Darden’s Chuy acquisition adds Mexican food to target younger eaters

See data in Dash.

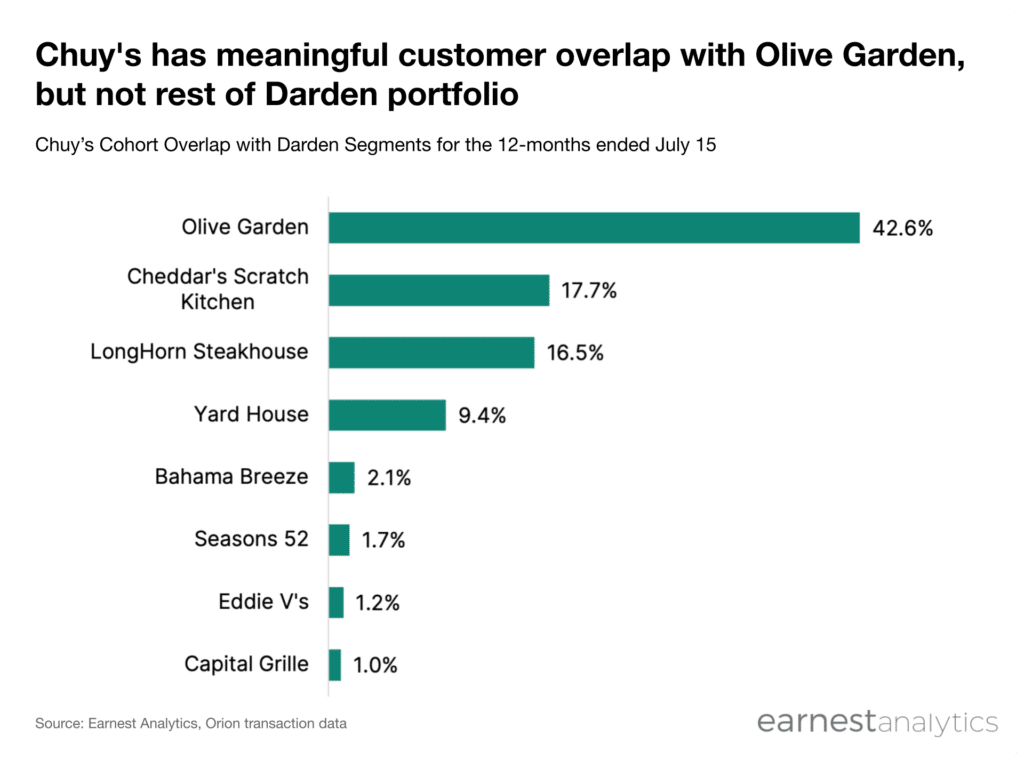

Over 42% of CHUY customers had eaten at an Olive Garden in the last 12 months ended July 15, according to Earnest credit card data, suggesting significant overlap between the restaurant brands which are set to become corporate cousins.

Despite the differentiated menu–Mexican in Chuy’s case and Italian and American for Darden brands–the proposed acquisition “complements [the] existing portfolio by allowing [Darden] to access the popular Mexican dining category, which [they] do not compete in today,” according to Darden management in a recent announcement. They further stated that “the Mexican category is one of the fastest-growing dining categories and Chuy’s is the largest full-service operator with strong unit economics.”

The next highest overlap between Chuy’s and Darden brands is with Cheddar’s Scratch Kitchen and LongHorn Steakhouse at 18% and 17%, respectively.

See data in Dash.

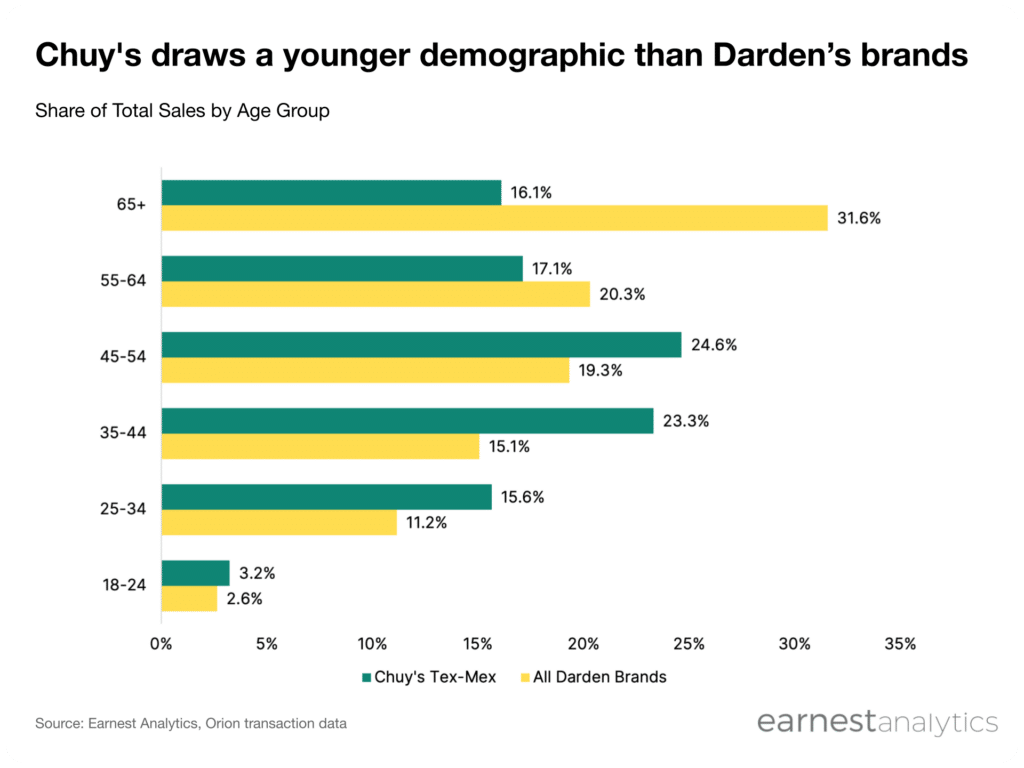

Darden management specifically mentioned the Mexican category because of its “broader appeal and it actually appeals a lot more to the younger people.”

Customers aged 18 to 44 accounted for 42% of Chuy’s total sales in June 2024, compared to just 29% of Darden’s sales from this age group. The acquisition would immediately bring younger eaters into the Darden fold.

Track Casual Dining spending for free