Discontinuations damper Relyvrio’s launch

Key Takeaways

Early in its launch, Relyvrio made headlines by exceeding the street’s revenue expectations and swiftly bringing Amylyx to profitability. However Amylyx’s most recent third quarter earnings report suggests that Relyvrio’s performance has fallen flat, with a significant miss on net product revenue and many unanswered questions regarding the drug’s high discontinuation rate. Considering the enduring unmet need in ALS, Relyvrio’s growth deceleration was a surprise for many.

Relyvrio was approved by the FDA in September 2022 and its key competitors in the ALS market are riluzole and Radicava ORS. Riluzole is an oral generic that was approved for ALS in 1995 and Radicava ORS is an oral formulation of Radicava (originally approved and administered as an intravenous infusion) that was approved in May 2022. In order to gain a better understanding of Relyvrio’s slowdown in growth, we compared launch metrics between Relyvrio and Radicava ORS using Earnest Phoenix Healthcare Claims, a closed claims dataset with strong visibility into specialty pharmacy drugs. Our analysis found that Relyvrio is significantly underperforming relative to Radicava ORS in terms of market penetration and therapy persistence, which may shed some light on its underwhelming third quarter performance.

- Relyvrio has struggled to penetrate the ALS market despite the prevalence of combination therapies; of patients actively taking at least two oral drugs to manage their ALS, only 22% are on Relyvrio vs. 82% are on Radicava ORS

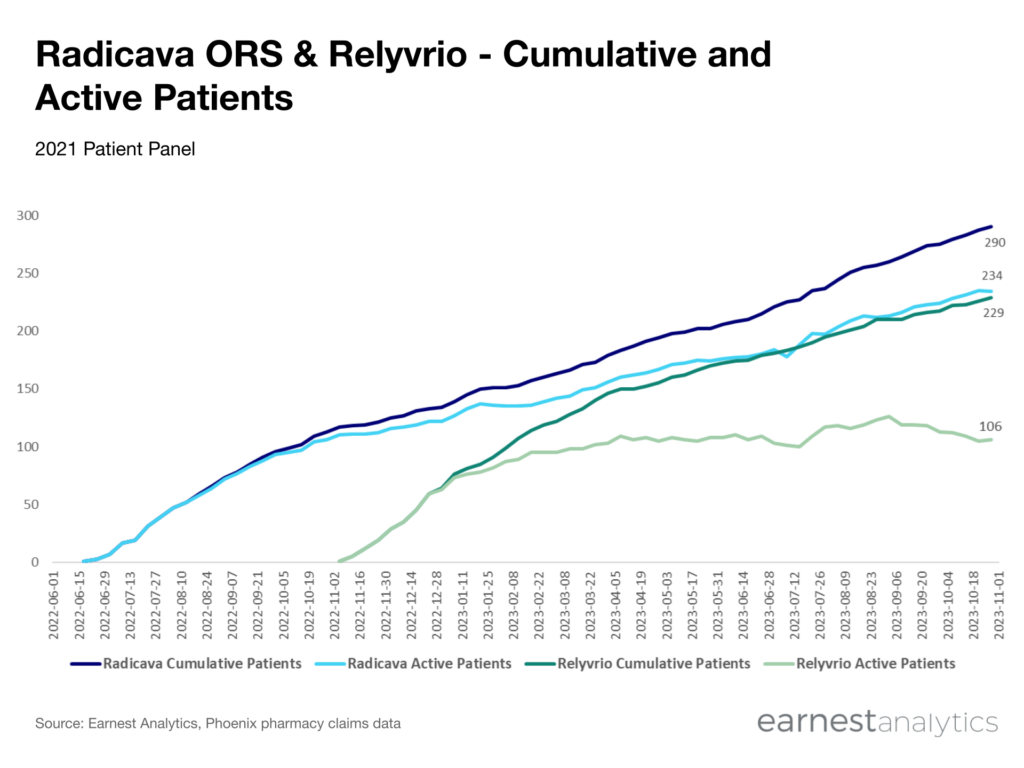

- While the number of patients that have started on Relyvrio and Radicava ORS is broadly comparable, far fewer patients remain active on Relyvrio relative to Radicava ORS (46% as compared to 80%)

- Among cohorts of patients who started on these drugs at the end of 2022, Relyvrio persistence is significantly inferior compared to Radicava ORS and riluzole

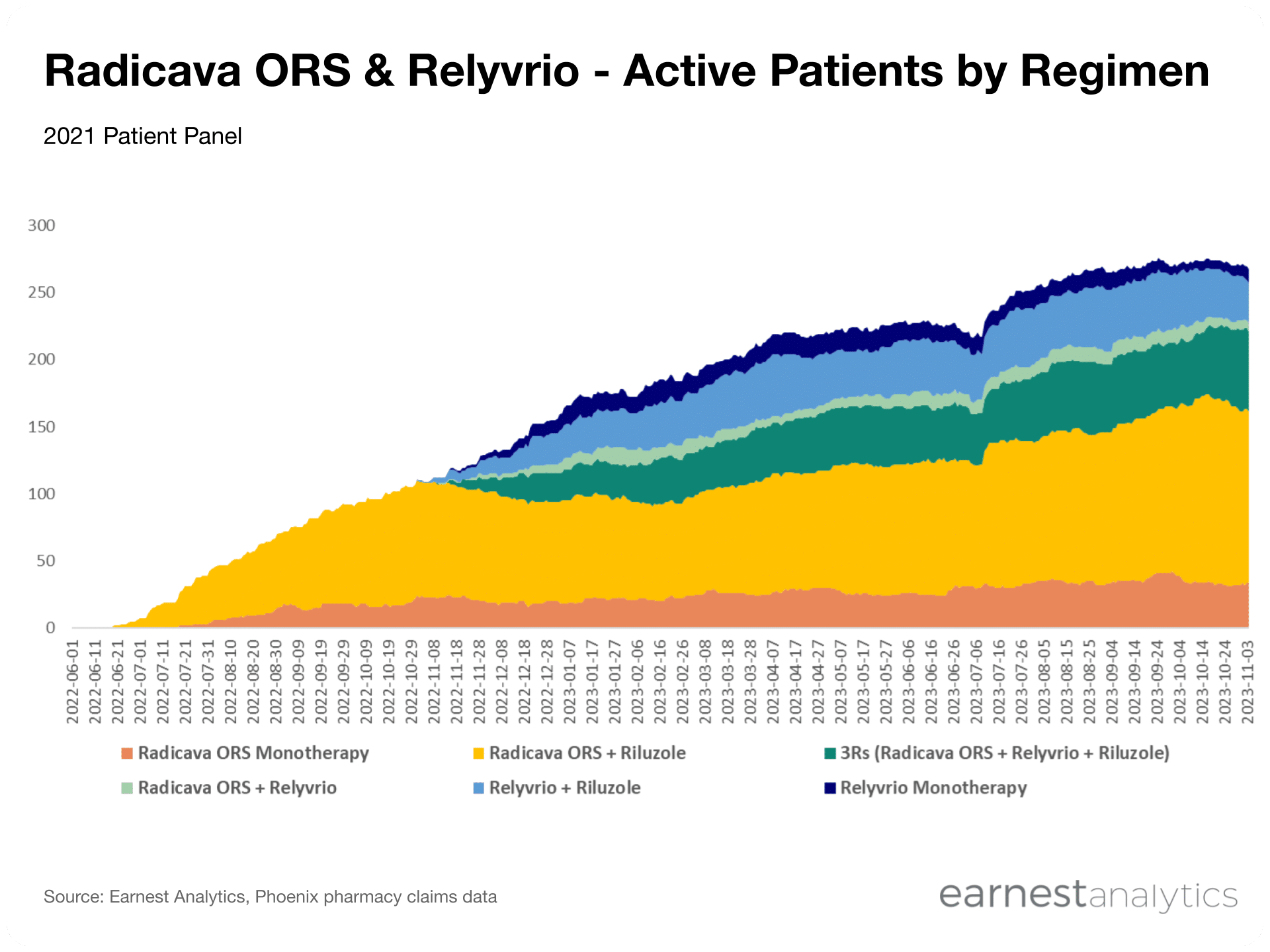

For patients on oral combination therapies, Radicava ORS plus riluzole is the most popular dual-drug regimen, while Relyvrio has struggled to gain share outside of patients on triple combination therapy

Contact Sales for more details.

While 80% of cumulative Radicava ORS patients to date have remained active on therapy, less than half of cumulative Relyvrio patients are continuing therapy. However, the number of cumulative patients who have tried each drug is not significantly different, suggesting that Relyvrio’s growth challenges are related to duration of therapy rather than new-to-brand acquisitions, which is aligned with management’s recent commentary that “the slowdown in net adds this quarter was primarily driven by increased discontinuations.”

Contact Sales for more details.

Persistence trends among early adopters of Radicava ORS and Relyvrio (i.e., patients who initiated treatment in the 2H2022) show that Relyvrio’s discontinuation rates are significantly higher, with 86% of patients retained at 6 lifetime months for Radicava ORS vs. only 42% of patients for Relyvrio. For comparison, roughly 73% of riluzole patients are persistent at 6 lifetime months, which further indicates that Relyvrio’s persistence is particularly low among oral ALS drugs. Amylyx recently commented that “60% of people taking RELYVRIO remain on therapy 6 months after initiation in the U.S.,” which appears to be an overstatement relative to trends observed in the Phoenix dataset. However, given our persistence analyses are only based on a cohort of early patients, it will be crucial to continue to monitor this trend in coming months to see whether higher persistence rates are observed in later cohorts, and whether “additional educational efforts in the U.S. will result in increased prescribing and duration of use” as claimed by Amylyx.

Continue tracking Relyvrio’s commercial performance in real-time with Earnest’s Phoenix dataset. Reach out to Earnest to gain access to continuous insight into the growth of Relyvrio and other specialty pharmacy products.