Darden’s pending acquisition complements its fine dining portfolio

Key takeaways:

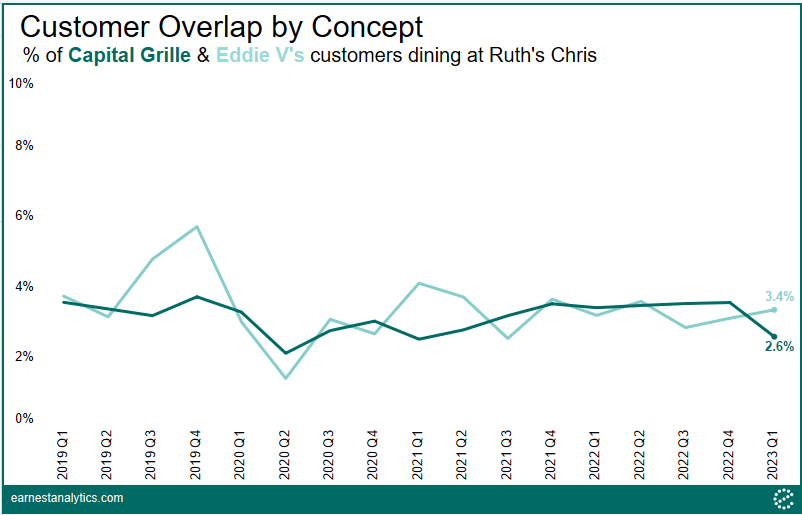

- Darden fine dining concepts and Ruth’s Chris have minimal customer overlap

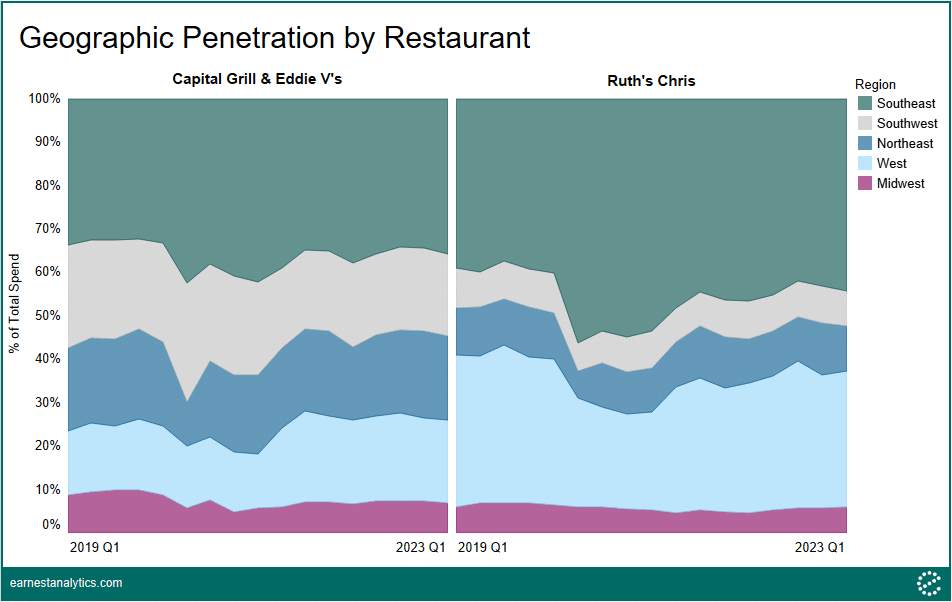

- Darden has limited exposure to the West region, while the West accounts for a significant portion of Ruth’s Chris spend

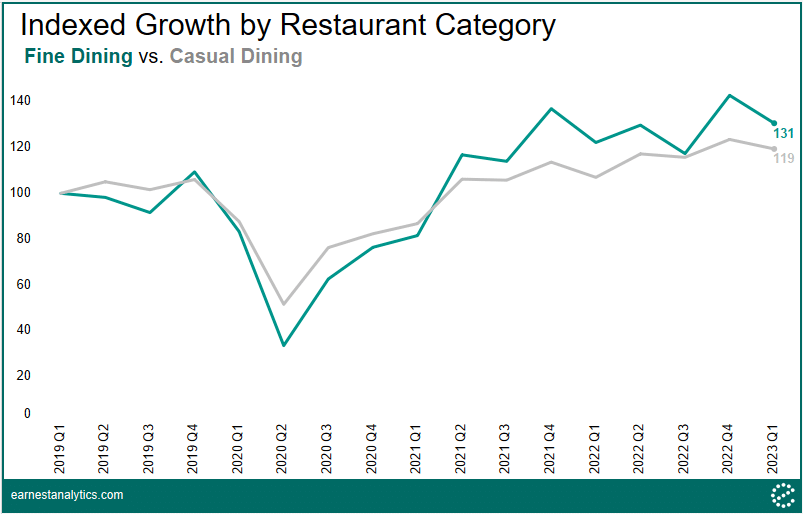

- Spend on Fine Dining is materially higher than pre-pandemic levels and has outpaced Casual Dining

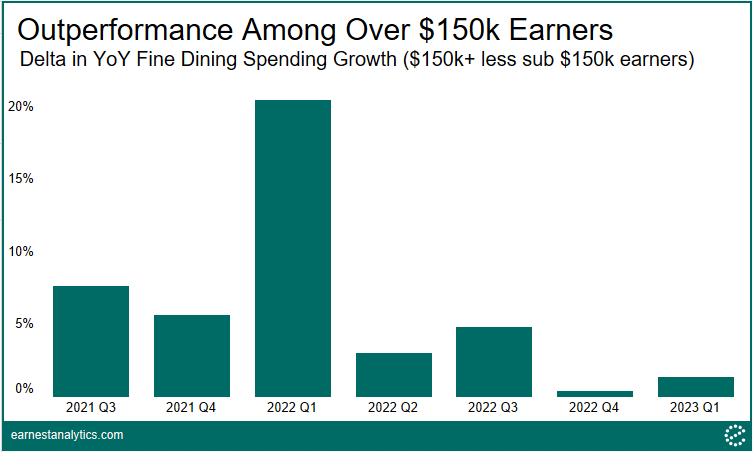

- $150k+ earners outspent peers on Fine Dining the last seven quarters

Darden customers largely do not dine at Ruth’s Chris

“Ruth’s Chris also complements our portfolio with a differentiated brand that allows us to capture a wide range of fine dining guest occasions that we are not competing for today… there is very little crossover between guests at Ruth’s Chris and our fine dining brands.”

– Darden/Ruth Acquisition Conference Call

On 5/3/23, Darden Restaurants (DRI) announced it would acquire Ruth’s Hospitality Group (RUTH) for $715 million. Following the announcement, Darden hosted a conference call to explain the rationale supporting the acquisition.

On the acquisition conference call, Darden management indicated its fine dining concepts (i.e. Capital Grille and Eddie V’s) and Ruth’s Chris had minimal customer overlap, which makes the acquisition complementary to its portfolio. Earnest transaction data shows only 2% to 6% of Capital Grille and Eddie V’s customers dined at Ruth’s Chris on a quarterly basis from 2019 to 2022.

Darden has much lower exposure to the U.S. West region

“I think Rick mentioned earlier, the locations they go after are different. And to your point, they’re a little bit more different area from where fine dining would be. And so we do think that we can actually grow fine dining overall more by adding Ruth’s to our portfolio.”

– Darden/Ruth Acquisition Conference Call

Darden management noted differences between the two companies’ target locations but did not specifically comment on geographic exposure. Earnest data indicates that while the Southeast is the largest region for both companies, the West only accounted for 19% of spend at Darden’s fine dining brands compared to 31% of spend at Ruth’s Chris in 1Q23.

Fine Dining spend materially above pre-COVID levels; outpacing casual dining

“When you look at the fine dining segment, sales have outperformed relative to pre-COVID, and that is expected to continue.”

– Darden/Ruth Acquisition Conference Call

On the acquisition conference call, Darden management highlighted Fine Dining segment strength as another reason for the acquisition. Specifically, management noted Fine Dining segment sales surpassed pre-COVID levels. Earnest transaction data suggests consumer spending on Fine Dining restaurants grew 31% in 1Q23 relative to 1Q19. Spending growth on Fine Dining was even more pronounced than spending on Casual Dining, which was 19% higher relative to pre-COVID.

High earners have outspent for seven consecutive quarters

“As we have seen in our fine dining brands, consumers with income levels above $150,000 continue to dine out.”

– Darden/Ruth Acquisition Conference Call

Additionally, Darden management noted consumers making $150k+ continued to eat at fine dining restaurants. Earnest data shows consumers making over $150k have outspent on Fine Dining compared to their peers for the last seven quarters.