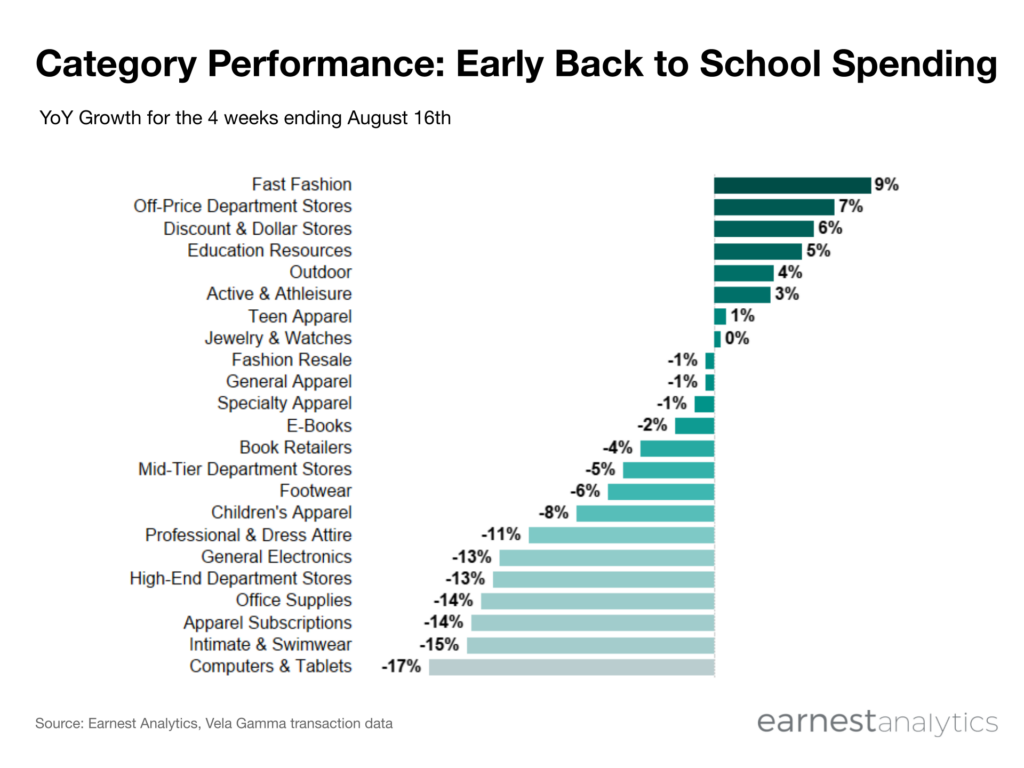

Early back to school spending favors fast fashion, discount retailers

Download full report: Analyzing Back To School Spending Using Earnest Transaction Data

Back to school spending for states in which class is already back in session* fell YoY across most major retail categories in the four weeks ending August 16, 2023. Interestingly, Electronics (i.e. Computers & Tablets and General Electronics) retailers declined double digits and are among the worst performing despite the National Retail Federation forecasting for Electronics spending to contribute significantly to overall back to school spend. Other notably challenged subcategories include Mid-Tier and High-End Department Stores, Footwear, and Office Supplies. This weakness coincides with recent commentary from Macy’s management who indicated they “have a cautious view on the consumer” as its customers have “more aggressively pulled back on spend in discretionary categories” and are “becoming more intentional on the allocation of their disposable income.”

In contrast, Fast Fashion, Off-Price Department Stores, and Discount & Dollar Stores all posted mid-to-high single digit gains, likely benefitting from consumer trade downs. This subcategory dichotomy suggests the consumer economy may be beginning to feel the pressure from a record high inflationary period.

Download full report: Analyzing Back To School Spending Using Earnest Transaction Data.

Notes:

*Early Back-to-School States include the East South Central (Alabama, Kentucky, Mississippi, Tennessee), West South Central (Arkansas, Louisiana, Oklahoma, Texas) and Mountain states (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming). The majority of counties in these states go back to school by the second week of August.