.

Earnest data shows that customers who subscribed for The New York Times in November ‘16 (Trump bump) have the lowest cumulative churn.

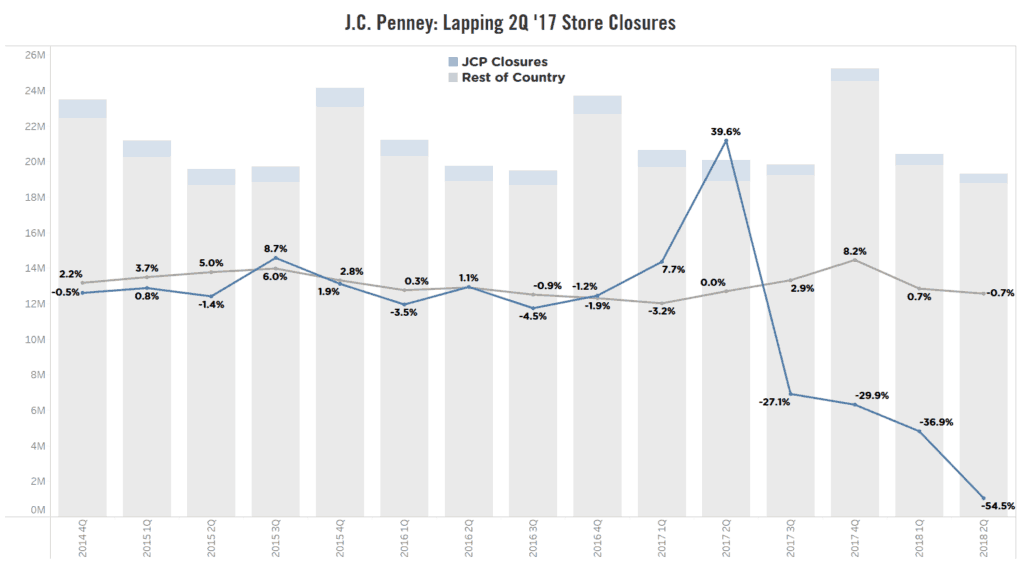

J.C. Penney 2Q 2018 Results | Earnings Call 08.02.2018

…Total net sales decreased 7.5% versus last year, while comp sales increased 0.3%…spread between total net sales and comp sales was primarily due to the 141 store closures in fiscal 2017, most of which were closing late in the second quarter of last year…

Earnest data tracked the spike in J.C. Penney sales in 2Q 2017 in cities with at least one store closure due to liquidation sales. J.C Penney lapped these closures in 2Q 2018.

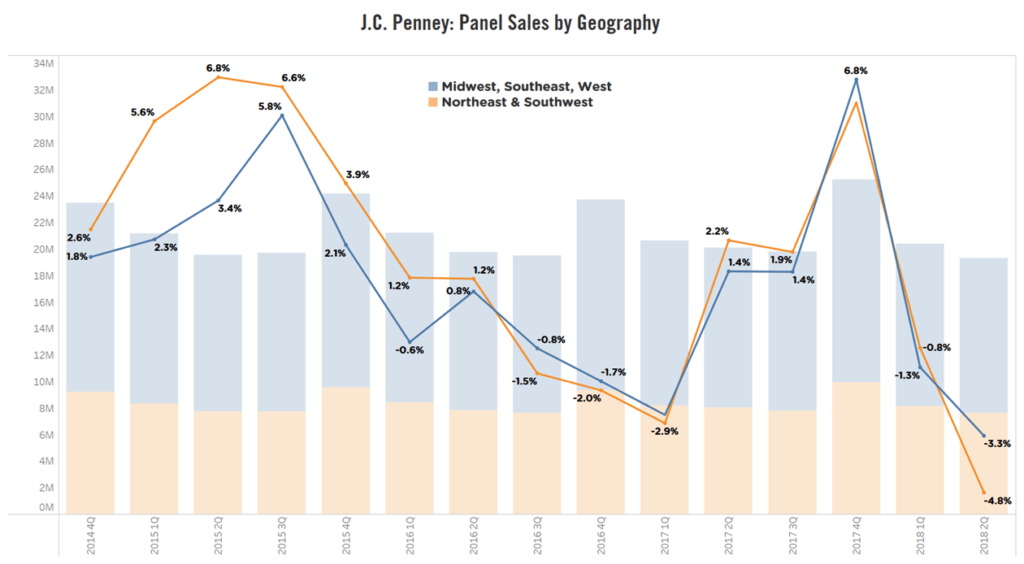

Geographically, the Southeast, Gulf Coast and Northwest regions were our best performing areas, while the Southwest and the Northeast were our most challenged regions.

Earnest data shows that Northeast and Southwest regions decelerated by ~4.1% compared to the rest of the country that was down ~2.2%.

Chipotle 2Q 2018 | Earnings Call 07.26.2018

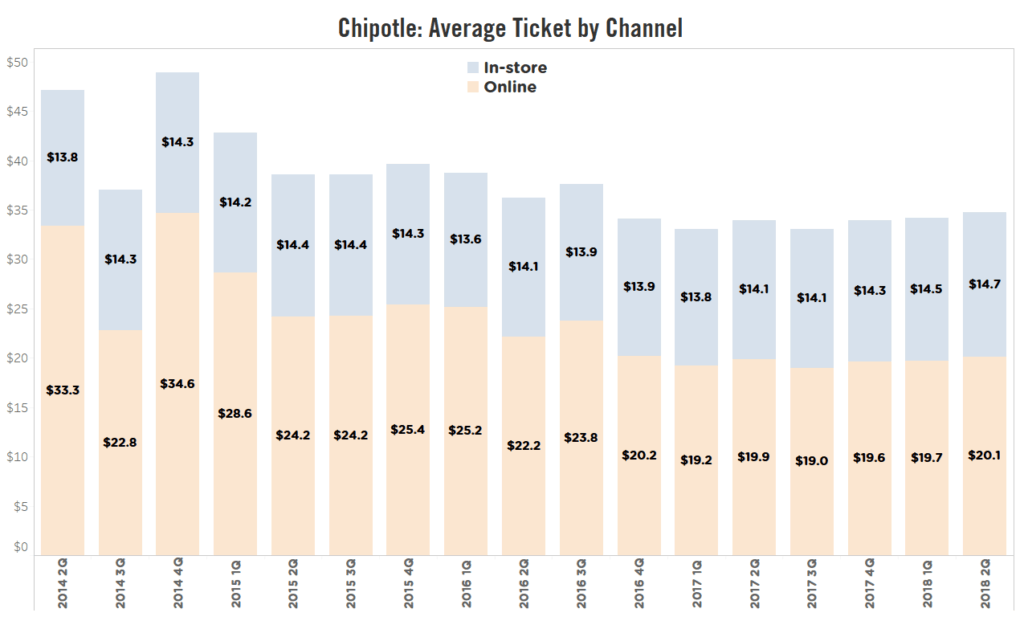

We see a nice increase in our digital orders. So the mobile and delivery orders are in that $16 to $17 range versus our traditional check in the $12 range.

Earnest data shows a similar trend with mobile orders about $4.5 higher than in-store orders.

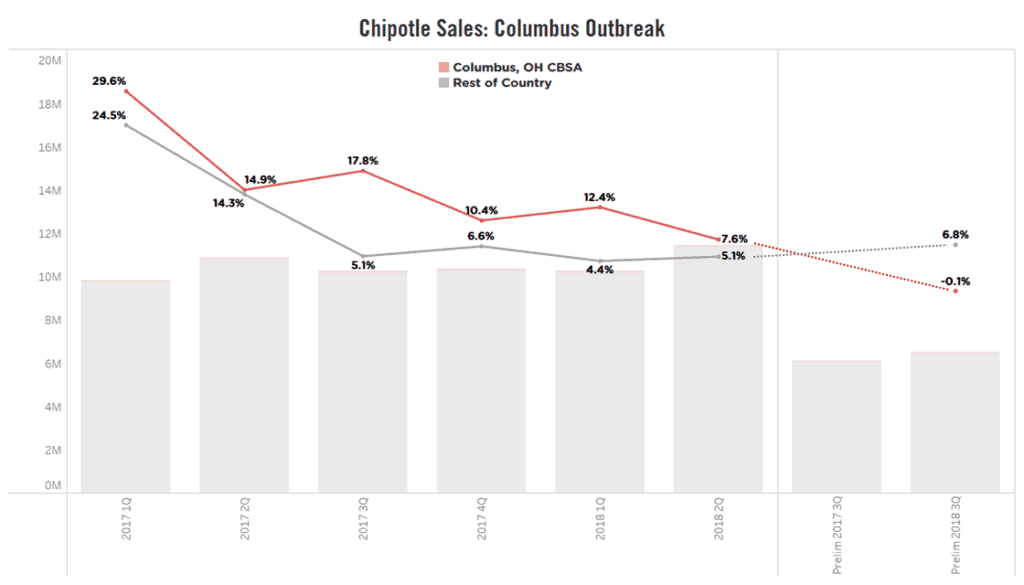

Earnest data in the current quarter: On 7/31, Chipotle closed one of its Columbus, OH locations due to customer complaints of food poisoning. Through end of August, Earnest data shows the damage from this outbreak seems to be contained in the Columbus metro area (sequentially decelerating by ~7.7%) compared to the rest of the country (sequentially accelerating by ~1.7%).

For more details about this analysis or our EarnestQuery product, please schedule a demo or reach out to [email protected]