Disney+ Just Can’t Wait to be King (of Streaming)

Following the launch of Disney+ in November 2019, we looked at the spending behavior of millions of de-identified U.S. consumers in order to understand Disney’s impact on the OTT Video market.

See our original, pre-Disney+ piece from October 2019.

Key takeaways:

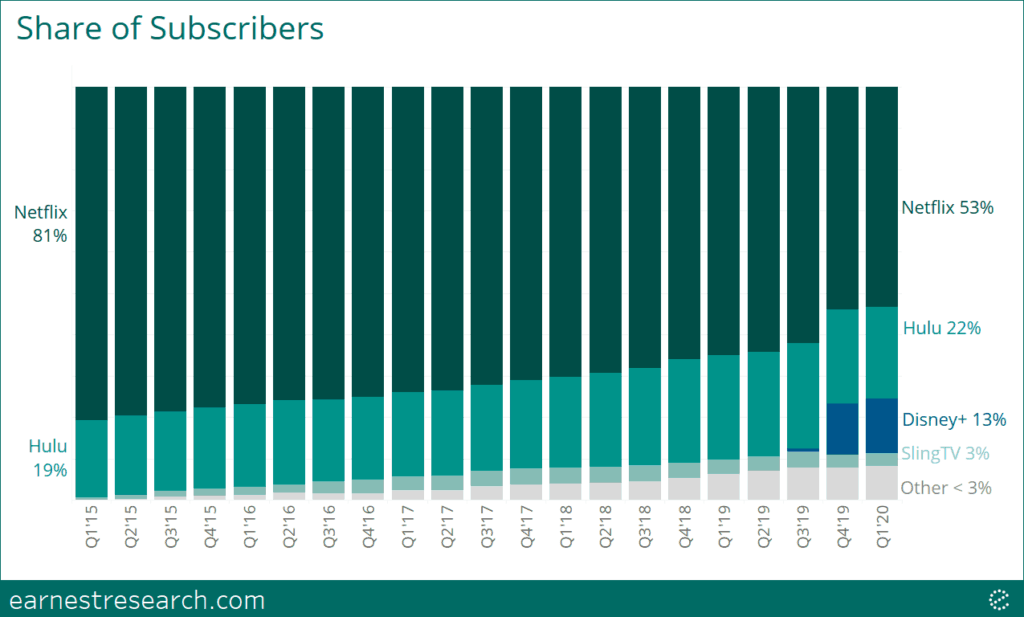

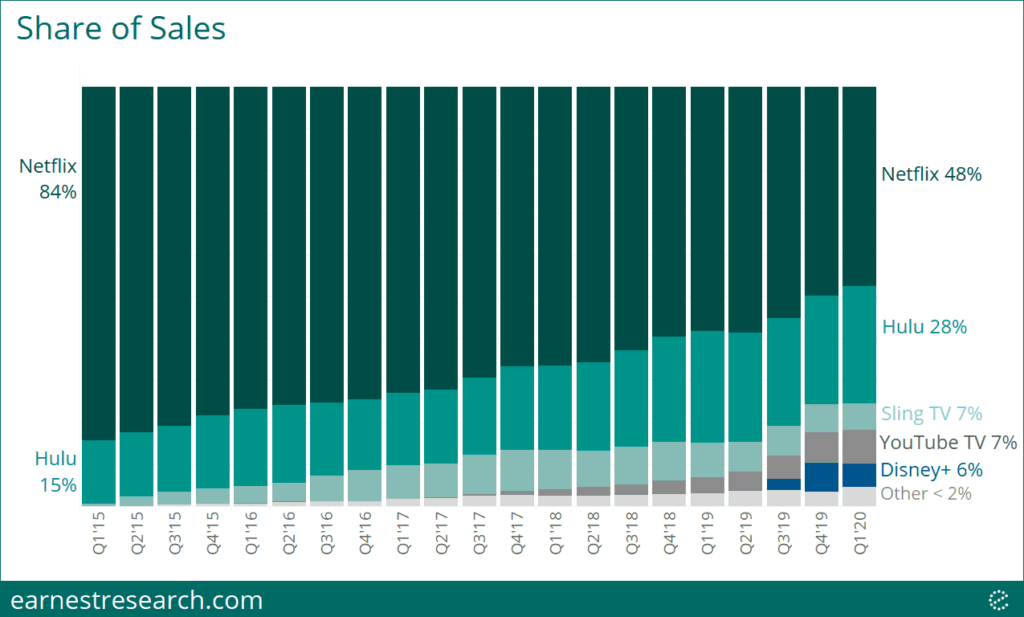

- Since launching in November 2019, Disney+ has already acquired 13% of subscribers and 6% of sales in the now heavily competitive OTT Video market.

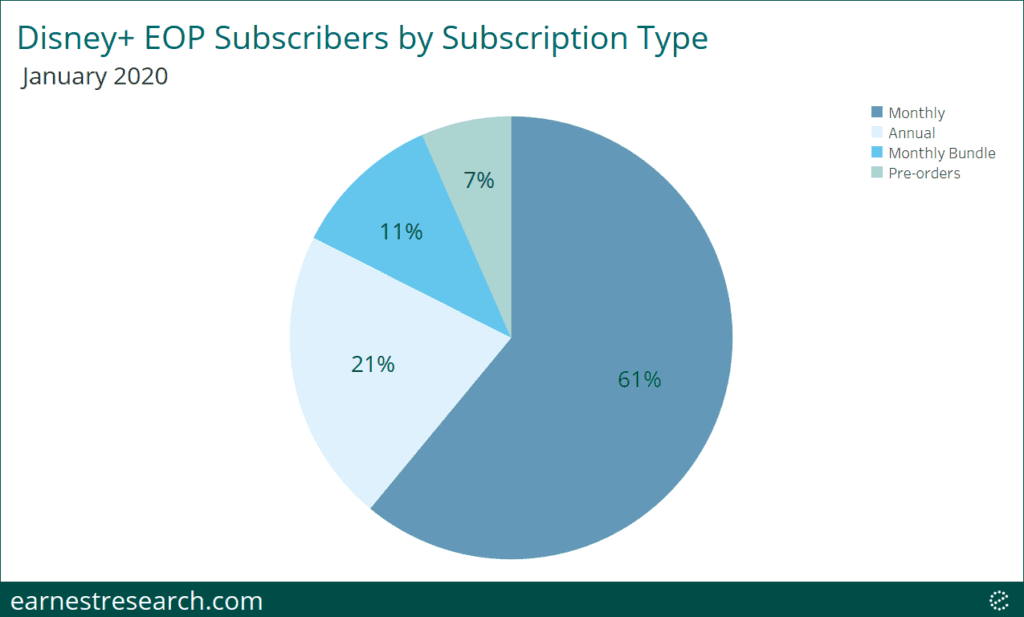

- Looking at Disney+ subscriptions, 61% of subscribers hold a monthly plan, 21% are annual, and 11% are subscribed to the bundle. The remaining 7% pre-ordered the service on multi-year plans.

- Netflix continues to lead the industry in platform exclusivity, with nearly 60% of its current subscribers loyal solely to its service, while ~25% of Disney subscribers exclusively hold Disney+ subscriptions.

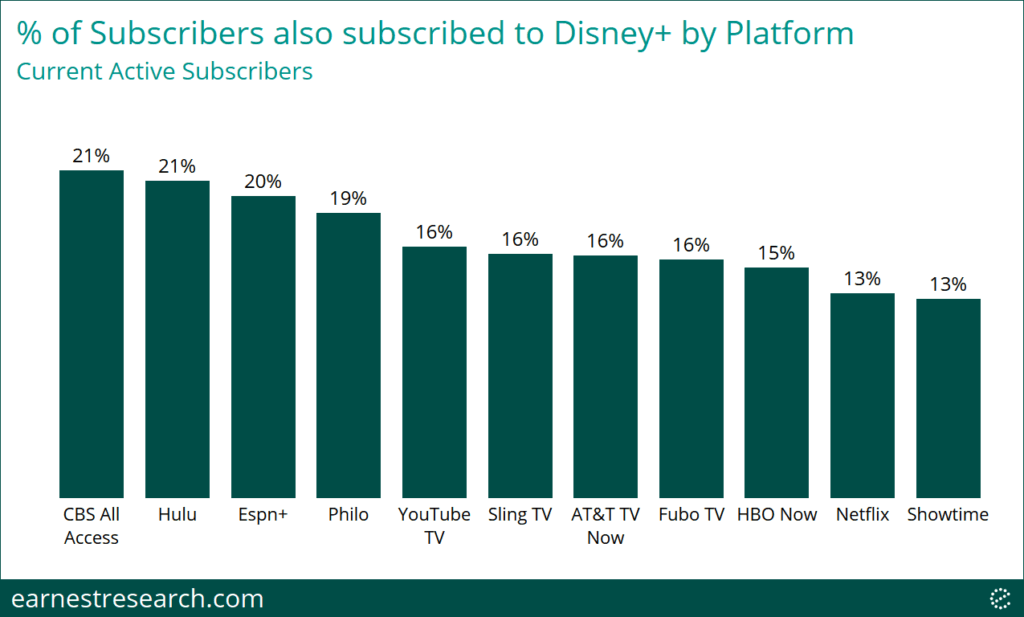

- Disney+ subscribers share the highest overlap with CBS All Access, Hulu, and ESPN+, each with ~20% of their subscribers on the Disney+ platform (though we expect this overlap to decline as subscribers migrate to the bundle). Netflix sees the lowest overlap with just 13% of its users subscribed.

An Updated State of the Market

What was once a two-player* OTT Video market, comprised of Netflix (80%+ share) and Hulu (15%+) in 2015, now has substantial competition from new entrants Apple TV+ and Disney+ which have joined the company of Sling TV, YouTube TV, ATT TV Now, and others, in an ongoing competitive battle for streaming subscribers.

In just a little over two months, Disney+ has managed to acquire a material piece of the OTT Video pie, taking 13% of subscribers and 6% of sales, and emerging as the ~3rd** to largest streaming platform in the data.

Other includes YouTube TV, CBS All Access, ESPN+, fuboTV, HBO Now, Philo, and Showtime.

*Analysis excludes Amazon Prime Video. Refer to notes for more information.

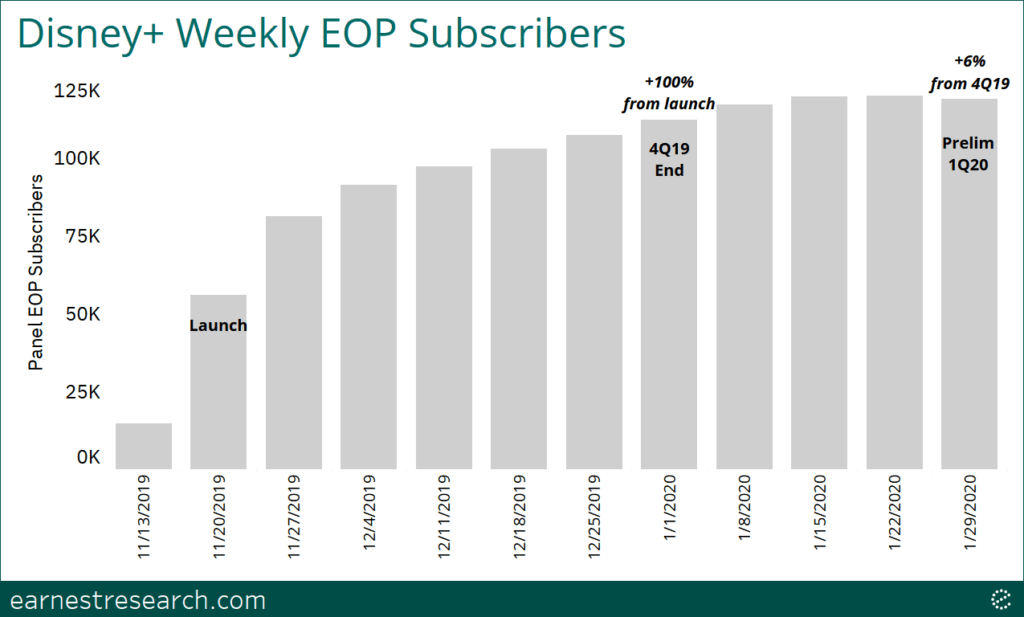

Disney+ Subscriber Growth

Last week, Disney reported that Disney+ subscribers grew from 10m+ on November 13th, a day after the platform’s launch, to 26.5m at the end of 4Q19 (+165%), and further to 28.6m as of February 3rd (+8%). Earnest panel subscribers show directionality similar growth figures, growing over 100% from launch to the end of 4Q19, and a further 6% to the end of January.

Disney+ Subscription Type Breakdown

Disney+ offers a monthly and annual plan, as well as a monthly option to bundle Disney+, Hulu, and ESPN+. We cut the data by subscription type in order to understand the current breakdown. As of January 2020, 61% of subscribers are on the monthly plan, 21% are on the annual plan, and 11% are subscribed to the bundle. The remaining 7% of subscribers are those that pre-ordered the service for two or three years pre-launch.

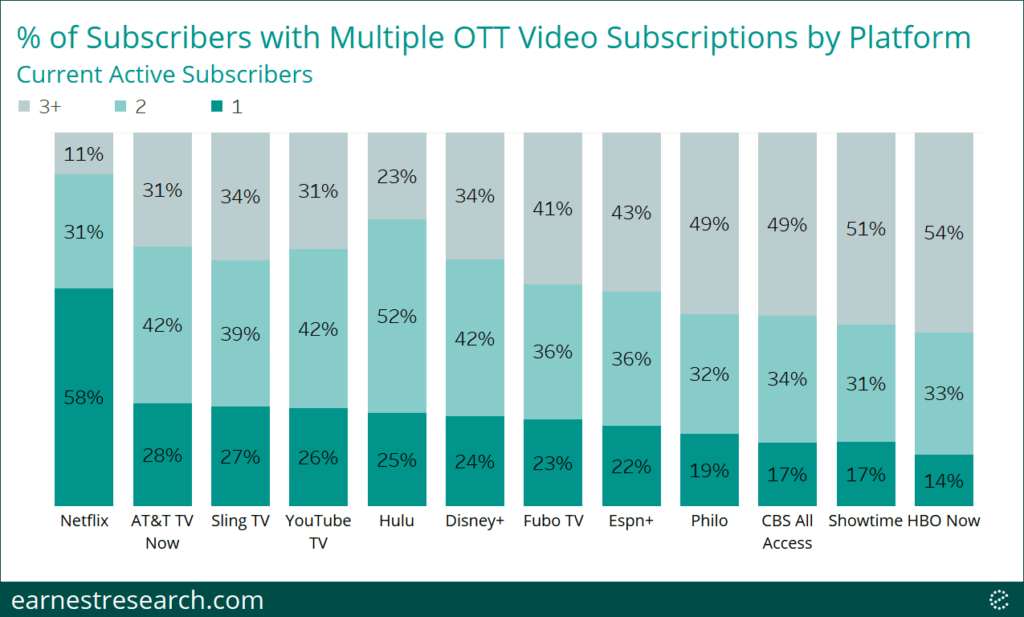

Platform Loyalty

Netflix continues to lead the industry in platform exclusivity, with nearly 60% of its current subscribers loyal solely to its service. This number was 65% back when we ran this analysis in October. All other providers see just a ~15% to 30% exclusive subscriber base, including Disney+ which sees ~25%. Philo, CBS All Access, Showtime, and HBO Now have the least exclusivity, with ~50% of their users subscribing to three or more platforms.

Overlap with Disney+

Looking specifically at the ~75% of Disney+ non-exclusive subscribers, the providers with the highest overlap include CBS All Access, Hulu, and ESPN+***, each with ~ 20% of their base also subscribed to Disney+. YouTube TV, Sling TV, ATT TV Now, and HBO Now see ~15% overlap, and Netflix sees slightly lower than that, at 13%, a reflection of its high loyalty profile.

Philo, fuboTV, and Showtime each have small sample sizes at less than ~500 overlapping subscribers.

Notes

Earnest cannot identify Disney+ subscriptions paid via third parties, such as through the Apple or Google Play app stores, as well as through Verizon which is giving its customers 12 months of Disney+ for free. Disney has noted that 50% of its current Disney+ subscribers have purchased subscriptions via third parties.

Analysis does not yet fully take into account subscriber churn from the Disney+ platform due to it only being two months since its November launch. Earnest only considers a subscriber to have churned if we do not see a payment within 65 days (for monthly plans) of his/her prior bill payment.

**Analysis excludes Amazon Prime Video and Apple TV+ as we cannot differentiate between Prime members that are actively using the Prime Video platform versus those that are not, and we cannot identify with certainty Apple TV+ subscription payments in the data.

***We anticipate that Hulu and ESPN+ overlap figures will come down as our logic begins to identify subscribers churning and switching to the Disney+ bundle plan.