Dave’s Hot Chicken expansion driving growth, taking Chick-fil-A share

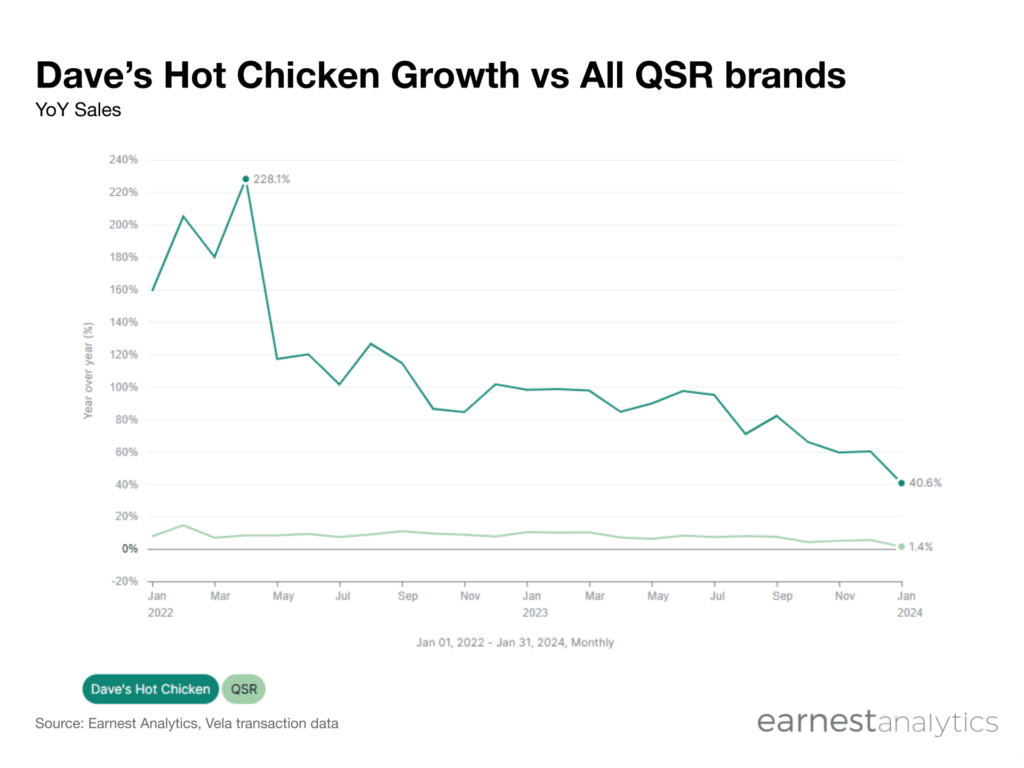

Dave’s Hot Chicken outpacing QSR brands

Founded in May 2017 with just $900 in a parking lot by four friends, Dave’s Hot Chicken consistently achieved high double-digit to triple-digit year-over-year sales growth, according to Earnest credit card data. As of November 2023, the company had 170 operational locations and an additional 862 in the pipeline.

With over two million TikTok and one million Instagram followers, Dave’s Hot Chicken attracts a young, affluent demographic. The typical customer tends to fall between the ages of 25-34 (represents 28% share of total, see chart in Dash) and skews towards higher income individuals ($150k+ income group represents 37% of total customer base). Notably, the $40-100k income group grew to 35% of the total customer base in January 2024, up from 11% in January 2021 (see chart in Dash).

Access Chart in Dash.

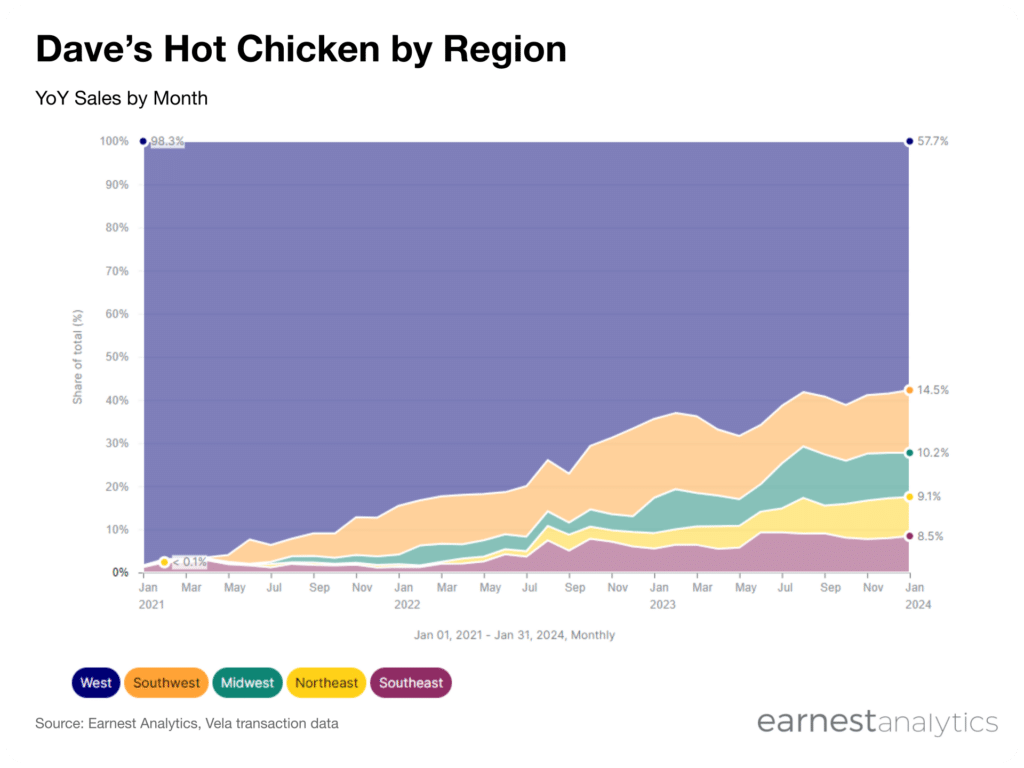

Dave’s Hot expanding beyond the West

The West still accounts for the largest regional portion of total sales (57.7%), but Dave’s Hot Chicken grew share in the remainder of the U.S. from less than 0.1% to 42.3% in just the past three years of expansion. Texas, Colorado, Oregon, North Carolina, and Arizona have become key contributors to sales growth outside of Dave’s home state of California (see chart in Dash).

Access chart in Dash.

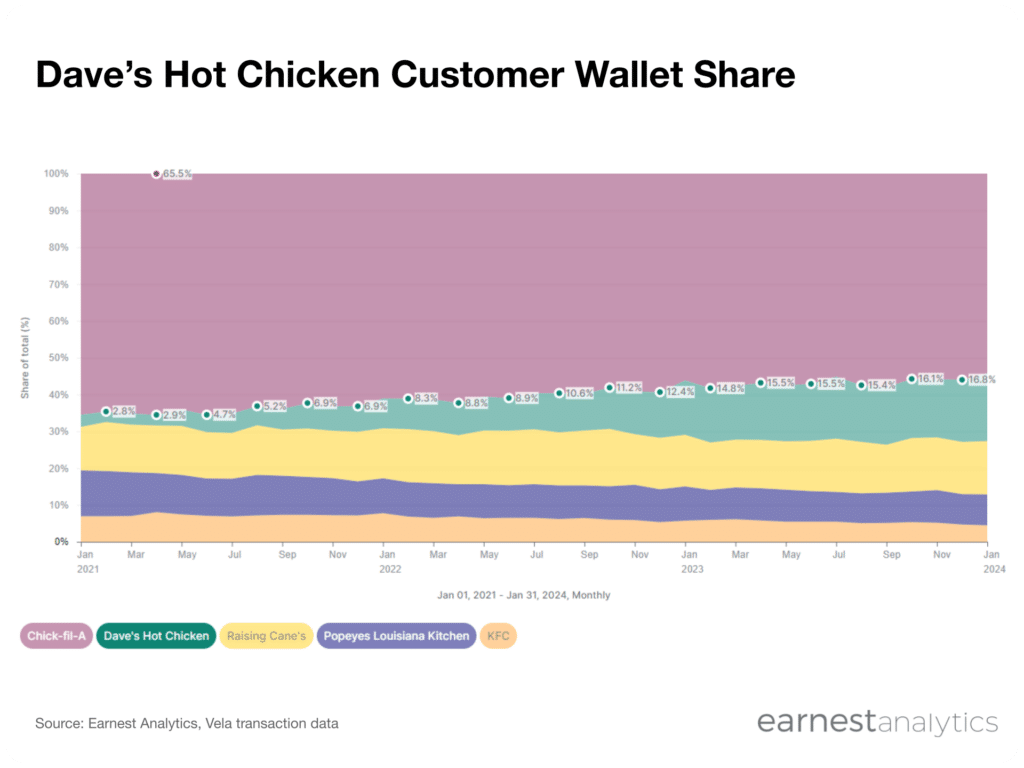

Dave’s Hot winning sales from Chick-fil-A

Earnest’s share of wallet analysis, which isolates spend by a brand’s existing customers across that brand’s competitors, suggests that customers of Dave’s Hot Chicken have increased their wallet spend at Dave’s by roughly 6x from January 2021 to 2024.

Dave’s Hot Chicken customers spent 10% less of their “chicken wallet” at Chick-fil-A than they did three years ago (65.4% share in January 2021 to 54.3% in January 2024). Share of spend at Popeye’s Louisiana Kitchen and KFC also decreased as Dave’s customers continue spending more.

Access chart in Dash.

Track Fast Food/QSR sales for free