Earnings by Earnest: 1Q 2020

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 1Q 2020, we looked at Target, Wayfair, Shake Shack, Neiman Marcus, and J.C. Penney.

Target

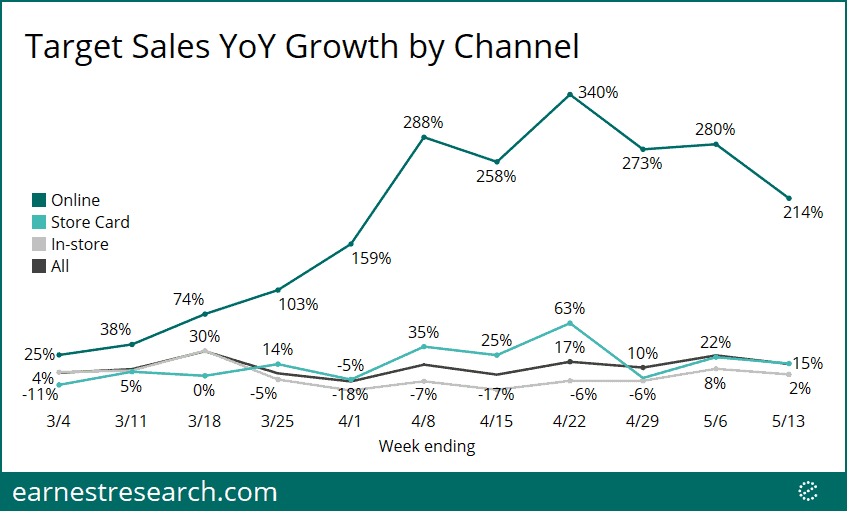

“Specifically, we began the quarter with a relatively normal February in which we saw overall comp growth of 3.8% and digital comp growth of 33%, and ended in April which saw total company comp growth of more than 16% and a jaw-dropping 282% increase in digital comp sales.”

– Brian C. Cornell, Chairman & CEO

In late April we saw online sales at Target spike at 340% YoY, and they have since remained well over 200%. In-store sales showed declines of 18% at trough and improved to -6% at the end of April; they have since returned to growth through the first half of May.

Wayfair

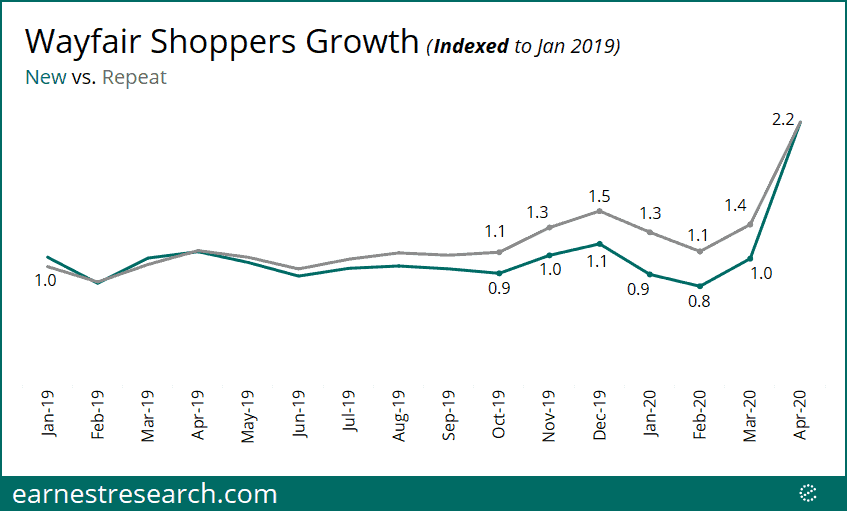

“We are seeing not just robust new customer acquisition, but also strong repeat trends from both long-term loyal and recently added new customers.”

– Michael Fleisher, CFO

After both new and repeat Wayfair shoppers grew at the end of 2019, the number of both cohorts dipped heading into February 2020; new shoppers bottomed at 80% of January 2019 levels. Since then, and heading into the crisis, both cohorts have grown dramatically to 220% of January 2019 levels.

Shake Shack

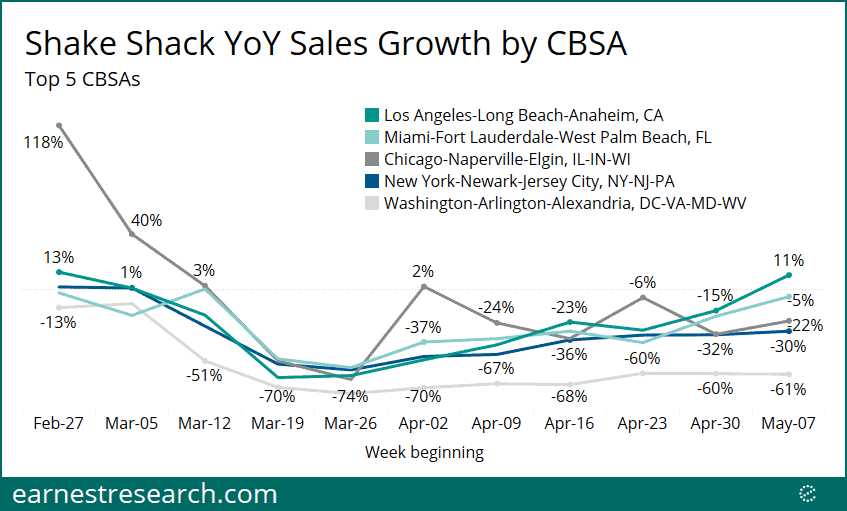

“From a regional perspective, despite all regions being significantly impacted, there are some notable differences in performance as well as the speed with which some markets are demonstrating improvements, with New York City not surprisingly, still acutely impacted.”

– Randy Garutti – CEO

Shake Shack sales growth in all of its top 5 CBSAs bottomed in late March. Since then, there have been different speeds of recovery, with Los Angeles and Miami making the largest jumps while New York and D.C. are still declining ~30 to 60% YoY.

Neiman Marcus and J.C. Penney

“The Company has commenced voluntary Chapter 11 proceedings in the U.S. Bankruptcy Court…The Company continues to leverage the strength of its e-commerce platforms, continuing to serve customers remotely and digitally through its associates and style advisors, as well as on the Neiman Marcus and Bergdorf Goodman websites and apps.”

– NMG Press Release on Filing for Bankruptcy Protection, May 7, 2020

“To implement the Plan, the Company today filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code…During this process, JC Penney will continue to be one of the nation’s largest apparel and home retailers with an expansive footprint of hundreds of stores across the U.S. and Puerto Rico and a powerful eCommerce site, jcp.com.”

-JCP Press Release on Filing for Bankruptcy Protection, May 15, 2020

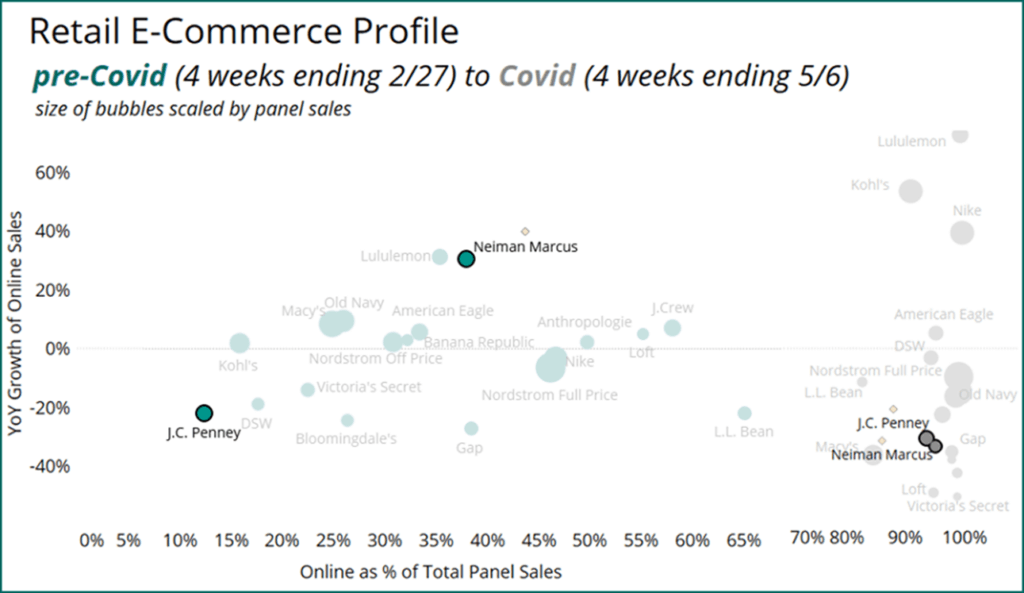

Just how strong are J.C. Penney’s and Neiman Marcus’ online channels? We analyzed the dramatic e-commerce transformation that almost all retailers faced because of COVID in a prior published blog post.

Looking at the e-commerce profiles of J.C. Penney and Neiman Marcus relative to their peers, J.C. Penney had one of the worst profiles pre-COVID: it was just ~15% of their top-line and was declining ~20% YoY. On the other hand, Neiman Marcus’ e-commerce profile was relatively healthy, at ~40% of sales and growing ~30% YoY. However, both profiles are now residing side-by-side, declining ~30% YoY, and struggling to adapt to online-only and post-COVID customer buying habits.

For more details about this analysis or Earnest data products, please schedule a demo or reach out to [email protected]