Discount stores, Off-Price, Fast Fashion see highest growth; suggest trade-downs

Download full report: Fast Fashion, Discount, Off-Price Buck Back to School Spending Declines.

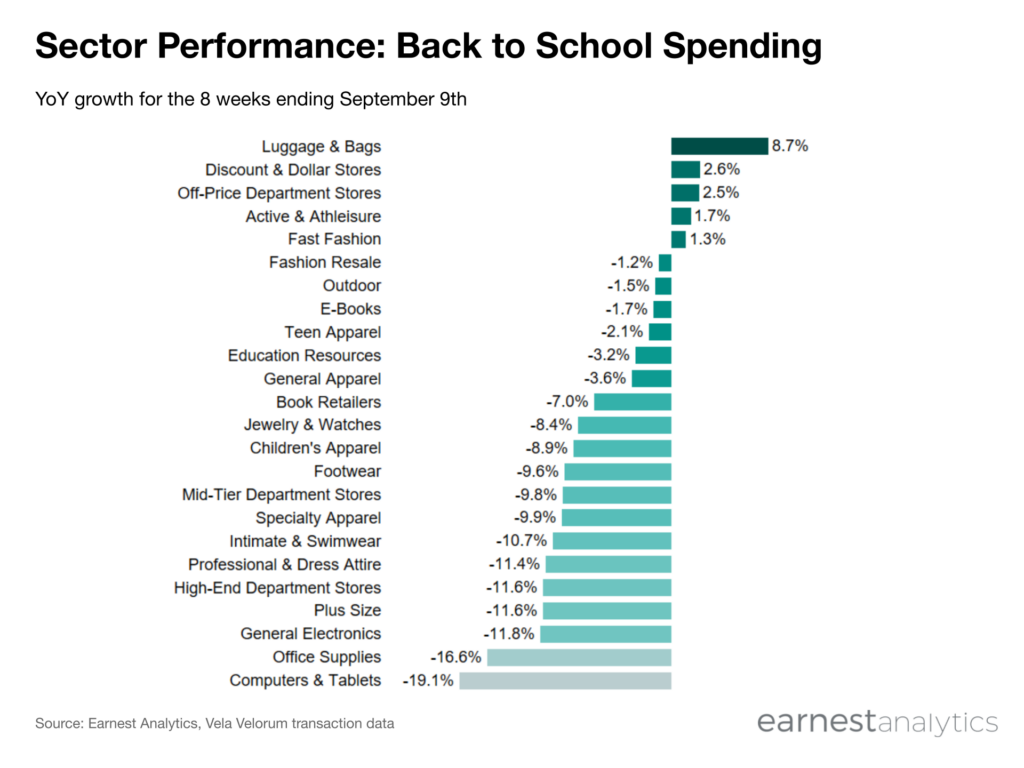

Total Back to School spending* fell 6.8% YoY during the 8 weeks ending September 12th according to Earnest Analytics’ Vela Velorum transaction data. Performance slowed from late July as spending began to annualize last season’s acceleration. However, bucking these declines included Luggage & Bags which grew the fastest, at 9% YoY, as well as Discount stores, Off-Price Department Stores, and Fast Fashion which grew low single digits, suggesting consumers may have traded down this season. The other category outperformer was Athleisure, with 2% growth, which includes Nike and Lululemon.

In contrast, Mid/High-End Department Stores, Electronics, Footwear, and Jewelry declined 10%, and Computers and Tablets declined 20%.

Download full report: Fast Fashion, Discount, Off-Price Buck Back to School Spending Declines.

*Back-to-school retailers include those within the Earnest Apparel and Department Store categories, as well as within Book Retailers, Computers and Tablets, E-Books, Education Resources, General Electronics, Dollar Stores, and Office Supplies subcategories.