Earnings by Earnest: 1Q 2019

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 1Q 2019, we looked at Ulta Beauty, CarMax, H&M, and Lululemon.

Ulta Beauty 1Q 2019

Earnings Call May 30, 2019

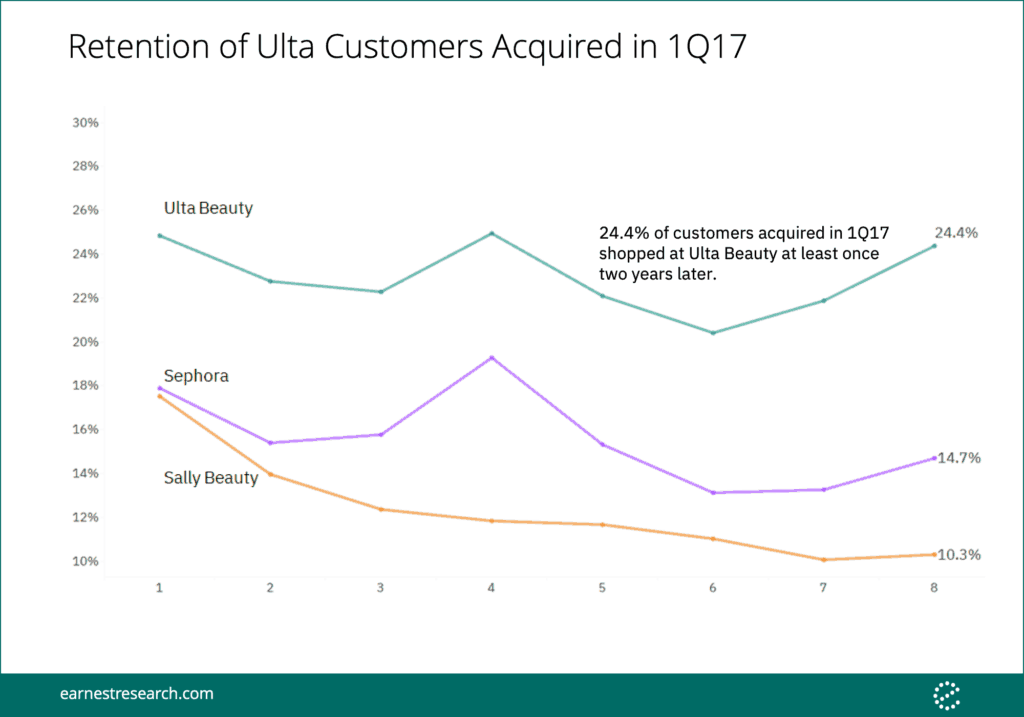

“We’re actively testing and experimenting with different programs to take the millions of new guests that we’ve been acquiring every year, and making sure they stay engaged with us. We have a high retention rate to begin with, but we think it could be higher.”Dave Kimbell – Chief Merchandising and Marketing Officer

Earnest data shows that Ulta Beauty has superior retention compared to competitors like Sephora or Sally Beauty. Almost a quarter of customers acquired in 1Q17 came back to shop at Ulta two years later..

CarMax 1Q 2020

Earnings Call June 21, 2019

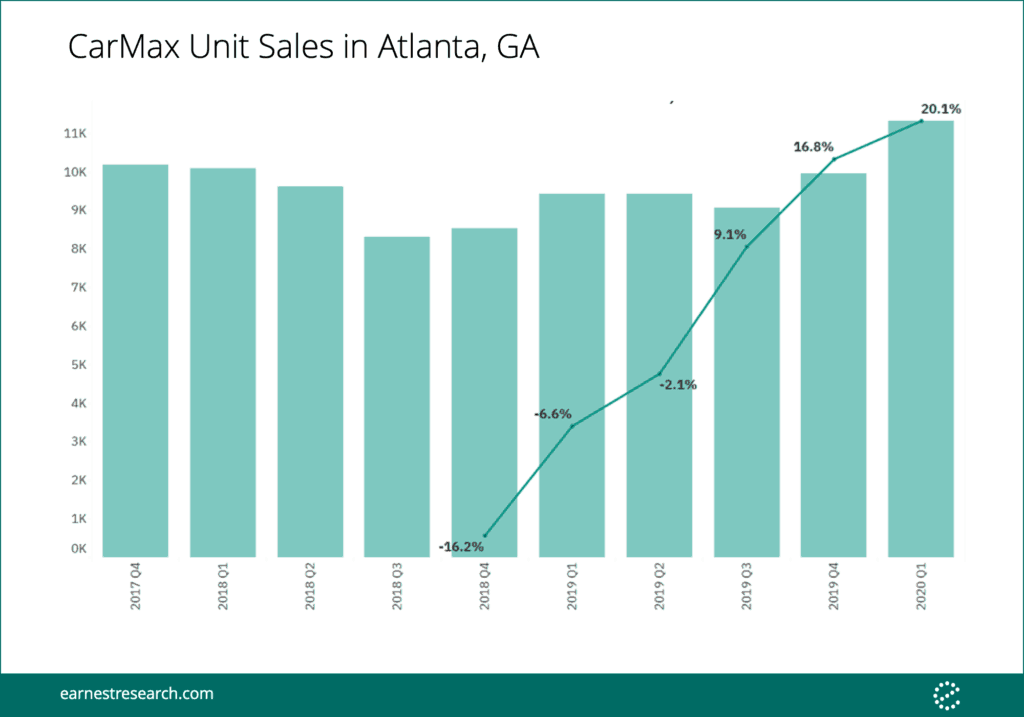

“While we are still in the early stages, we are very pleased with the results in our Atlanta market. The strong performance we saw last quarter carried over into the first quarter. Once again, we saw double-digit comps and the Atlanta market continues to outperform the overall company in both comp sales and appraisal buys.”Bill Nash – President and CEO

Earnest data shows that Atlanta unit sales continue to comp double-digit positive. Our data also shows that the 2y stack has accelerated vs. the last quarter, which was corroborated by management.

H&M 2Q 2019

Earnings Call June 27, 2019

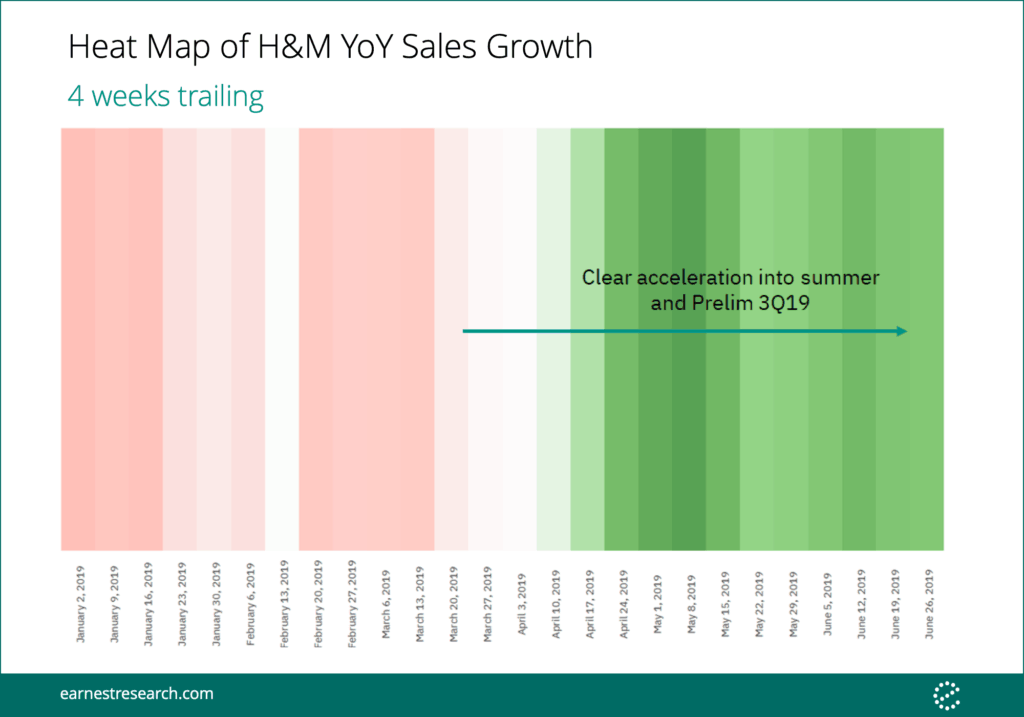

“The third quarter has also started well. Our summer collections so far have been very well received. We estimate that the sales in June will grow 12% in local currencies compared to June last year.”Karl-Johan Persson – CEO

Although management’s commentary refers to overall global performance, Earnest data is also tracking a strong start to the summer for the US segment.

Lululemon 1Q 2019

Earnings Call June 12, 2019

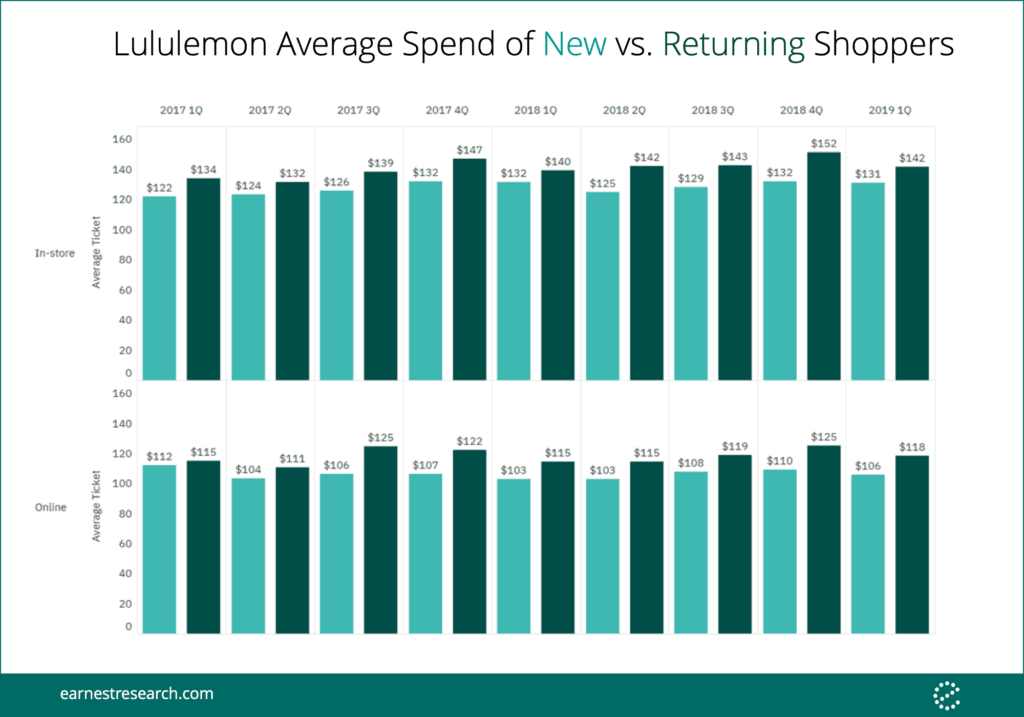

Q: “Is there any color you can provide in terms of [existing guests purchasing behavior and the new guests that you’re bringing into the store] — the average spend between those two cohorts?”

A: “We don’t share the average spend across our different guests.”Calvin McDonald – Chief Executive Officer and Director

We analyzed spending trends of Lululemon’s existing (made their first purchase at least a year ago) and new customers (made their first purchase within the last year). In 1Q 2019, the average in-store and online purchases for returning customers were 8% and 11% higher than those of new customers respectively.

For more details about this analysis or our Earnest Query product, please schedule a demo or reach out to [email protected].