DoorDash, Wingstop could be real Super Bowl winners in 2025

Super Bowl LIX 2025 will highlight several emerging US restaurant trends and brands according to Earnest credit card data. Among them, DoorDash continues to dominate the delivery aggregator market, though some markets are more competitive than others. QSR (Fast Food), Fast Casual, and Casual Dining are also set for a value-driven fight for young customers. There are several brands across the restaurant space likely to come out on top of this year’s biggest football event.

DoorDash could further Super Bowl weekend market lead in 2025

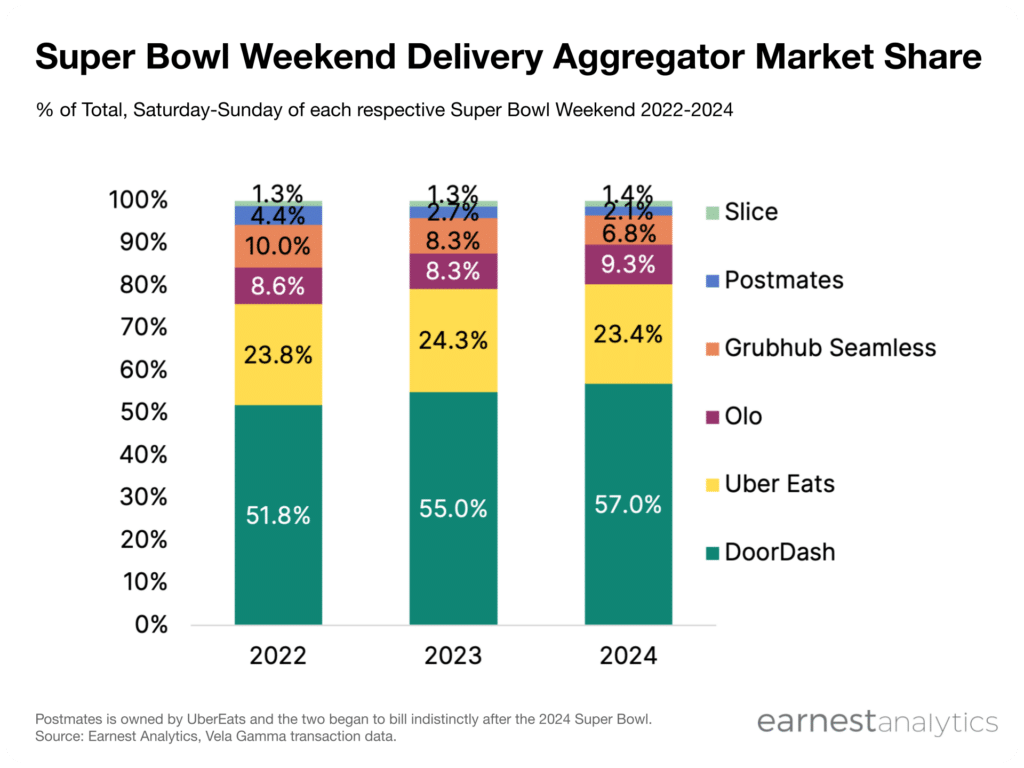

DoorDash (DASH) processed more delivery dollars during Super Bowl 2024 than any delivery platform according to Earnest credit card data. DoorDash captured 57% of total Super Bowl weekend aggregator spend, rising 2 points from 2023 and 5.2% from 2022. Uber Eats (UBER) held 23.4% share, losing 90 basis points from 2023. Olo, a digital ordering and delivery platform, grew to 9.3% share in 2024. Grubhub’s share fell to 6.8%, a 150 basis point decline from the previous year.

DoorDash is likely to notch an even bigger share during the 2025 Super Bowl. The aggregator steadily gained share throughout 2024. It also commands 60.7% of the national delivery market heading into Super Bowl 2025. Still there are some markets where share is more evenly split, like New York.

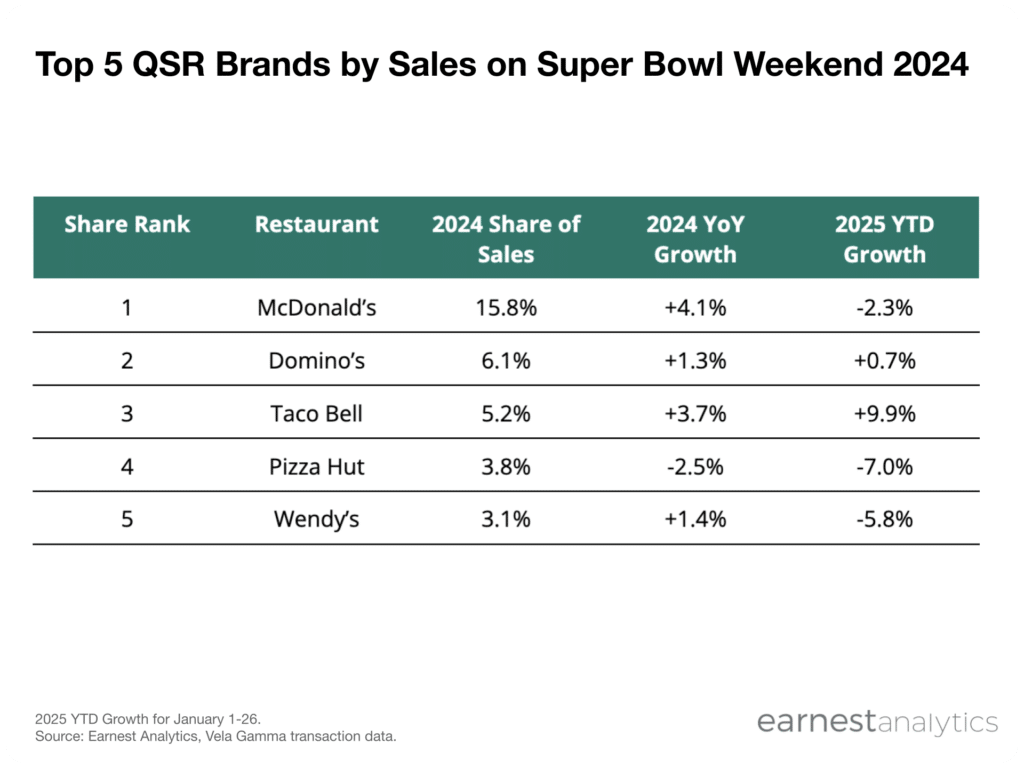

McDonald’s set to lead among QSR (Fast Food) during Super Bowl, Taco Bell to grow

QSR sales share during Super Bowl weekend 2024 remained stable compared to 2023. McDonald’s (MCD) led with a 15.8% share, growing +4.1% YoY. Pizza Hut (YUM) and Papa John’s (PZZA) saw sales decline -2.5% YoY and -4.7% YoY. Domino’s grew +1.3% YoY. Though outside the top five, Dave’s Hot Chicken experienced a notable +54.2% YoY growth compared to +1.8% for the QSR subcategory.

Taco Bell (YUM) leads major QSRs by growth in January 2025, up 9.9% YoY YTD. Its focus on value and new menu items have likely helped drive growth. Dave’s Hot Chicken (+44.4% YoY YTD) could also gain share during the Super Bowl. The brand has yet to crack the top 5 biggest Super QSR brands by sales.

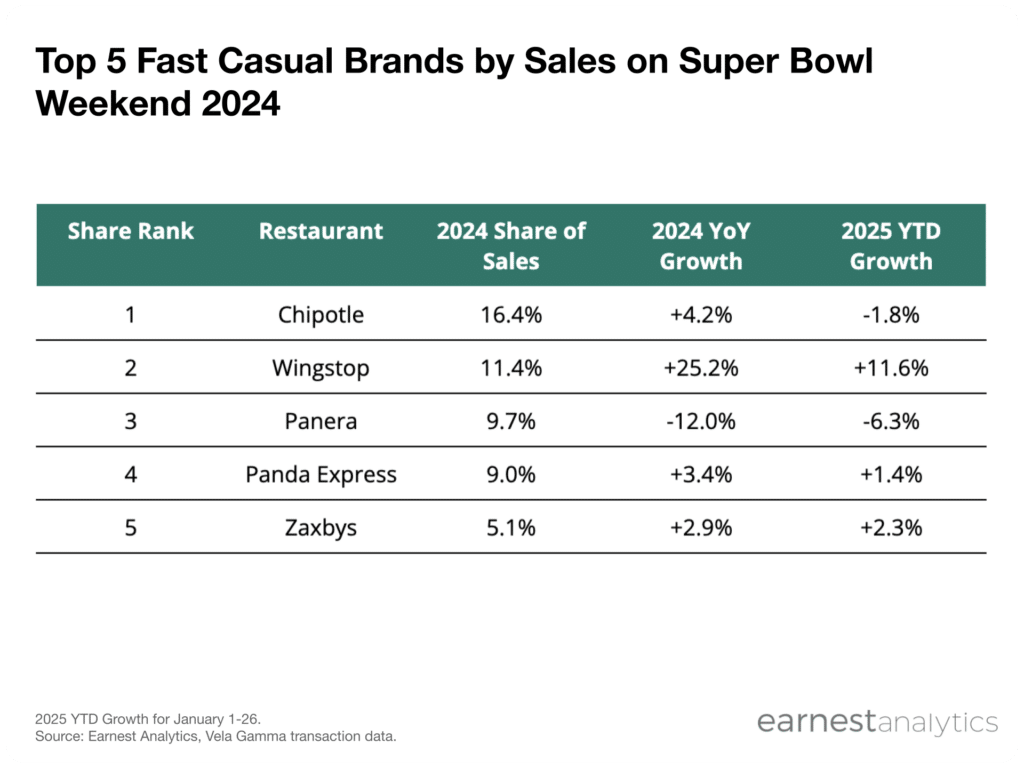

Chipotle dominates sales, but Wingstop likely to expand share

While Chipotle (CMG) led Fast Casual sales share during Super Bowl weekend 2024, Wingstop (WING) saw the strongest growth among top brands. Wingstop grew its share from 9.2% in 2023 to 11.4% in 2024, driven by 25.2% YoY sales growth. Chipotle, Panda Express, and Zaxby’s maintained stable share, each posting low single-digit sales growth.

Chipotle, the QSR share leader of 2024, saw sales decline 1.8% YoY YTD. Meanwhile, Wingstop grew 11.6% YoY YTD. The wing brand is well-positioned to expand its share over Super Bowl weekend 2025 given recent momentum.

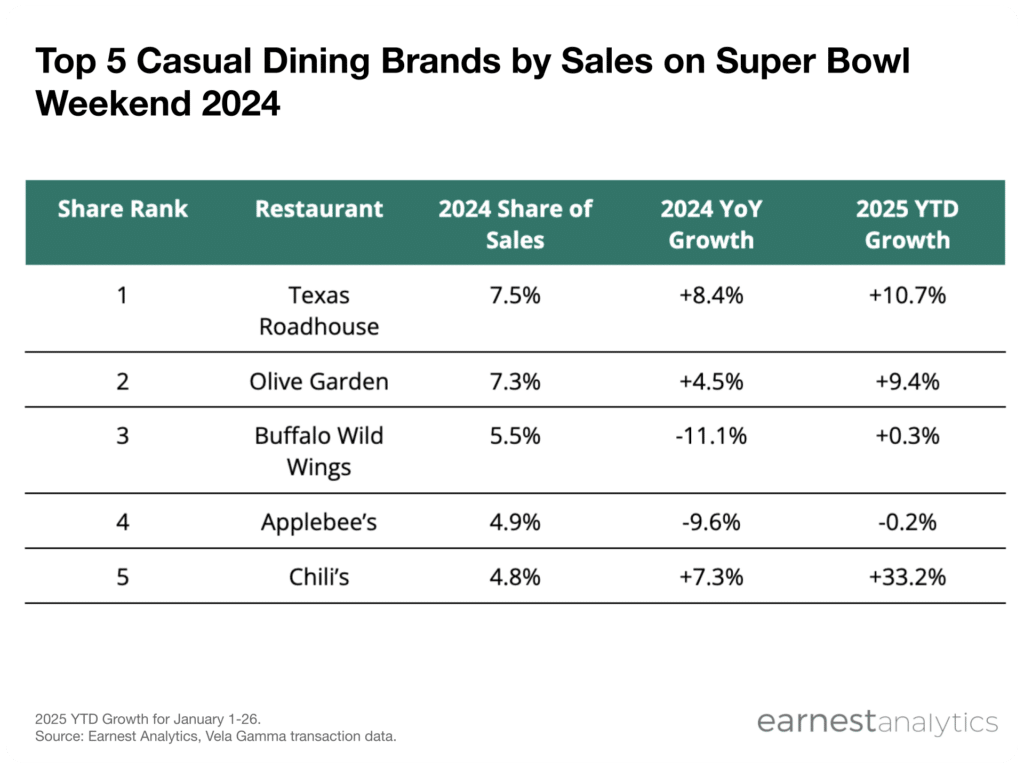

Texas Roadhouse and Olive Garden remain Casual Dining favorites

Texas Roadhouse (TXRH) and Olive Garden (DRI) remained closely matched in Super Bowl market share for the second year. Texas Roadhouse gained 80 basis points of share in 2024, driven by an +8.4% YoY sales increase. Chili’s grew share by 50 basis points, achieving +7.3% YoY sales growth by emphasizing value and appealing to Gen Z. In contrast, Buffalo Wild Wings lost 40 basis points of share, with sales declining -11.1% YoY.

Chili’s is the fastest-growing major Casual Dining restaurant YTD, up an impressive +33.2%. The brand is likely to gain share during the Super Bowl. Texas Roadhouse (+10.7% YTD) and Olive Garden (+9.4% YTD) are primed to maintain their majority share on recent sales strength.